GROWTHACES.COM Forex Trading Strategies

Taken Positions

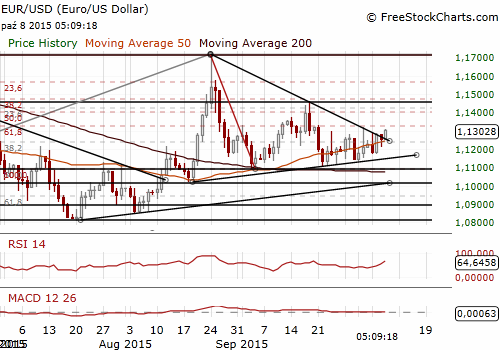

EUR/USD: long at 1.1220, target 1.1400, profit locked in at 1.1230, risk factor **

EUR/USD: Watch FOMC Minutes

(stay long for 1.1400)

The USD is falling against the EUR today, as investors awaited minutes of the last Federal Reserve meeting for clues on monetary policy (18:00 GMT). September FOMC meeting was surprisingly dovish and prompted expectations the Federal Reserve might postpone an interest rate to 2016. Fed funds futures currently do not have a 100% pricing in of a fed funds rate hike to 0.25% until February of 2016. We think such opinions are too dovish and still expect a hike in December. However, today’s minutes are likely to be dovish, as they should shed some light on the reasons for delaying a rate hike.

The minutes are going to be from a meeting that was three weeks old (September 16-17). There was still more scare from China and Asia at that time, and it was even worse in the prior weeks and in August. Current Fed stance is probably slightly more hawkish than it was in September. There was only one vote to hike on the FOMC. But then came more hawkish commentary from the Fed presidents. The last stance of Yellen was that conditions appear proper for a rate hike by the end of this year.

The EUR/USD broke above the 1.1289 high on October 5 and psychological level of 1.1300 today. The next key resistance level is the 61.8% of the 1.1460-1.1105 slide at 1.1324 and then the cloud top at 1.1341. Breaking above these levels will open the way to the target of our long position.

The European Central Bank publishes its minutes at 11:30 GMT. We do not expect meaningful hints about a possible QE expansion. In our opinion the ECB minutes will not be a strong market mover today.

We have locked in the profit on our EUR/USD long at 1.1230.

Significant technical analysis' levels:

Resistance: 1.1319 (high Oct 2), 1.1324 (61.8% of 1.1460-1.1105), 1.1330 (high Sep 21)

Support: 1.1234 (hourly low Oct 8), 1.1211 (low Oct 7), 1.1173 (low Oct 6)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.