Market Brief

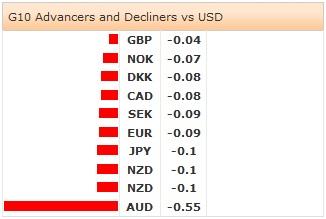

The good economic data failed to boost enthusiasm in New York yesterday, yet the fading risk sentiment due to geopolitical tensions in Iraq lifted the safe-haven demand in US dollars. The US sent troops back to Iraq, 275 armed forces for protection of diplomatic posts. Traders should be ready to face a carry unwind and get positioned accordingly.

Data-wise, the US empire manufacturing survey in June unexpectedly improved to 19.28 (vs. 15.00 exp. & 19.01 last). The US industrial production expanded by 0.6% in May (vs. 0.5% exp. & -0.6% last), the capacity utilization improved above expectations from 78.6% to 79.1% over the same month. The US 10-year government yields shortly advanced to 2.61%, while the DXY index rebounded from 80.400 overnight. The focus is on Fed verdict on June 18th. The consensus leans towards a deceleration in monthly QE tapering from 45bn to 35bn dollars. In Canada, the increase in existing home sales in May (from 2.8% to 5.9%) limited the USD/CAD upside attempt at the 21-dma (1.0883). The MACD (12, 26) stepped in the bearish zone, yet the rising USD demand should keep the downside above the key 1.0804 Fibonacci support (38.2% on 2009-2011 drop).

In China, the foreign direct investment turned unexpectedly negative in May (-6.7% in May, vs. 3.2% exp. & 3.4% last). The Yuan upside attempt has been limited sub-6.2000; USD/CNY returned to its 50-dma (6.2358). While technicals stay in the Yuan-supportive zone, decent option bids are placed at 6.2000/50 for today expiry.

JPY-crosses were slightly better bid in Tokyo. USD/JPY holds ground above the critical 200-dma support (101.60), resistance is eyed at the daily Ichimoku cloud cover (102.23/66). EUR/JPY trades with steady negative bias below the 200-dma (138.86), subject to broad based EUR bias.

EUR/USD continues testing 1.3580/1.3600 offers, while technicals are mixed. The 50-dma (1.3729) crossed below the 100-dma (1.3734) favoring technical shorts, while the MACD turns neutral. A daily close above 1.3552 should send the MACD in the positive territories.

In UK, the Cable consolidates strength right below 1.7000/11 area before the CPI release (due at 08:30 GMT). The inflation reading has surprised on the upside last month, a similar surprise should reinforce the upside attempt in GBP-complex. The critical resistance stands at 1.7043 (5-yr high). As suspected, the oversold conditions in EUR/GBP sent the pair towards 0.80000, yet offers (& option related expiries) keep the upside capped at 0.80000/0.80500 region. The RSI now stands at 22%, the 30-day lower BB at 0.79996. We believe that deeper correction is needed at the current levels, while keeping our mid-term call on the bearish side.

Today’s economic calendar consists of Swedish May Unemployment Rate, EU27 May New Car Registrations, Spanish and Euro-zone 1Q Labor Costs, Swiss May Producer & Import Prices m/m & y/y, Italian April Trade Balance, UK May CPI, PPI and RPI m/m & y/y, ZEW June Survey on German Current Situation and Expectations in June for Germany and Euro-zone, US May CPI m/m & y/y, US May Housing Starts and Building Permits m/m.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.