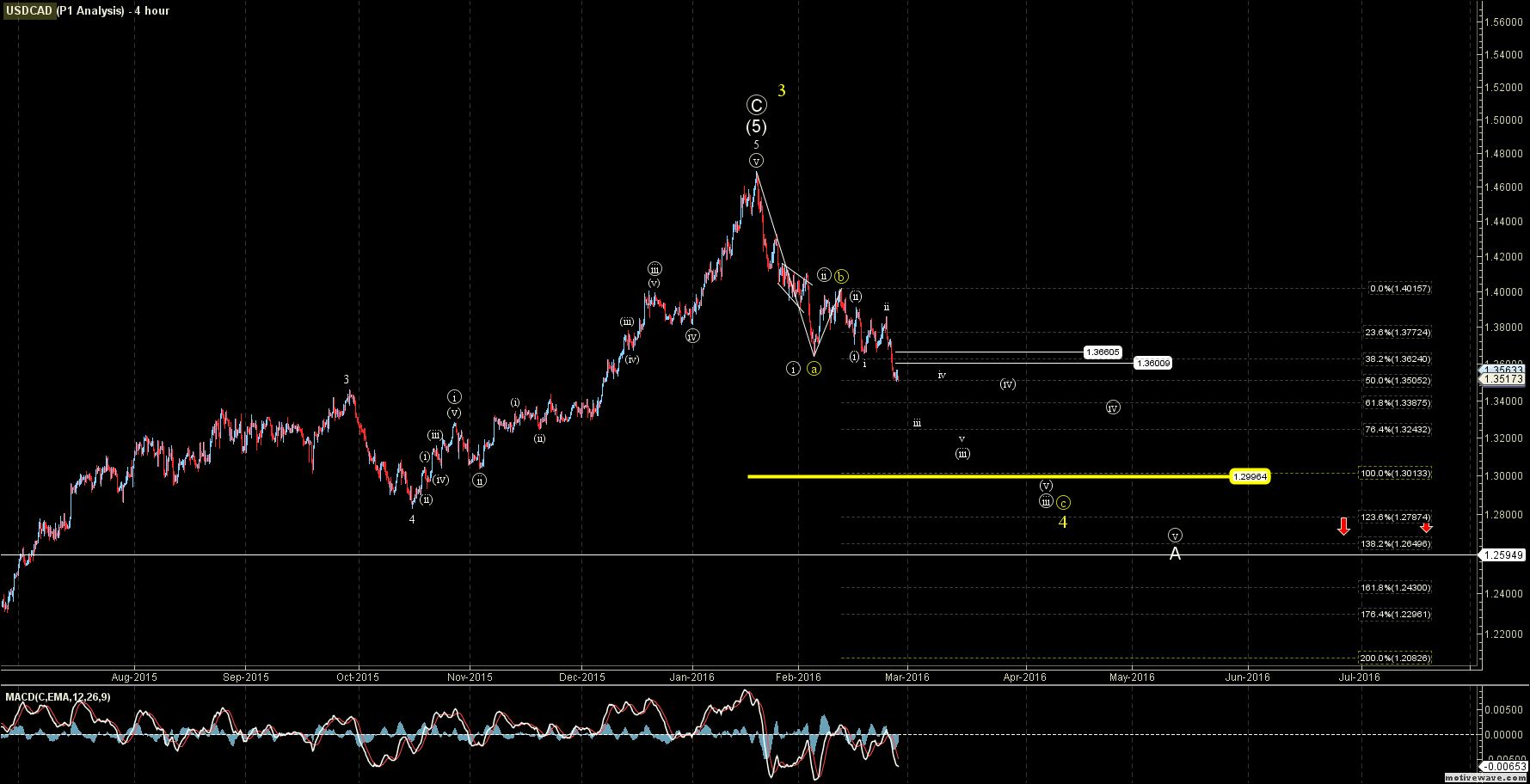

On the larger time-frames it is clear that the top that we saw in January at the 1.4696 level was a significant larger degree top. This high hit the 338.2 extension of the initial wave off of the 2011 low almost to the penny. While the 338.2 extension is a less common extension, the fact that it came so close to hitting that fib on such a large degree does make me take notice. This is a much more common Fibonacci extension level that we would expect to see during a third wave and not a C wave.

So while the entire move off of the 2011 low is still not entirely clear and could be counted as either a completed corrective pattern or still an impulsive pattern, the fact that we hit the 338.2 extension certainly has me leaning towards this still needing yet another move up over the January high prior to a much larger degree top being in place. Now with that being said, on the more intermediate time-frames over the next several months the trend is clearly down and as long as we remain under the 1.3603-1.3660 resistance levels I do expect to see lower levels.

Zooming into the 1 hour chart we can see that the action we saw on Friday was very typical of a minor degree fourth wave consolidation. In this case I am counting this consolidation as part of wave ((4)) of iii down with targets for wave iii coming in at the 1.3416 -1.3302 zone with resistance levels for this wave ((4)) again coming in at the 1.3603-1.3660 zone. A break back over this resistance zone would be the first indication that this move to the downside for wave C of 4 is not going to play out impulsively. Of course as the pattern is still very incomplete even if we do break back over these resistance levels it is still likely that we still will see lower levels in the form of an ending diagonal to the downside as the pattern is still quite incomplete.

It would really take a move over the February 24th high at the 1.3857 level to consider that we have a more significant bottom in place, and as long as we are trading under these levels the pressure over the intermediate time-frame is still very much to the downside on this pair.

The commentaries and analysis represent the opinions of the analyst nd should not be relied upon for purposes of effecting securities transactions or other investing strategies, nor should they be construed as an offer or solicitation of an offer to sell or buy any security. You should not interpret these opinions as constituting investment advice. Our analysts may have personal positions in the instruments mentioned.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Ethereum may sustain trading inside key range, ETH ETFs to be delayed until 2025

Ethereum is beginning to show signs of recovery on Thursday despite a second consecutive day of poor performance in Hong Kong's spot Ethereum ETFs. Bloomberg analyst James Seyffart has also shared that a spot Ethereum ETF may not happen in the US in 2024.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.