Analysis for April 9th, 2013

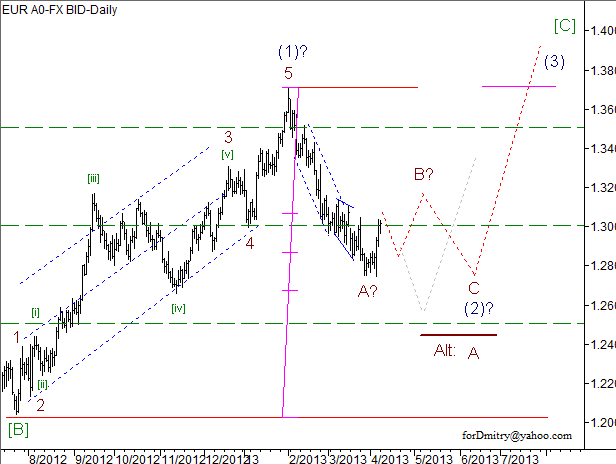

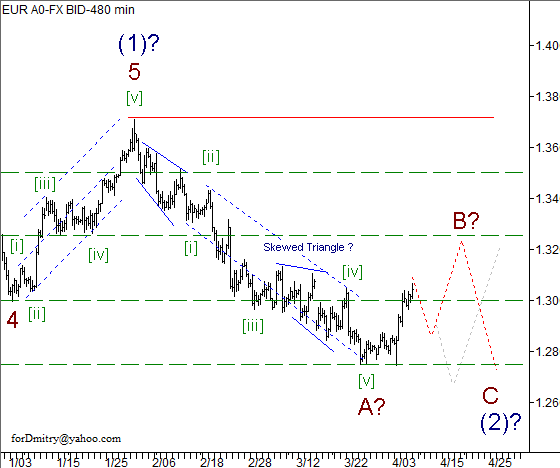

EUR/USD

We may assume that a descending correction (2) of [C] is taking the form of zigzag; right now Euro is forming a local ascending correction B of (2).

We can’t exclude a possibility that the price is forming an ascending of horizontal structure, which may the second part of a large zigzag (2), wave B of (2).

We can’t exclude a possibility that a possible correction B may take the form of flat, double three, or zigzag.

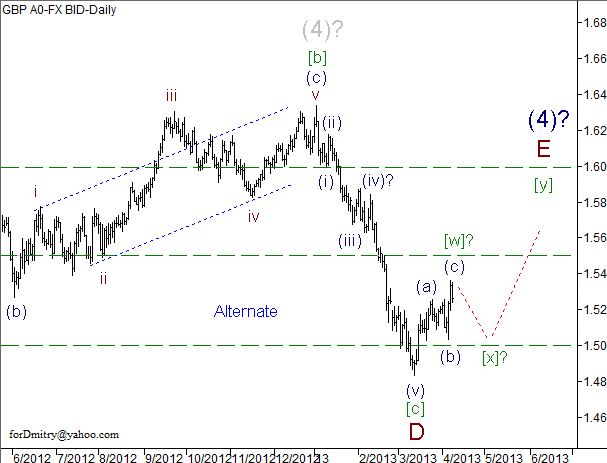

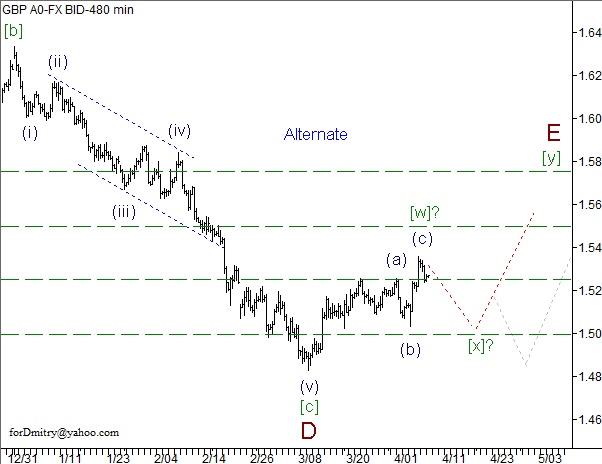

GBP/USD

We can’t exclude a possibility that Pound is forming an ascending wave E of (4), which may take the form of zigzag.

The pair is forming an ascending wave E, which may take the form of double zigzag.

We can’t exclude a possibility that the pair finished an ascending zigzag [w] of E. In this case, later the price is expected to start a local descending correction [x] of E.

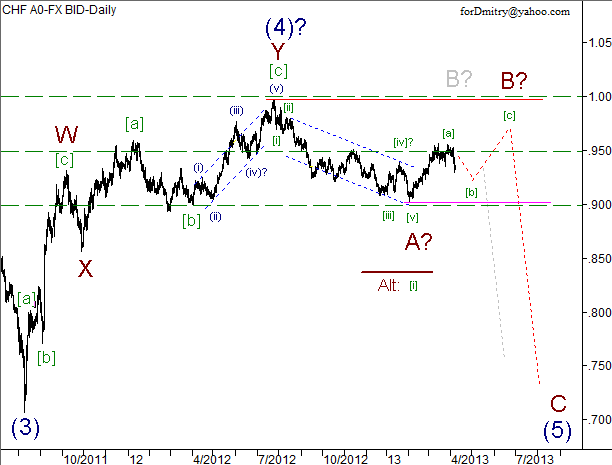

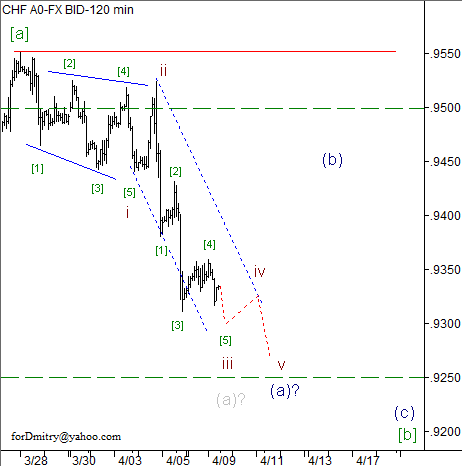

USD/CHF

We can’t exclude a possibility that after completing an ascending correction B of (5), Franc may continue falling down inside a final wave C of (5).

We may assume that the pair is forming a local descending correction [b] of B, which may take the form of zigzag.

We may assume that the price is finishing the first part of a possible zigzag [b], wave (a) of [b].

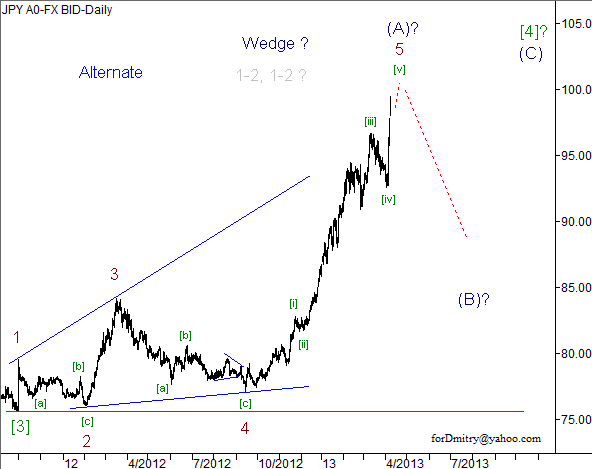

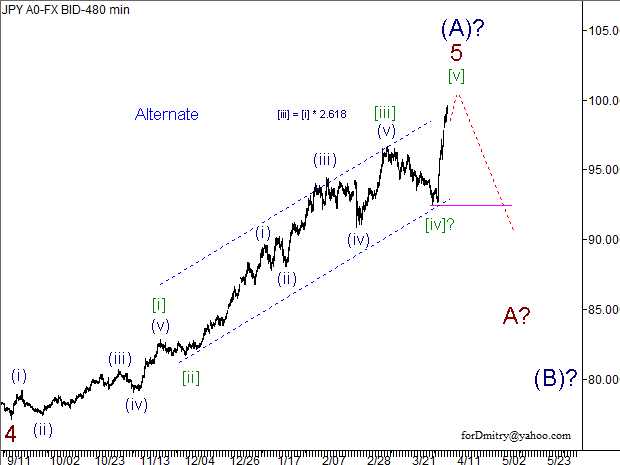

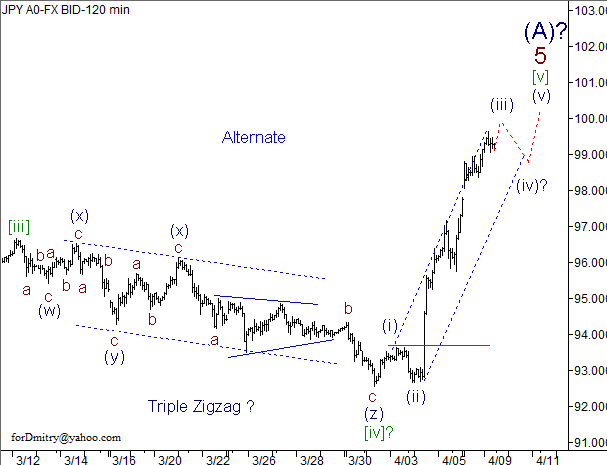

USD/JPY

If our assumption that the pair is completing an ascending wedge (A) of [4] is correct, then later the price may start forming a descending correction (B) of [4].

The pair is finishing an ascending impulse 5 of (A), which may be followed by a medium-term descending trend inside a correction (B).

The price is finishing an impulse [v] of 5 of (A). If the pair doesn’t expand it, then later we can a reverse downwards.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.