Gold Price Forecast: XAU/USD bulls await US NFP report before positioning for further gains

- Gold price remains supported near the weekly top amid dovish Fed-inspired USD selling bias.

- Renewed concerns about an economic downturn further underpin the safe-haven commodity.

- Bulls turn cautious and look to the crucial US NFP report before positioning for further gains.

Gold price (XAU/USD) trades with a positive bias for the third straight day and is placed around the $2,520 area, or the top end of the weekly range during the early European session on Friday. The upside, however, seems limited as traders remain cautious ahead of the crucial US Nonfarm Payrolls (NFP) report, which might influence market expectations about the possibility of a larger interest rate cut by the Federal Reserve (Fed) in September. This, in turn, will play a key role in driving the US Dollar (USD) demand and provide a fresh directional impetus to the non-yielding yellow metal.

Meanwhile, the markets are pricing in a 40% chance that the Fed will lower borrowing costs by 50 basis points (bps) at the end of the September 17-18 policy meeting. The bets were lifted by a mixed bag of US employment data released this week, which provided evidence of a deteriorating labor market. In fact, a report on Wednesday showed that US job openings dropped to a three-and-a-half-year low of 7.673 million in July. Adding to this, Automatic Data Processing (ADP) reported on Thursday that private-sector employment registered the smallest rise since January 2021 and increased by 99K in August.

Furthermore, Chicago Fed President Austan Goolsbee said on Friday that the longer-run trend of labor market and inflation data justify easing interest-rate policy soon and then steadily over the next year. This keeps the US Treasury bond yields depressed at their lowest levels in more than a year and drags the USD away from a two-week high touched on Tuesday, which, in turn, is seen offering some support to the Gold price. Hence, even a slight disappointment from the closely-watched US monthly jobs data could prove negative for the Greenback and pave the way for some meaningful upside for the commodity.

In contrast, the immediate market reaction to the better-than-expected report is more likely to be limited amid the prospects for an imminent start of the Fed's rate-cutting cycle. Nevertheless, the Gold price remains on track to register modest weekly gains and the fundamental backdrop seems tilted firmly in favor of bullish traders.

Technical Outlook

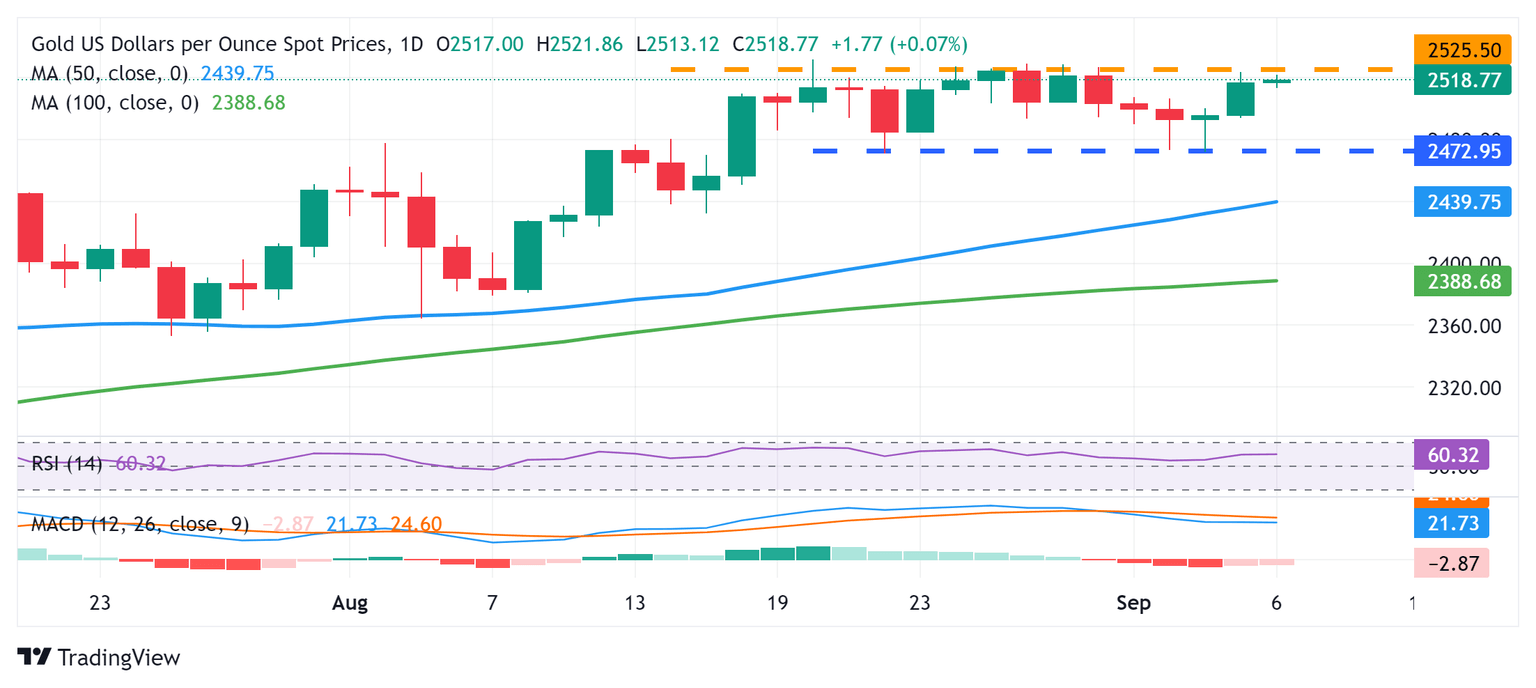

From a technical perspective, a sustained strength beyond the $2,524-$2,525 hurdle will reaffirm the near-term positive outlook. Given that oscillators on the daily chart are holding in positive territory and are still away from being in the overbought zone, the Gold price might then aim to surpass the all-time peak, around the $2,531-$2,532 region touched in August. The subsequent move-up should pave the way for the resumption of a well-established uptrend witnessed over the past two months or so.

On the flip side, the $2,500 psychological mark now seems to protect the immediate downside, below which the Gold price could slide to the $2,471-$2,470 horizontal support. A convincing break below the latter will set the stage for deeper losses towards the 50-day Simple Moving Average (SMA), currently pegged near the $2,440 region, en route to the $2,400 mark and the 100-day SMA, around the $2,388 zone.

XAU/USD daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.