GBP/USD Forecast: Focus on UK’s reopening

GBP/USD Current price: 1.4190

- The UK full reopening at doubt amid the rising number of coronavirus cases.

- The UK celebrates the Spring Bank Holiday on Monday, no data will be published.

- GBP/USD has the risk skewed to the upside, needs to break above 1.4235.

The GBP/USD pair advanced for a fourth consecutive week to settle at 1.4190, not far from its monthly high at 1.4233. The pair fell through the first half of the day, recovering after the release of upbeat economic data that spurred risk appetite. The pair swung on the back of the dollar’s strength/weakness, as the case for a bullish pound was cooled by concerns about the Indian coronavirus variant.

The UK’s massive immunization campaign led to lifting restrictions in the kingdom by steps, with the last one scheduled for June 21. All measures are scheduled to be lifted and free international travel should resume that day. However, the increasing number of new contagions due to the mentioned strain puts at doubt easing restrictions in three weeks.

Data wise, the UK did not publish relevant data on Friday, and since it celebrates the Spring Bank Holiday this Monday, it will remain empty at the beginning of the week.

GBP/USD short-term technical outlook

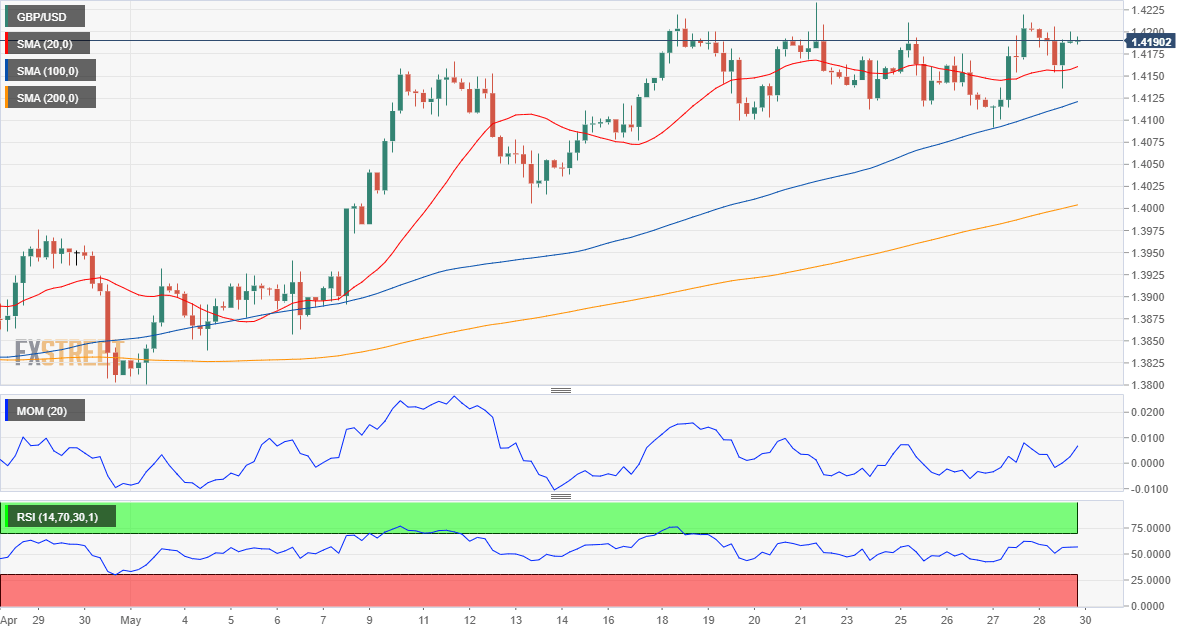

The GBP/USD pair maintains its positive stance in the daily chart but lacks momentum. The pair has held above a bullish 20 SMA, currently at 1.4075 and advancing above the longer ones. However, technical indicators ease within positive levels, the Momentum approaching its 100 level but the RSI stable at 61. The 4-hour chart shows that the pair is neutral-to-bullish, having settled above a directionless 20 SMA, while the longer ones head north below it. Technical indicators remain above their midlines, although without directional strength.

Support levels:1.4165 1.4120 1.4075

Resistance levels: 1.4235 1.4285 1.4330

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.