![]()

Beijing has loosened policy one more in an effort to support its slowing economy. The People’s bank of China (PBoC) cut the reserve requirement ratio (RRR) by a 100 basis points on Sunday evening to 18.5%, reducing the amount of capital that banks are required to hold in reserve. It is the biggest cut to the RRR since the depths of a financial crisis and it’s designed to spur lending in the world’s second largest economy.

The move by the PBoC was in response to some soft economic data out of China last week. While growth figures for last quarter met expectations, industrial production and retail sales numbers raised concerns about the health of the economy this quarter. Retail sales and industrial production only increased 10.2% y/y and 5.6% y/y in March respectively, missing expected increases of 10.9% and 7.0% respectively, which when combined with last Monday’s soft trade numbers, it doesn’t paint of rosy picture of China’s economy at the beginning of Q2.

Even so, this latest cut to the RRR – the PBoC also cut the RRR by 50 basis points in February – was much bigger than the market was expecting and may raise concerns about the health of China’s economy. In saying that, the PBoC has a lot of room to move with monetary policy and this latest move, combined with other RRR and IR cuts, signals an aggressive shift towards a looser monetary policy stance - RRR cuts are more effective than IR cuts in our opinion, as they help to counteract a drain on liquidity due to massive capital outflows.

The aussie

AUDUSD’s initial reaction to the RRR cut was very positive, which is to be expected. Looser monetary policy in China is theoretically good news for the commodity-backed aussie that relies heavily on Chinese demand. There was also some data out of China last week that showed that China’s property market collapse is slowing.

In March, new home prices fell in 49 of the 70 cities surveyed tracked by Beijing, compared with 66 cities in February. This shows that some local moves to support the property market are working and bodes well for the AUD.

Last week, it wasn’t so much China’s soft economic data that weighed on the Australian dollar but a collapse in the amount of land sold over the first quarter and an increase in the stockpile of new homes, as well a mild slowdown in fixed asset investments. So, any news that China’s property market may be stabilising is good news for the aussie. However, the concern is that this latest move by the PBoC will raise concerns about the overall health of China’s economy (Beijing has a clearer picture of the economy that the market), but this is only a big problem for the Australian dollar if Beijing cannot fight the slowdown – eyes back on economic data!

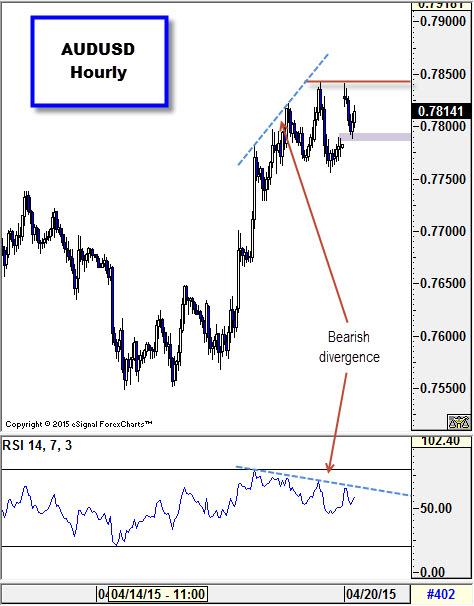

AUDUSD

AUDUSD leapt to an important resistance zone around 0.7840 at the open this morning, before pairing some of these gains later in the morning. Last week’s close around 0.7790 is now an important support zone for the pair. This puts AUDUSD between a rock – 0.7840 – and a hard place – 0.7790. Below 0.7840, our bias remains lower due to some technical weakness in the pair.

Source: FOREX.com

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.