- A combination of factors prompted some aggressive short-covering around GBP/USD.

- The key focus will remain on the first US presidential debate, scheduled this Tuesday.

- The incoming Brexit-related headlines will also be looked upon for some trading impetus.

The GBP/USD pair witnessed some aggressive short-covering move on the first day of a new trading week and was being supported by a combination of factors. The British pound's strong outperformance was fueled by the optimism over a breakthrough in this week's Brexit trade negotiations. Reports indicated that the two sides remain optimistic that some kind of a deal will be struck before the very important EU summit in mid-October. The UK PM spokesman reinforced market expectations and said that a Brexit agreement was still possible. The spokesman, however, added that there are significant gaps and the EU must adopt a more realistic policy position.

The sterling got an additional boost after the Bank of England (BoE) policymaker, Dave Ramsden, downplayed the possibility of negative interest rates in the short-term. In an interview with the Society of Profession Economists, Ramsden was noted saying that he still sees the effective lower bound in the bank rate at 0.10%. He further said that the central case sees GDP recovering steadily but there are real uncertainties and risks from the pandemic, Brexit and the US election. BoE is ready to act further if needed. This, along with some US dollar profit-taking, pushed the pair to one-week tops, or levels beyond the 1.2900 round-figure mark.

Upbeat Chinese data released over the weekend and optimism over additional US fiscal stimulus triggered a strong rally in the global equity markets. The risk-on mood dented the greenback's perceived safe-haven status and remained supportive of the pair's intraday positive move of around 180 pips. However, worries about a surge in new COVID-19 infections and political uncertainty in the US helped limit the USD pullback. Investors remain concerned about a smooth transfer of power if President Donald Trump losses the election in early November. Hence, the key focus will be on the first presidential debate, scheduled later this Tuesday.

Apart from this, the incoming headlines from the ninth and the final round of Brexit talks, starting this Tuesday, will influence the sentiment surrounding the British pound and further contribute to produce some meaningful trading opportunities.

Technical levels to watch

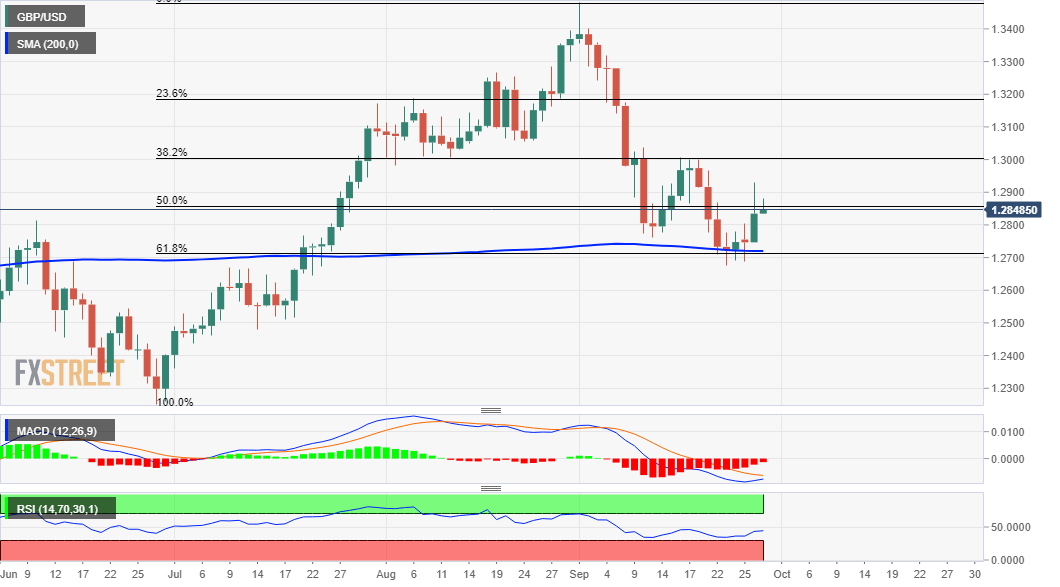

From a technical perspective, the overnight rally could be solely attributed to some short-covering from a technically significant moving average (200-day SMA). The lack of any strong follow-through buying and a subsequent pullback of around 100 pips points to the prevalent selling bias at higher levels. Hence, any move back towards the 1.2925-30 region might still be seen as a selling opportunity. This, in turn, should continue to cap the pair near the key 1.3000 psychological mark. Only a sustained move beyond will negate any near-term bearish bias and pave the way for additional gains.

On the flip side, the 1.2800 mark now seems to protect the immediate downside and is closely followed by the 1.2775 horizontal support. Failure to defend the mentioned levels would turn the pair vulnerable to slide back towards the 1.2700 round-figure mark (200-DMA). Some follow-through selling below the recent swing lows, around the 1.2675 level, will set the stage for the resumption of the downward trajectory. The pair might then accelerate the fall further towards mid-1.2500s before eventually dropping to the key 1.2500 psychological mark.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.