Market Brief

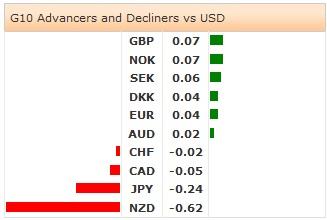

The Chinese GDP growth slowed from 7.7% to 7.4% in the first quarter, slightly higher than 7.3% expected. The expansion in China’s industrial production missed market expectations in March, the retail sales printed slightly better performance. The urban investments increased by 17.6% (vs. 18% exp. & 17.9% last). The FDI is due today. The overall Chinese picture lifted the risk appetite in the emerging Asia; stock markets traded mostly in green. USD/JPY advanced to 102.29 as Nikkei stocks gained 3.01%.

In New Zealand, the CPI accelerated 0.3% q-o-q (vs. 0.5% exp. & 0.1% last) and 1.5% y-o-y (vs. 1.7% exp. & 1.6%). NZD/USD traded with negative bias on softer NZ inflation and China concerns. Better-than-expected Chinese data failed to reverse the intra-day bearish momentum, NZD/USD traded down to 0.8579. Bearish techs suggest deeper correction in NZD; however the inflation data is unlikely to impact expectations on RBNZ rate hike on April 24th. The bias remains on the upside.

AUD/USD fell to 0.9332 on slower Chinese growth concerns. The relief rally post data (slightly better-than-exp.) sent AUD/USD to 0.9380 walking into the European opening. The MACD (12, 26) is to step in the red zone for a daily close below 0.9315. Option related bids trail above 0.9375, offers are to be tipped below 0.9340. AUD/NZD extends gains to 1.0912, highest since February 4th. Decent option bids are placed at 1.0900 for today’s expiry.

Released yesterday the UK headline inflation retreated from 1.7% to 1.6% in March as expected. GBP/USD spiked to 1.6661, before quickly bouncing to daily averages. The UK jobs data is due today and the average weekly earnings may have increased to 1.8% annually (vs. 1.4% in February). GBP/USD rallies to 1.6746 as Europe walks in. Technicals are bullish, resistance pre-1.6750 is being tested this morning, stops are eyed above. On the downside, the first line of support stands at 1.6632/35 (50 & 21 dma).

The Euro-zone inflation figures are due today (at 09:00 GMT) and should confirm the further softness in preliminary headline and core CPI readings: CPI y/y expected at 0.5%, CPI core at 0.8%. EUR/USD advances to 1.3831, demand in EUR/JPY helped. The 21-dma (1.3796) remains the key short-term support.

The US inflation accelerated faster than expected in March. The CPI m-o-m advanced from 0.1% to 0.2%, pulling CPI y-o-y up from 1.1% to 1.5% (vs. 1.4% expected). The CPI y-o-y excluding food and energy hit 1.7% (form 1.6% expected & last). The numbers are USD-supportive although the market reaction remained limited. We are only half a percentage point lower from some Fed participants’ 2% inflation threshold to keep rates at the current lows. DXY advance to 79.904, yet couldn’t make it higher than the 21-dma (79.972).

Today, the Bank of Canada will give policy verdict and is expected to keep the policy rate unchanged at 1.0%. Traders also watch the Norwegian March Trade Balance, Italian February Trade & Current Account Balance, UK March Claimant Count Rate and Jobless Claims Change, UK February 3 months ILO Unemployment Rate and 3 months Average Weekly Earnings, Euro-Zone March (Final) CPI m/m & y/y, Credit Swiss ZEW Survey on April Expectations in Switzerland, US April 11th MBA Mortgage Applications, Canadian February International Securities transactions, Us March housing starts and Building Permits, US March Industrial Production & Capacity Utilization, US March Manufacturing (SIC) Production and US Fed Beige Book.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.