![]()

FX performance in the last week has thrown up a lot of unanswered questions: is the EUR heading lower after a period of consolidation? Is the dollar rally back on? Is GBP able to shrug off future referendum storms? This all leads to one important question for the trader – what is the market’s favourite strategy right now?

Earlier this year the carry trade had been reaping fruit earlier this year, however, this strategy has stalled as former funding currencies start to recover. As a re-cap, funding currencies tend to be sold in favour of higher-yielding currencies, which can have a higher value. However, although interest rates in the Eurozone are negative (deposit rates, anyway), and the ECB has embarked on a large-scale QE programme, the EUR has been an unreliable funding currency. For example, although it is still lower versus the dollar since the start of this year, to the tune of 5%, it has managed to gain 6% vs. the USD since April. Thus, for anyone shorting the EUR in recent weeks, it has been a painful experience.

In contrast, the New Zealand dollar, the highest yielding currency out of the expanded majors with an interest rate of 3.5%, it has gained the only 0.5% vs. the USD since April, and has actually lost 0.5% of value versus the USD since the start of May.

Changing strategy

The conclusion from this is clear: in this environment the carry trade is dangerous. Trying to sell low yielding currencies and buy higher yielding currencies is a loss making trade. We believe the carry trade is struggling at this junction because there is a lot of uncertainty around the timing of rate increases from some of the world’s major central banks, including the Federal Reserve and the Bank of England. Even the ECB has felt it necessary to explicitly state that its QE programme will survive until September next year, after some doubted its longevity after a spate of better growth and inflation data from the currency bloc.

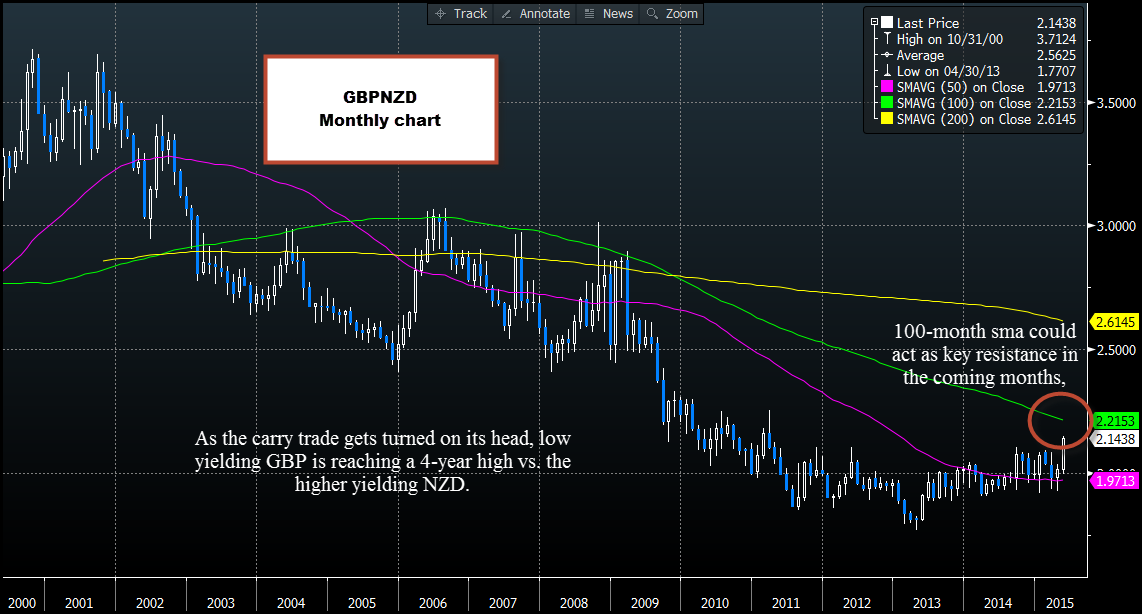

An example of the decline of the carry trade is the performance of GBPNZD. As the Kiwi has been languishing at the bottom of the pile, the pound has been getting its groove back in recent weeks; hence GBPNZD is approaching a 4-year high. The next key level to watch is 2.2153 – the 100-month moving average, as you can see in the chart below.

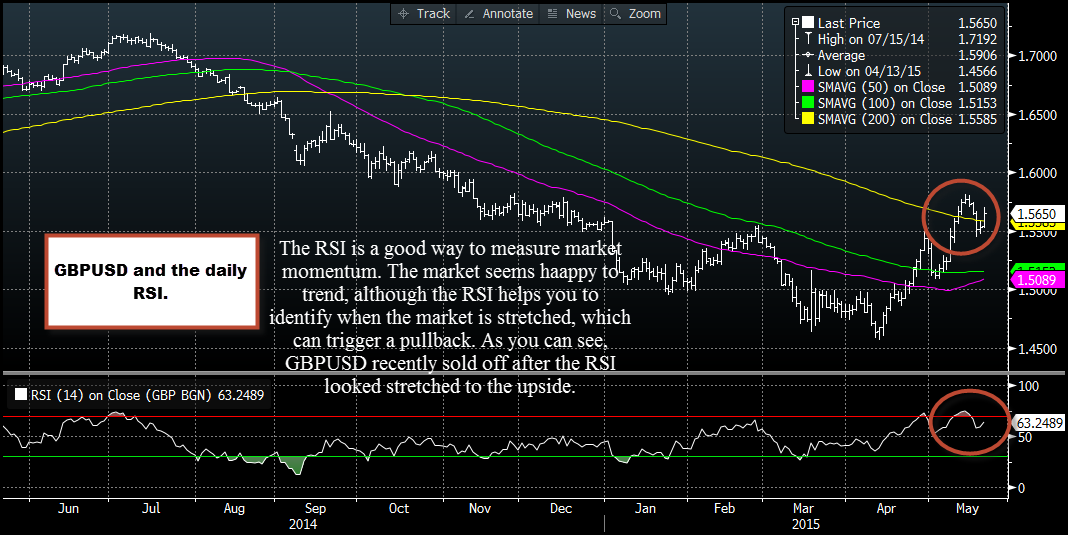

FX traders should not despair, the carry trade may not be working out, but the momentum trade is on track. There are different ways of measuring momentum in the FX market, one way that we like here at FOREX.com is using the Relative Strength Index (RSI). As you can see in figure 2, which shows GBPUSD and its daily RSI, GBPUSD had been trending higher after making a low in April, until it looked stretched to the upside, when GBPUSD reversed course. Based on recent price data, the sell-off in GBPUSD earlier this week coincided with the RSI moving into overbought territory above 70.

Take Away:

The EUR has been an unreliable funding currency in the last 2 months.

In fact, the carry trade has been turned on its head in recent weeks, with higher yielding currencies weakening, and low yielding currencies gaining strength vs. the USD.

This is why GBPNZD is at a 4-year high.

Momentum strategies have been more reliable in this environment, including RSI strategies.

Overall, until the Fed and the BOE decide when they will raise interest rates the carry trade is a difficult sell. In contrast, momentum strategies appear to be king for now.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.