Gold Price Forecast: XAU/USD sees a dead cat bounce following Fed’s hawkish cut

- Gold price off monthly lows, remains below $2,600 amid the Fed’s hawkish rate cut.

- The US Dollar consolidates at multi-month highs alongside the US Treasury bond yields.

- Gold price remains a ‘sell-on-bounce’ trade on the daily time frame.

With the full final week of 2024 almost drawing to a close, Gold price remains vulnerable near one-month lows below $2,600, licking the hawkish US Federal Reserve (Fed) policy decision-inflicted wounds.

Gold price loses $2,600 as Fed signals fewer rate cuts in 2025

Gold price extended its corrective decline from five-week highs of $2,726 and hit the lowest level in a month near $2,580 before rebounding toward $2,600, where it now wavers.

The primary reason behind the Gold price downside is the Fed’s cautious outlook on interest rate cuts in the face of US President-elect Donald Trump’s protectionist world, which is likely to be inflationary.

The US central bank lowered policy rate by 25 basis points (bps) to 4.25%-4.50% range, as widely expected. However, the Fed’s Statement of Economic Projections (SEP), the so-called Dot plot chart, forecast two quarter-percentage-point rate reductions by the end of 2025. That is half a percentage point less in policy easing next year than officials anticipated as of September.

The Fed policymakers project inflation jumping to 2.5% from 2.1% in their prior projections for the first year under the new Trump administration.

The hawkish Fed shift triggered a sharp rally in the US Treasury bond yields, which drove the US Dollar (USD) to over two-year highs against its major rivals. The US Dollar Index (DXY) surged to 108.27, its highest since November 2022.

Looking ahead, traders will react to the Fed’s hawkish cut outcome while awaiting the policy verdicts from the Bank of Japan (BoJ) and the Bank of England (BoE). Both central banks are expected to stand pat on interest rates, but their outlooks on the policy course next year will hold the key to market sentiment.

The US Dollar could take the lead from the USD/JPY price action following the BoJ policy announcements, impacting the USD-sensitive Gold price. However, any move is likely to be temporary, as the focus will remain on the latest Fed projections.

Gold traders will also look forward to the US data releases, including the third-quarter growth revision, Jobless Claims and Existing Home Sales data, for fresh trading impetus ahead of Friday’s US November PCE inflation report.

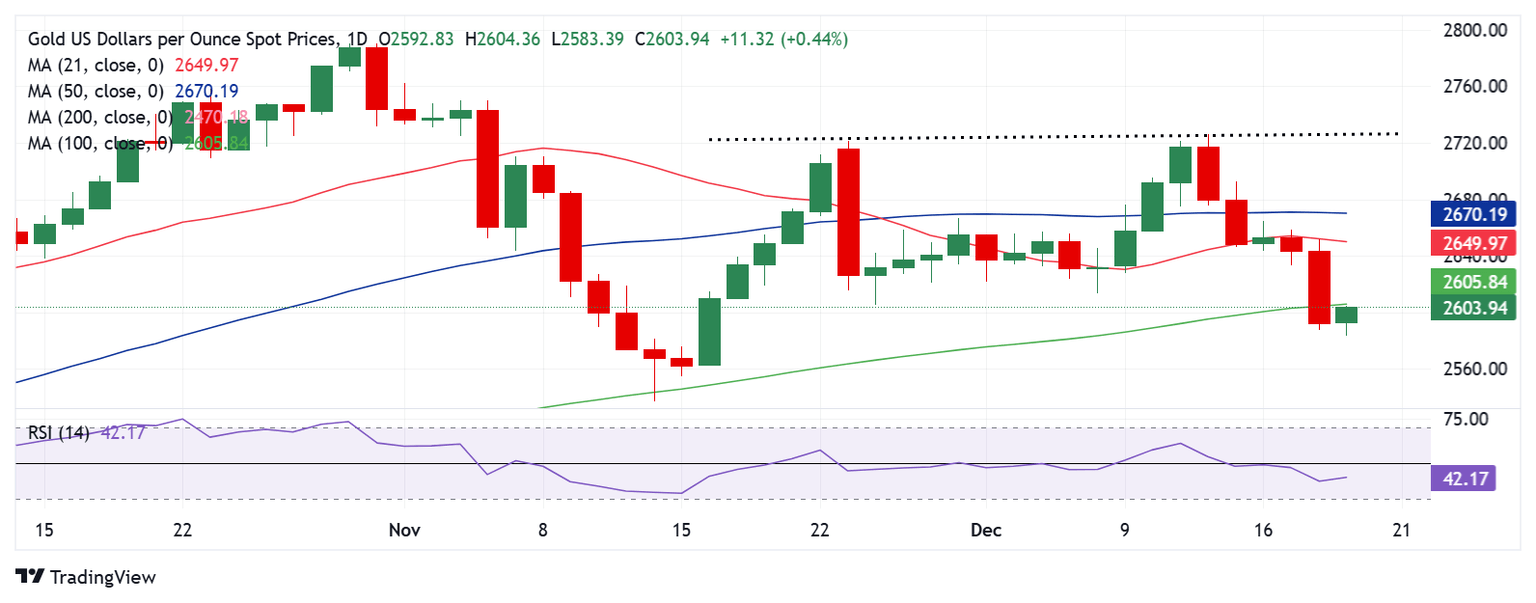

Gold price technical analysis: Daily chart

The daily chart shows that Gold price is testing the key 100-day Simple Moving Average (SMA) at $2,605 on its tepid recovery attempt early Thursday.

Recapturing that level on a daily closing basis is critical to unleashing additional recovery.

The next topside barrier is at the December 17 low of $2,633, followed by the 21-day Simple Moving Average (SMA) of $2,650.

The 14-day Relative Strength Index (RSI) has ticked up but remains below the 50 level, suggesting that Gold price remains a good selling opportunity on rebounds.

If the turnaround fizzles out, Gold sellers will again challenge the monthly low of $2,583.

The November 15 and 14 lows at $2,555 and $2,537, respectively, could come into play.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.