Gold Price Forecast: XAU/USD sellers stay hopeful whilst below $2,350

- Gold price turns south toward $2,300 early Thursday, snapping a three-day rebound.

- The US Dollar looks to extend post-US CPI data recovery, courtesy of the Fed’s hawkish hold.

- Gold sellers remain poised to test the key $2,277 support, as the daily RSI stays bearish.

Gold price is trading in the red for the first time this week, looking to retest the $2,300 level early Thursday. Gold sellers fight back control following the hawkish US Federal Reserve (Fed) interest rate decision but stay cautious ahead of the US Producer Price Index (PPI) inflation data due later on Thursday.

Gold price enjoyed a good two-way business on Fed day

Gold price enjoyed good two-way price action on Wednesday, starting off the day on a cautious footing, consolidating Tuesday’s rebound in the lead-up to the US Consumer Price Index (CPI) data release.

Gold buyers received a fresh boost on a much softer-than-expected US CPI report, which bolstered expectations of Fed interest rate cuts this year. Increased dovish Fed bets smashed the US Dollar alongside the US Treasury bond yields across the curve, driving Gold price closer to the $2,350 barrier.

The headline CPI was flat over the month in May, below expectations for a 0.1% gain. Core CPI rose 0.2%, also below estimates for a 0.3% increase. The annual figures also came in softer than the market consensus.

However, the tide turned against Gold price, as sellers jumped back into the game on the Fed policy announcements. Gold price reversed nearly $15 from multi-day highs to settle with modest gains near $2,325 on Wednesday.

Fed held policy rates steady in the range of 5.25%-5.50%, following the June policy meeting. The revised Summary of Economic Projections, the so-called dot-plot, indicated the policymakers expect to cut rates only once in 2024, against a projection of three rate cuts in the March forecasts and down from two rate cuts widely anticipated.

Fed Chair Jerome Powell also delivered hawkish comments during his post-policy meeting press conference, noting that "more recent readings on inflation have shown easing. So far this year, we have not got greater confidence on inflation in order to cut."

"Will need to see more good data to bolster confidence on inflation,” Powell added.

With the ‘Super Wednesday’ now out of the way, attention turns toward a fresh batch of top-tier US economic data, including the PPI report, which could raise doubts over the Fed’s hawkish outlook on interest rates.

Gold price will likely remain at the mercy of risk trends and the US Dollar price action, in the aftermath of the key US events.

Gold price technical analysis: Daily chart

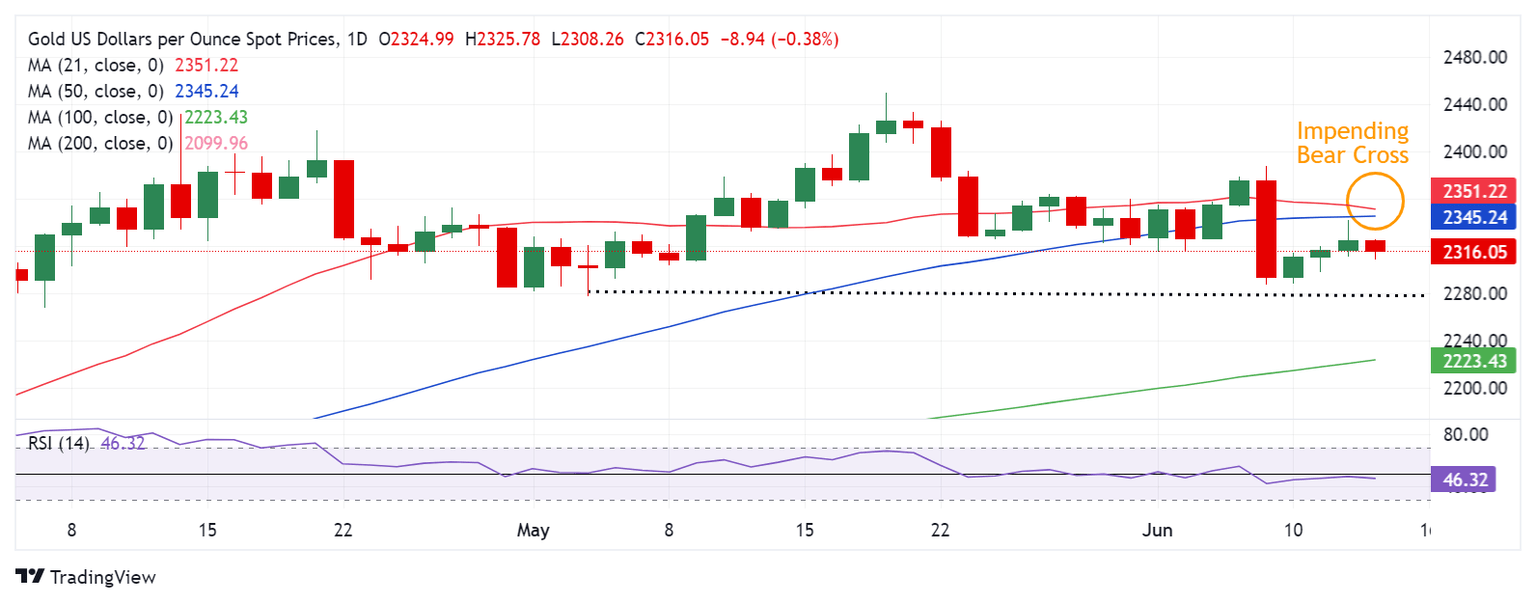

As observed on the daily chart, the Gold price defied bearish pressures on Wednesday but the downside bias remains intact going forward, as the 14-day Relative Strength Index (RSI) holds well below the 50 level and a Bear Cross remains in the making.

The 21-day Simple Moving Average (SMA) is on the verge of crossing the 50-day SMA from above, which if happens will validate the bearish crossover, opening the door for a renewed downtrend in Gold price.

The immediate support is now seen at the $2,300 threshold, below which the May 3 low of $2,277 will be threatened. A sustained break below the latter is critical to boosting sellers toward the $2,250 psychological barrier.

Alternatively, the recovery in Gold price will need acceptance above key confluence support-turned-resistance near $2,350, where the 21-day and 50-day SMAs coincide.

Gold buyers will then flex their muscles toward the May 24 high of $2,364 on their way to the June 7 high of $2,388.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.