Gold update: Higher degree correction in play [Video]

![Gold update: Higher degree correction in play [Video]](https://editorial.fxsstatic.com/images/i/gold-03_XtraLarge.jpg)

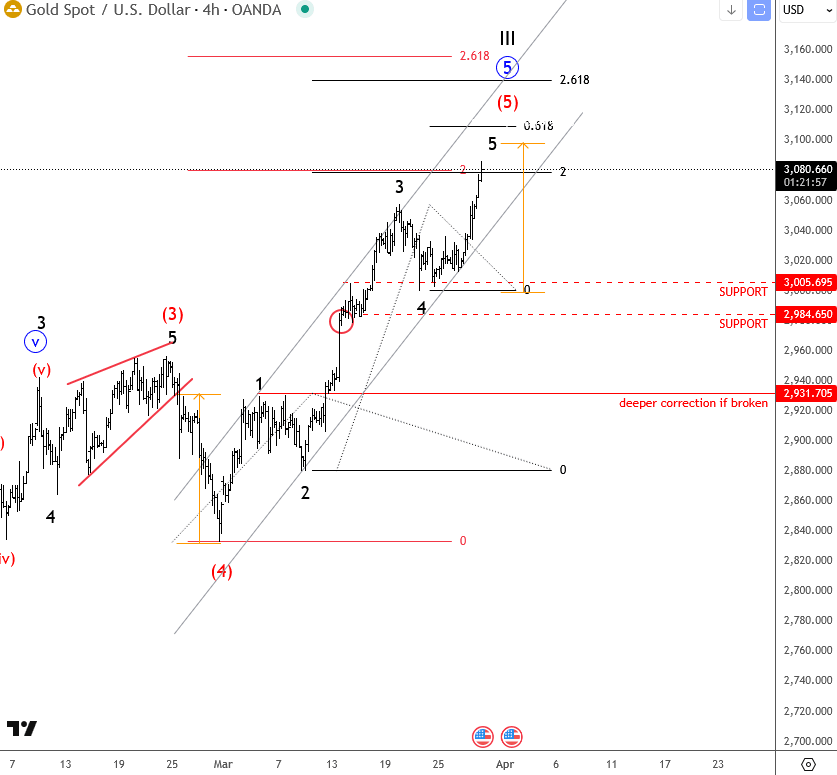

We talked about gold on March 28, where we mentioned and highlighted that it’s finishing wave 5 of extended wave III based on Elliott wave analysis.

XAUUSD 4H Chart From March 28

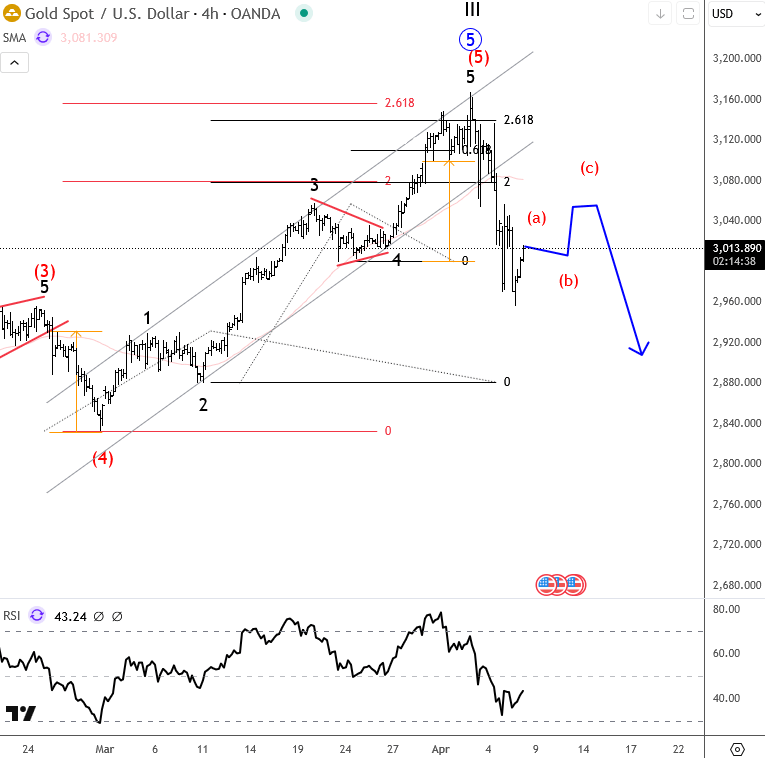

We warned about a potential reversal on gold, as we were able to count five waves up from the February lows. What we see now is a very strong and decisive break out of the upward channel, confirming that the impulse up in red wave 5 cycle is completed. This means the metal is now entering a higher-degree correction, which is certainly possible since bulls stopped at a very important FIB level on the daily chart, where we also see a potential completion of an extended black wave three based on the Elliott wave structure model on a daily TF.

XAUUSD 4H Chart From April 08

For a detailed view and more analysis like this, you may want to watch below our latest recording of a live webinar streamed on April 07 2025:

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.