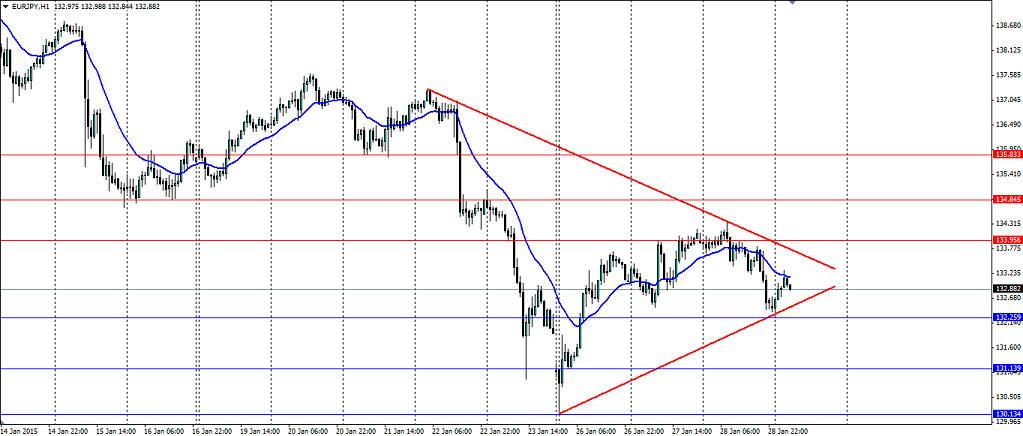

The Euro-Yen pair has been trending downwards in a fairly consistent fashion recently. A consolidative pennant pattern could point to an impending breakout that will see the bearish trend continue.

The trouble in the Eurozone is far from over and the new leaders in the Greek political landscape could cause some serious concern for the Euro. If the new Syriza party decide to default on their bailout loans from the EU and ditch the shared currency, the Euro will feel the full effect of this as the market will no doubt speculate about a wider breakup.

The Yen on the other hand has found plenty of strength recently as the turmoil in Europe sent investors looking for safety. We saw more demand for the Yen’s safety today as Singapore took the market by surprise and lowered interest rates. Certainly as the global economy looks to slow, the Yen will be sought after.

Inflation figures for Japan are due later this week and are expected to dip slightly. If inflation remains at 2.4% the pair will certainly break lower, however, a fall in the Japanese CPI could add bullish pressure to pair. Either way the news will add volatility. There is also inflation data due form the Eurozone which is expected to dive to -0.5%. The Unemployment rate is also due out along with German retail sales and Spanish CPI. Certainly there is potential for Euro to break to the downside.

Technically speaking, a pennant pattern is indicative of a continuation of the current trend, which in this case is bearish. If we see a breakout lower as expected, look for support to be found at 132.25, 131.13 and 130.13. A breakout to the upside, although unlikely, will find resistance at 133.95, 134.84 and 135.83.

A pennant has formed on the EURJPY pair that could indicate a breakout. A continuation of the bearish trend is to be expected for such a pattern, however, watch for inflation figures that could dictate direction.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Ethereum may sustain trading inside key range, ETH ETFs to be delayed until 2025

Ethereum is beginning to show signs of recovery on Thursday despite a second consecutive day of poor performance in Hong Kong's spot Ethereum ETFs. Bloomberg analyst James Seyffart has also shared that a spot Ethereum ETF may not happen in the US in 2024.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.