BP Plc

The dollar traded unchanged against most of its G10 peers during the European morning Tuesday.

The New Zealand dollar was the only G10 currency to lose against the dollar, after the country’s biggest dairy exporter reduced its forecast milk price for the 2014/15 season. The drop in price from last season will reduce the collective income of New Zealand dairy farmers by around 1.9% of GDP. Kiwi dropped approximately 0.40% against dollar after the announcement to trade at midday in Europe at levels last seen 10th of June. NZD/USD hit 0.8555 and moved lower. I would expect the decline to test the support barrier of 0.8478 in the near future, marked by the lows of the 9th of June.

BP Plc announced its financial results for Q2 2014. Profits were approximately 34% higher than the same period last year and up 13% from Q1 2014. The company warned however that "if further international sanctions are imposed on Rosneft or new sanctions are imposed on Russia, this could have a material adverse impact on our financial position and results of operations". BP is one of the largest foreign investors in Russia through its 19.75% stake in Russian state oil company Rosneft, one of the entities that is the target of sanctions.

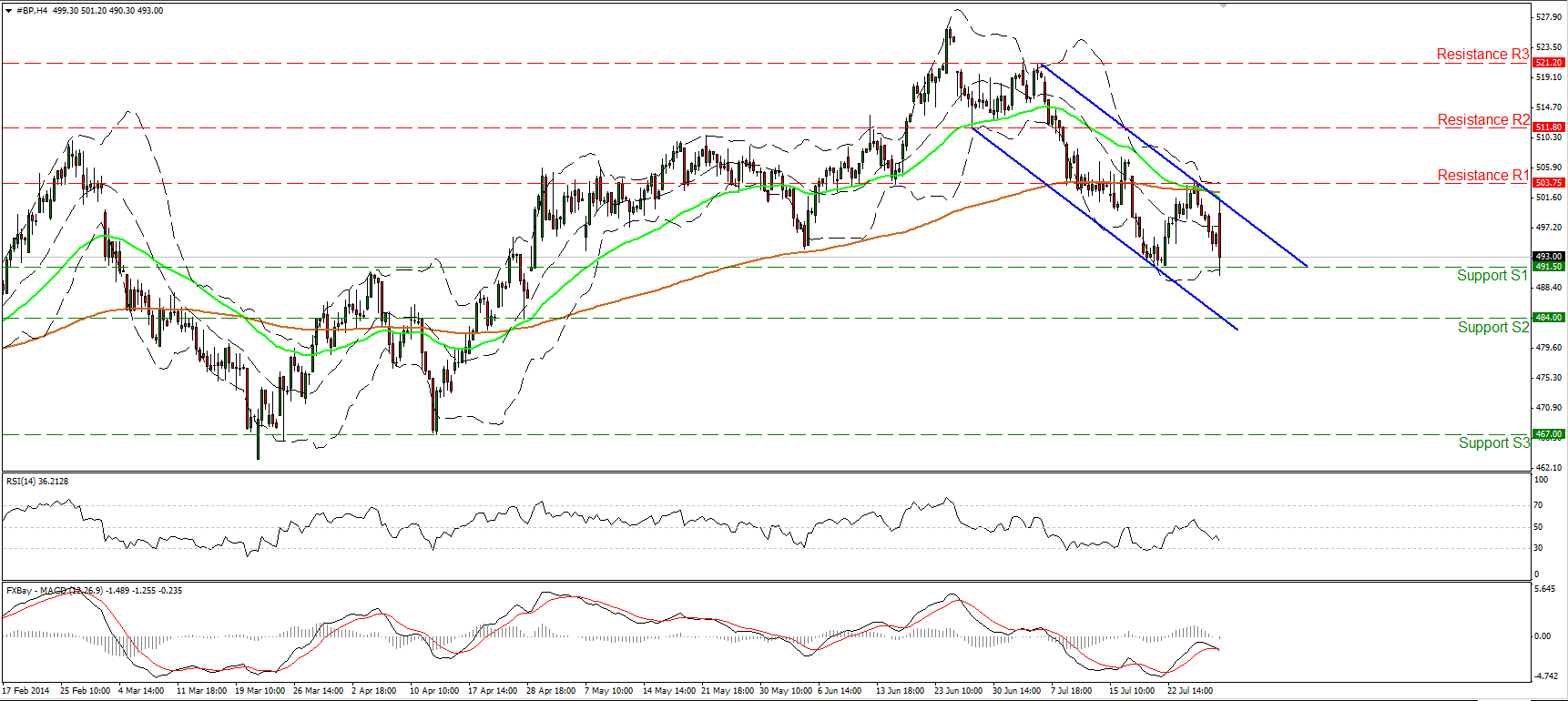

BP shares were down about 0.9% at midday. The decline was halted near the previous low at 491.50 (S1) and the price rebounded somewhat. From a technical point of view, the price has the necessary momentum to move below that barrier, since the RSI lies below 50 and has further to go before signaling oversold conditions, while the MACD, already negative, edged below its signal line. A clear move below 491.50 (S1) could trigger further extensions to target the next support at 484.00 (S2), first. As long as the price is printing lower peaks and lower troughs within the blue downside channel, I consider the near-term path to be to the downside. Moreover, the 50-period moving average fell below the 200-period one, adding to the negative picture of the stock. In the bigger picture, a weekly close below 491.50 (S1) could signal the completion of a possible head and shoulders formation on the daily chart and could reverse the overall longer-term uptrend. The daily MACD remains below both its trigger and zero lines, while the 14-RSI hit its 50 line and moved lower, corroborating my negative stance.

Support: 491.50 (S1), 484.00 (S2), 467.00 (S3).

Resistance: 503.75 (R1), 511.80 (R2), 521.20 (R3).

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Ethereum may sustain trading inside key range, ETH ETFs to be delayed until 2025

Ethereum is beginning to show signs of recovery on Thursday despite a second consecutive day of poor performance in Hong Kong's spot Ethereum ETFs. Bloomberg analyst James Seyffart has also shared that a spot Ethereum ETF may not happen in the US in 2024.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.