Market Brief

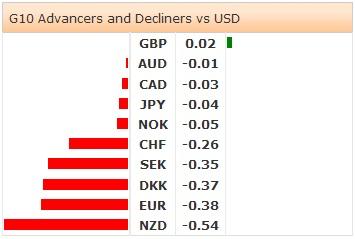

Asia equity markets are flat waiting to take their direction from the US markets. Overall price action so far in Europe has been subdued due to a bank holiday in the UK. The Nikkei is up 0.48%, Hang Seng up 0.30% yet Shanghai dropped 0.51%. Asia rates are higher while US treasuries yields are slightly lower (US 10yr yield 2.39%). USD was mixed after Yellen’s slightly less dovish speech in Jackson Hole. EURUSD fell to 1.3189 on the one-two punch of Yellen & Draghi. While USDJPY rallied to 104.49 on BoJ Gov Kuroda comments that additional easing was a possibility before reversing to 104.12. AUDUSD was in demand climbing to 0.9323. The divergence between central banks strategy become even more apparent in recent days. FOMC Chair Yellen sounded less dovish which contrasted significantly from ECB President Draghi’s and BoJ Governor Kuroda very dovish, pro-easing comments.

Markets are still analyzing central bank speak which came in hard and heavy in the last few days. Fed Chair Yellen's long-awaited Jackson Hole address remained true to her core view that the Fed would stay on an accommodating track till the labor markets, supported by aggregate demand, improved. However, she was clear to highlight that she would listen to other members analysis, understanding that gauging slack in the markets is a complex task. We believe the Fed is on a clear path, abet slow and careful, toward policy tightening next year. The timing of the tightening cycle will depend on data and the reaction of financial markets to higher rates. ECB president Daghi sounded exceedingly dovish (stealing the spotlight from Yellen) as he signaled that action would come as inflation continued to slide. He acknowledges that an expectation for inflation in the Eurozone has decreased. He stated that “the Governing Council will acknowledge these developments and within its mandate will use all of the available instruments needed to ensure price stability over the medium term.” German IFO was weaker across the board as business climate fell to 106.3 verse 107.0 exp, expectations 101.7 vs 102.1 exp and current assess 111.1 vs 112.0 exp. Clearly Draghi is ready to act after 16-straight months of dis-inflation with asset purchases or quantitative easing. In the near-term, we remains constructive on USD and GBP against the EUR and JPY due to policy divergence.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.