A currency isn’t the stock price of a country. Many people assume that when a country’s economic fundamentals improve, the currency should appreciate. That’s probably based on the idea that a currency is like a stock. When a company’s results increase, usually the stock price goes up. The same thing should happen with a country. But it’s not necessarily true, and we saw that overnight with USD. The economic news was as usual favorable, but that didn’t matter to the market. Pending home sales for May were much much higher than expected -- +6.1% mom instead of the market consensus of +1.5%, and far higher than +0.4% in April. This suggests that the economy is indeed recovering from the disappointing first quarter, and that GDP will be higher in Q2 than in Q1, because housing sales add to GDP (real estate brokers’ commissions and all that). The Chicago PMI disappointed but the three-month average is still the highest for several years and the details were solid. Meanwhile the Dallas Fed manufacturing survey was better than expected. There was also a speech by San Francisco Fed President Williams, who said he expected GDP to run around 3% for the rest of the year, a fairly healthy pace, and for the unemployment rate to hit 6% by the end of the year. Yet bond yields declined by 1 or 2 bps, as did the implied interest rate on Fed Funds futures, and the dollar weakened against most of the G10 currencies. Month-end buying may have been responsible; we’ll have to see whether any of the move is reversed over the coming week.

The one exception was the yen, which weakened as a somewhat better-than-expected Tankan report sent Japanese stocks higher. The current conditions were in several cases weaker than expected, but the expectations for Q3 were generally in line with or even better than expectations. Particularly encouraging was the jump in large manufacturers’ capital spending predictions. There was also a rise in the output price index, indicating that deflationary pressures are decreasing. However, the tankan did not indicate much upward pressure on wages, so I personally doubt the Bank of Japan’s scenario that inflation will pick up in the second half of the year (unless the yen begins weakening again). Already break-even inflation rates on index-linked Japanese government bonds show that the market does not expect inflation to hit the BoJ’s 2% target. I also have reservations about how successful PM Abe’s “Third Arrow” of structural reform will be. The net result is that I still think the BoJ will have to take further steps later this year to loosen policy further, which will weaken the yen.

The Reserve Bank of Australia (RBA) kept rates steady at 2.5%, as was universally expected. I could discern no significant differences at all between the statement this time and last time. AUD/USD moved up around 20 bps, perhaps on relief that they didn’t come out with any stronger statement about the AUD.

Today is PMI day. It started in China, where the official manufacturing PMI for June increased exactly in line with market expectations to 51.0 from 50.8. The final manufacturing PMI for June from HSBC/Markit however was revised down slightly, although it remained above the crucial 50 barrier. It was notable that AUD/USD barely moved when the figure was released. Perhaps AUD is becoming less sensitive to Chinese economic news and more sensitive to domestic factors.

Later we get the manufacturing PMI figures for June from several European countries, the Eurozone as a whole, the UK and the US. As usual, the final forecasts for the French, the German and Eurozone’s figures are the same as the initial estimates. The UK manufacturing PMI is estimated to be slightly down to 56.8 from 57.0, while in the US, the ISM manufacturing PMI is expected to have risen to 55.8 from 55.4. That could prove USD-supportive, except yesterday’s good US indicators failed to support the dollar so one wonders if today’s will.

Besides the PMIs, we have the German unemployment rate for June and Eurozone’s unemployment rate for May. Both rates are expected to have remained unchanged at 6.7% and 11.7% respectively.

Only one speaker is scheduled on Tuesday’s agenda. ECB Governing council member Ewald Nowotny, speaks at a briefing with IMF about the Fund’s review of Austria.

THE MARKET

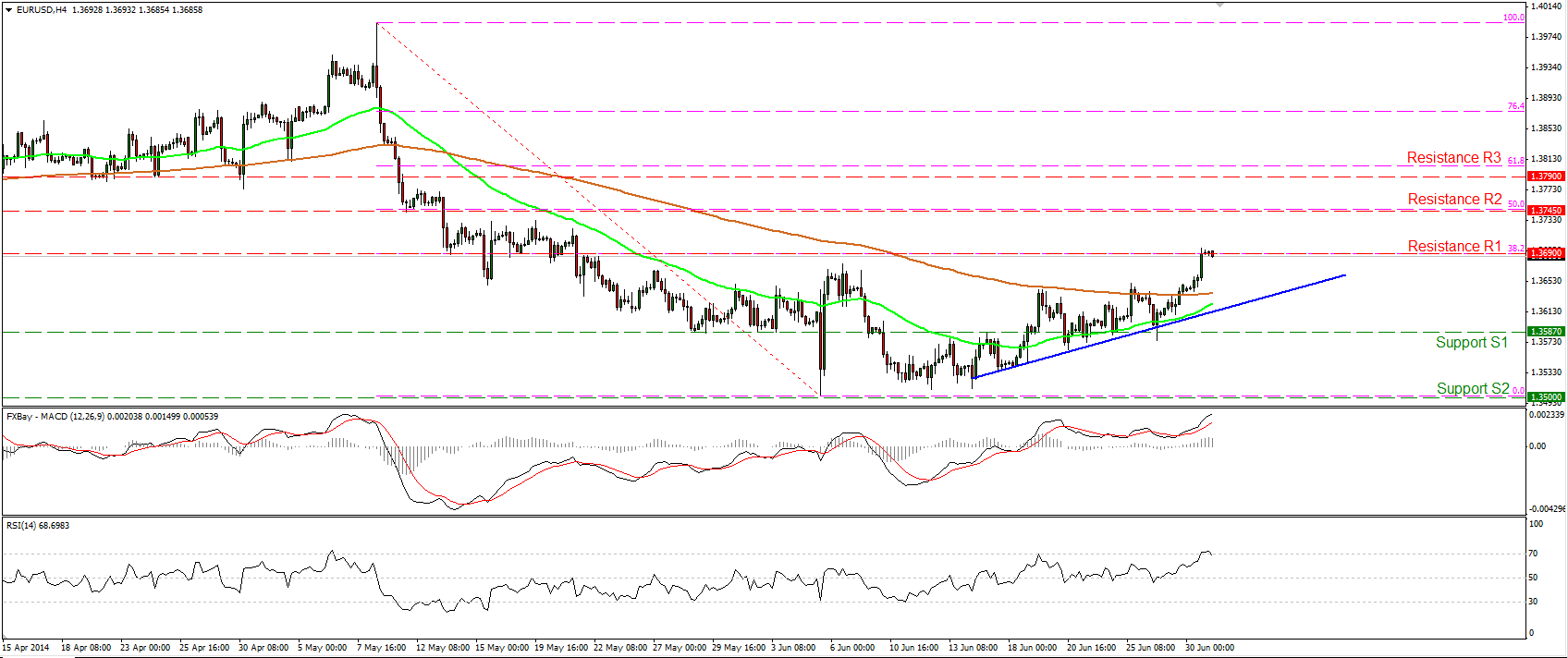

EUR/USD reaches the 1.3690 zone

EUR/USD moved higher on Monday reaching the 38.2% retracement level of the 8th May- 5th June decline. The MACD lies above both its zero and signal lines, but the RSI seems ready to exit its overbought zone. As a result, I would expect the forthcoming wave to be to the downside, maybe for a test near the blue upside support line. Since the pair is still trading above that near-term support line, I consider the upside correcting phase to remain in effect. Only a dip below 1.3587 (S1) may signal that the retracement is over and pave the way towards the key support of 1.3500 (S2).

Support: 1.3587 (S1), 1.3500 (S2), 1.3475 (S3).

Resistance: 1.3690 (R1), 1.3745 (R2), 1.3790 (R3).

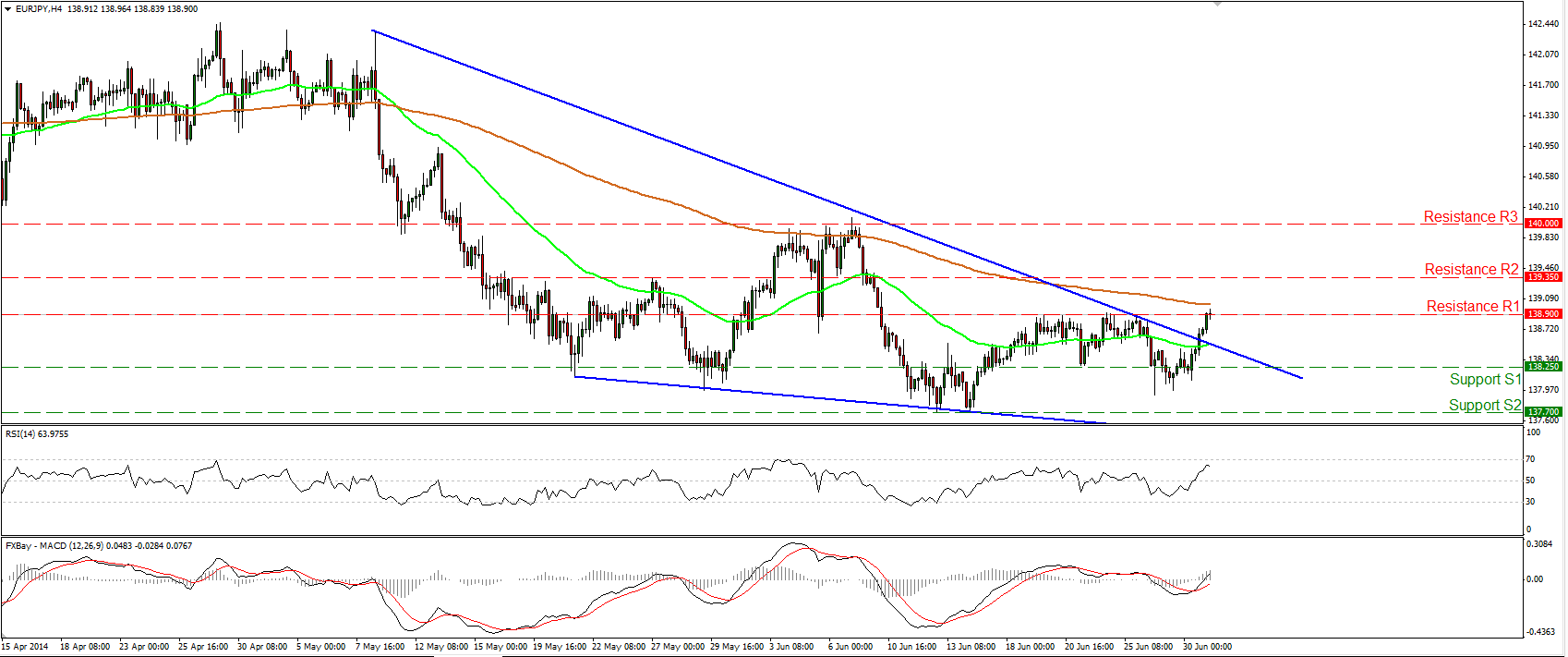

EUR/JPY breaks the upper bound of the wedge

EUR/JPY moved higher yesterday, violating the upper boundary of the falling wedge formation. The advance was halted by our resistance barrier of 138.90 (R1), where an upside violation may confirm the exit of the wedge pattern and trigger extensions towards the 140.00 (R3) psychological zone. Both our momentum studies moved higher, with the MACD crossing above its signal and zero lines. This confirms the recent bullish momentum and increases the possibilities for further advance in the near future. In the bigger picture, the long-term path of the rate remains to the sideways since we cannot identify a clear trending structure.

Support: 138.25 (S1), 137.70(S2), 136.75 (S3).

Resistance: 138.90 (R1), 139.35 (R2), 140.00 (R3).

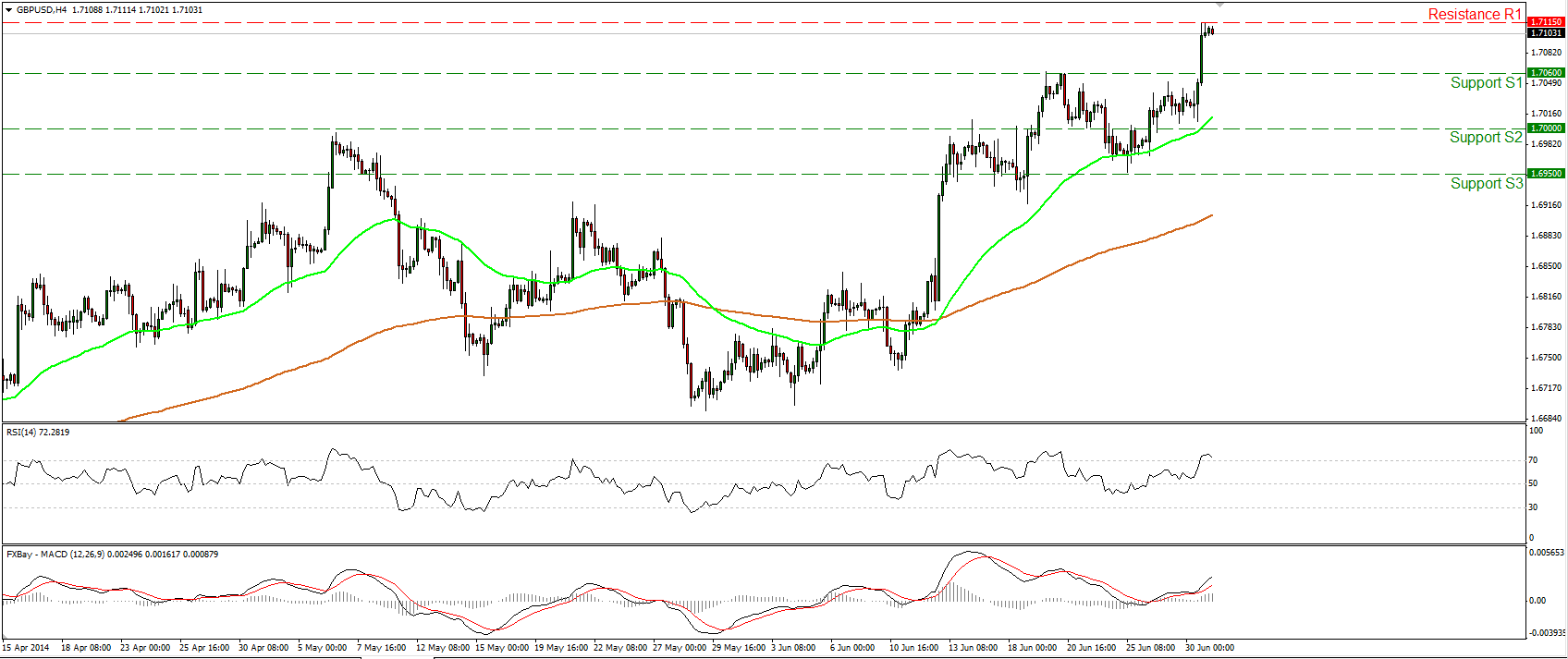

GBP/USD above 1.7100

GBP/USD surged on Monday, breaking above the hurdle of 1.7060 and confirming a forthcoming higher high. The rally was halted by the resistance bar at 1.7115 (R1), where a decisive upside violation could pave the way towards the 1.7200 (R2) zone. The MACD lies above both its trigger and zero lines, but the RSI seems ready to exit its overbought territory. Having that in mind, I would expect some consolidation or a pullback before the longs take control again. In the bigger picture, the 80-day exponential moving average provides reliable support to the lows of the price action, keeping the long-term path to the upside.

Support: 1.7060 (S1), 1.7000 (S2), 1.6950 (S3).

Resistance: 1.7115 (R1), 1.7200 (R2), 1.7300 (R3).

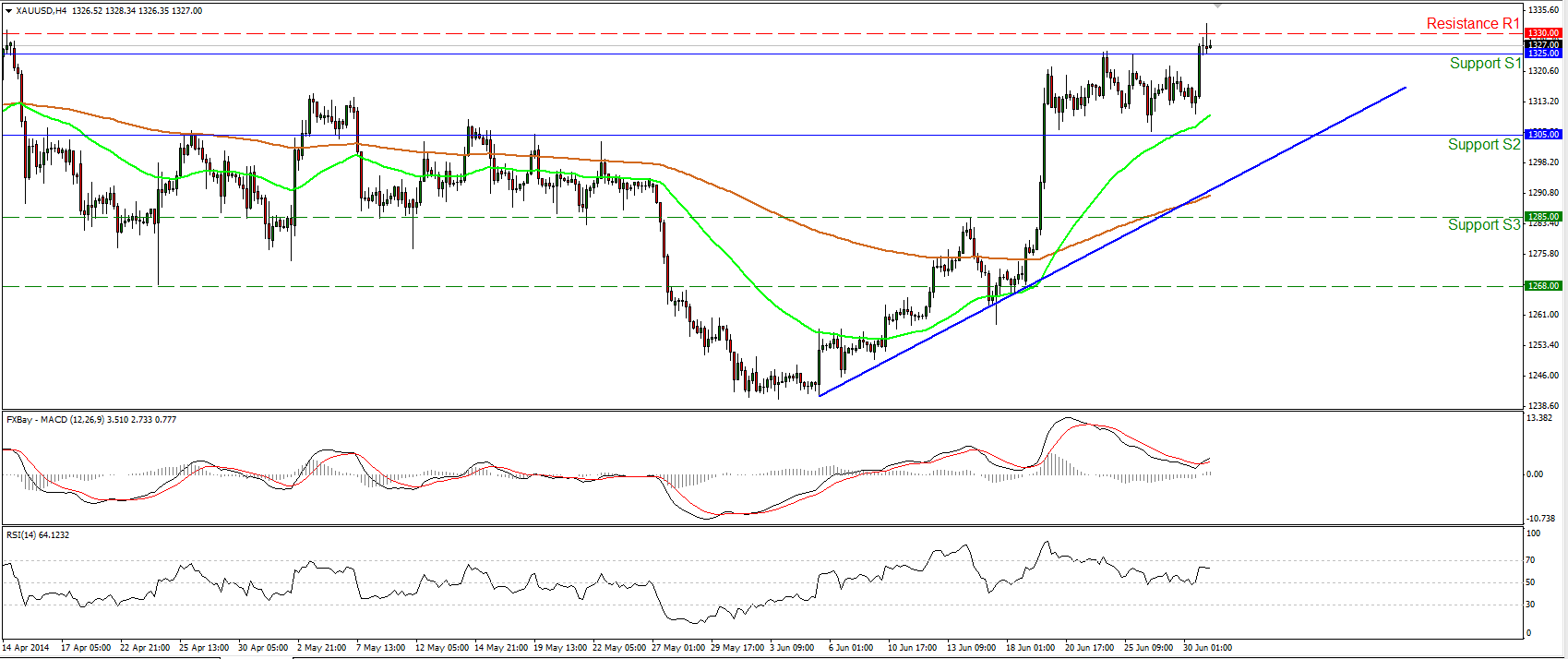

Gold breaks out of the range

Gold emerged above 1325, the upper boundary of the short-term sideways path it has been trading since the 19th of June. The precious metal is now trading below the resistance of 1330 (R1) and if the bulls are willing to overcome that barrier, I would expect them to trigger extensions towards the next obstacle at 1342 (R2). The MACD, already within its positive territory, crossed above its trigger line, while the RSI moved higher after finding support at its 50 level, amplifying the case for the continuation of the advance. As long as the metal is trading above both the moving averages and above the blue uptrend line, the overall technical picture remains positive.

Support: 1325 (S1), 1305 (S2), 1285 (S3).

Resistance: 1330 (R1), 1342 (R2), 1350 (R3).

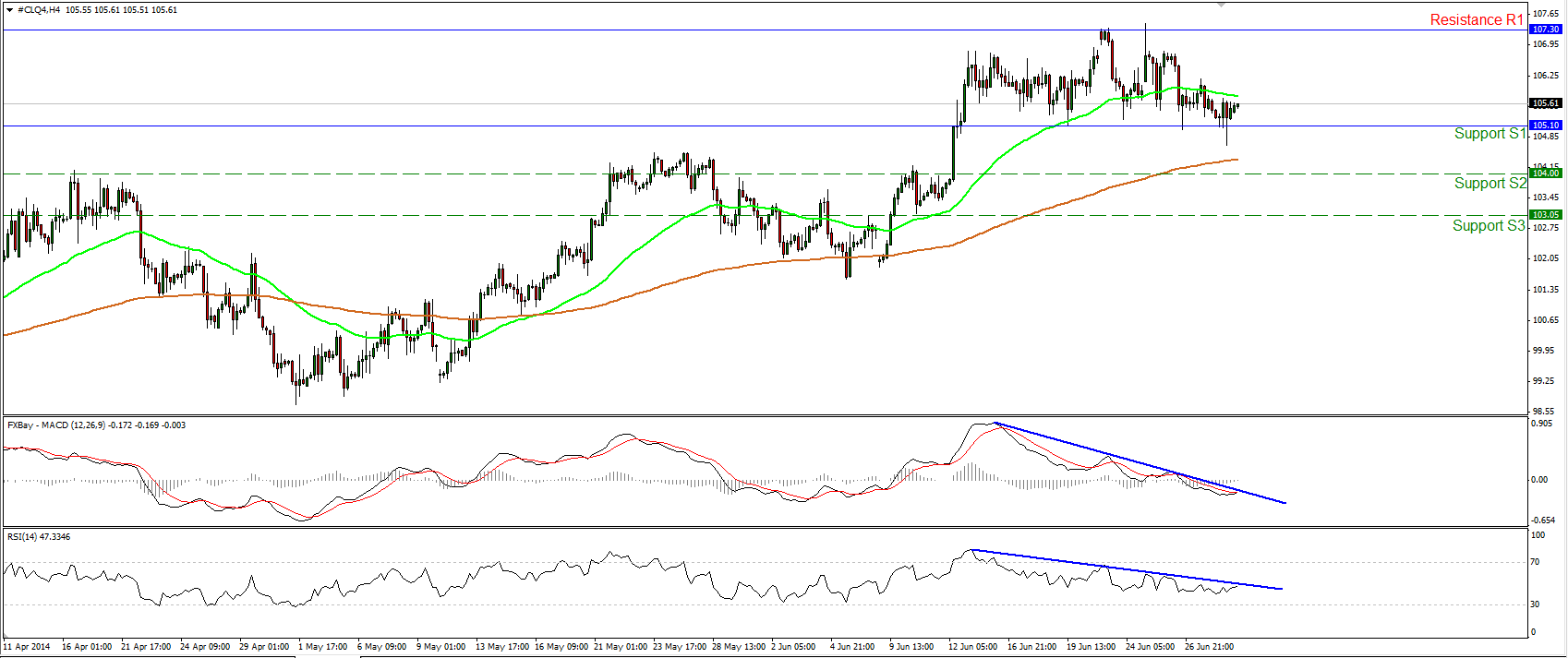

WTI keeps the sideways path intact

WTI declined and tried to break below the 105.10 (S1) support, but failed to do so and remained within the range between that barrier and the resistance of 107.35 (R1). Since the short-term path of oil remains to the sideways, I still see a neutral picture. Only a decisive break out of the sideways range could provide more clues about the forthcoming directional movement of WTI.

Support: 105.10 (S1), 104.00 (S2), 103.05 (S3).

Resistance: 107.35 (R1), 108.00 (R2), 110.00 (R3).

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.