- GBP/USD has jumped above 1.29 after UK PM Johnson intervened in Brexit talks.

- Doubts about a breakthrough, Trump's coronavirus, and Non-Farm Payrolls could bring the cable back down.

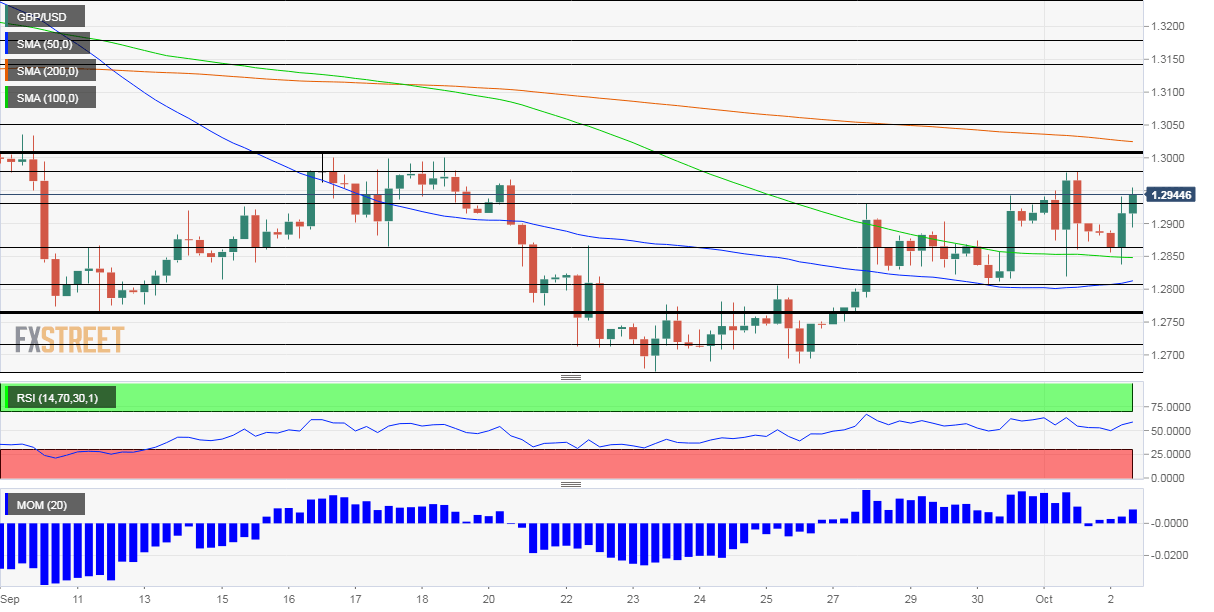

- Friday's four-hour chart is showing minor upside momentum.

Taking it to the top-level – Prime Minister Boris Johnson will speak with European Commission President Ursula von der Leyen on Saturday. The news of the PM's intervention triggered hopes for a Brexit breakthrough and boosted the pound. However, there are reasons to doubt that sterling would hold onto these gains.

Johnson's move comes one day after von der Leyen announced legal action against the UK. Brussels sent a formal notice, which is the first step ahead of going to court on the Internal Markets Bill. The controversial legislation knowingly violates the Brexit Withdrawal Agreement and aims to fully derail the already sensitive talks on future relations.

Will the British leader cede ground to the bloc? That happened last year when he agreed to allow for a customs border on the Irish Sea. However, the IMB violates that concession, and the EU will likely be more skeptical. Moreover, the telephone call takes place when markets are closed, and investors may prefer to refrain from taking risk ahead of the weekend.

GBP/USD also faces pressures from the other side of the pond. Around six months after Johnson told the world he has coronavirus, President Donald Trump tweeted a similar message, adding to uncertainty ahead of the elections and supporting the safe-haven dollar.

There are several differences between the COVID-19 stories of both blond leaders. Johnson reported symptoms of coronavirus when little was known about it, and eventually became gravely ill. Trump was diagnosed due to exposure to his aide Hope Hicks and is reportedly doing perfectly well. Knowledge about treating the virus has substantially evolved since then.

Nevertheless, Trump is 74 years old and is overweight, thus being at higher risk. His rival Joe Biden is older and both men shared the same stage at the presidential debate on Tuesday. Uncertainty about the elections and also the fiscal stimulus package have substantially risen.

See Trump's coronavirus adds uncertainty in three ways, stocks have more room to fall

On Thursday, Republicans and Democrats failed to reach an agreement on the next relief deal. Friday's Non-Farm Payrolls report may push lawmakers into action, especially as it is expected to show a slowdown in job growth.

Economists expect an increase of around 850,000 positions in September and a minor drop in the unemployment rate from 8.4% to 8.2%. On the other hand, figures leading toward the publication beat estimates, opening the door to an upside surprise, lifting the dollar.

See

- Nonfarm Payrolls Preview: Eagerly waiting for an upbeat report

- US Employment Situation Report September Preview: A challenge to define normality

Overall, there is considerable potential that the current jump in GBP/USD may make way for a fall, as experienced in previous days.

GBP/USD Technical Analysis

Pound/dollar has bounced off the 100 Simple Moving Average on the four-hour chart and is trading above the 50 SMA. On the other hand, it is depressed below the 200 SMA and upside momentum has yet to pick up.

Support is at 1.2860, a swing high from late September. It is followed by 1.2810, a low point early this week, and 1.2760, which separated ranges last week.

Resistance is at 1.2980, the weekly high, followed by 1.30, which is a round number and capped GBP/USD last week. Further above, 1.3050 looms.

More: Who will be the next president? Markets seem to care more about Congress' actions (for now)

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.