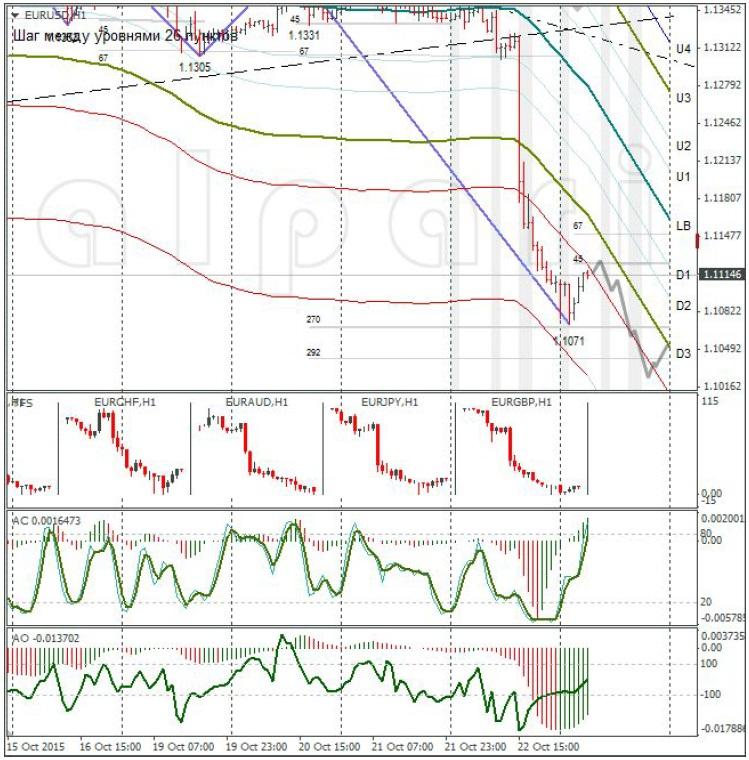

Hourly

Yesterday’s Trading:

On Thursday the euro/dollar fell by 230 points. In the second half of the day, Mario Draghi made the euro drop to 1.11.

The ECB kept its interest rate unchanged. Mario Draghi announced that the ECB is ready to extend QE in December and a drop in the base rate and deposit rate was discussed.

Main news of the day:

From 10:00 to 11:00 EET, EU PMIs for the service sector in October will be out;

At 15:30 EET, Canada’s September CPI will be out;

At 16:45 EET, the US is releasing its October business activeness index in the manufacturing sector.

Market Expectations:

The euro fell below 1.1086. Now it needs to close the day below 1.1070 and then the sellers will see the road to 1.0970 open up, with a EURUSD nosedive to 1.0461 following it. There’s no important news out in Europe today (I don’t see the PMI as important) which could change the fate of the euro/dollar, so after a rebound, I’m waiting for a continuation of yesterday’s tendency to 1.1035.

Technical Analysis:

Intraday target maximum: 1.1125, minimum: 1.1035, close: 1.1055;

Intraday volatility for last 10 weeks: 121 points (4 figures).

The euro/dollar has fallen below the D4 and has stopped still near 270 degrees. There’s no AO divergence with the price, meaning we should consider a correction after a fall in the rate to 1.1035. We could see it head straight to 1.0965, so don’t be caught out on the downward knife edge.

Daily

On 15th October, Ewald Nowotny flipped the euro rate on its head, on 22nd October, Mario Draghi set the fall in stone. Yesterday saw the trend line and the LB broken. The eurobulls tested the 3rd September minimum (1.1086). The euro is now above the support. The dotted line is the trend for the closing prices. A close below 1.1050 will be enough to open the road to 1.0965. We can see a bearish impulse on the monthly time frame which could be compounded towards the end of the month. Now to the weekly.

Weekly

The euro/dollar tested the lower limit of the 1.1086-1.1494 channel after Draghi’s press conference. I’m waiting for a close below 1.1086 and then we can prepare for a break in the trend line which takes its beginnings from a 1.0461 minimum.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.