Analysis for April 16th, 2015

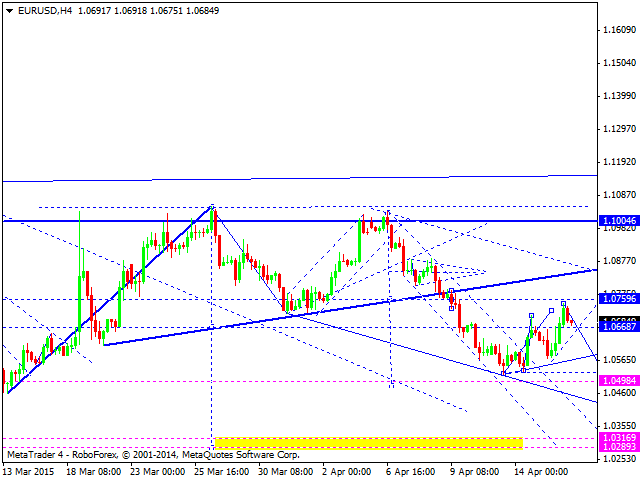

EURUSD, “Euro vs US Dollar”

Eurodollar has completed an ascending impulse as a five-wave structure. We think, today the price may break an ascending channel and the minimum of this impulse. The target of this decline is at level of 1.0300.

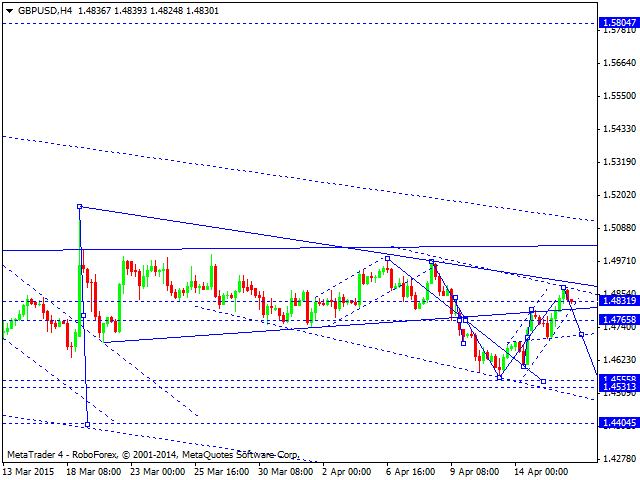

GBPUSD, “Great Britain Pound vs US Dollar”

Pound has completed an ascending impulse, which may be considered as a correction. We think, today the price may break an ascending channel of this impulse and then continue falling towards the main target at level of 1.4400.

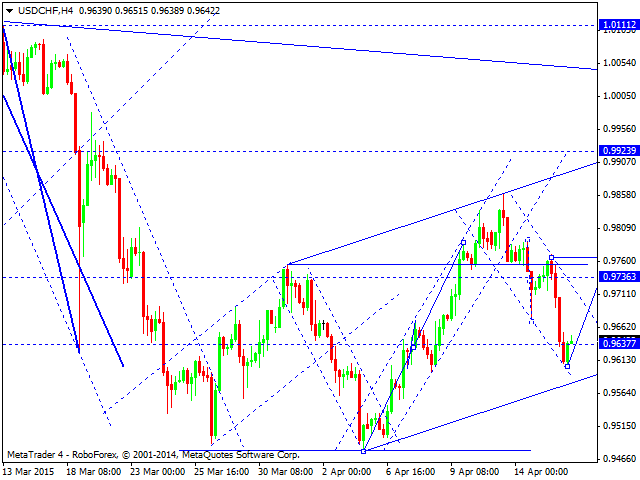

USDCHF, “US Dollar vs Swiss Franc”

Franc has completed a descending structure, which may be considered as a correction. We think, today, the price may break the channel of this correction and then start forming an ascending wave to reach level of 0.9930.

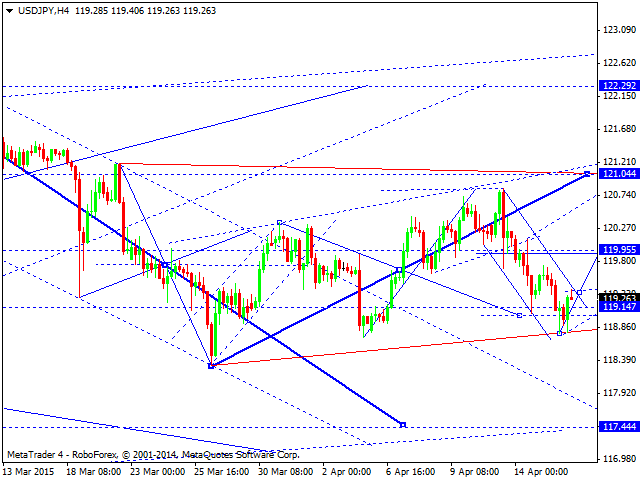

USDJPY, “US Dollar vs Japanese Yen”

Yen has reached the target of its descending wave. We think, today the price may break this correctional channel and start forming another ascending wave with the target at level of 121.00. After that, the pair may continue falling towards level of 117.40.

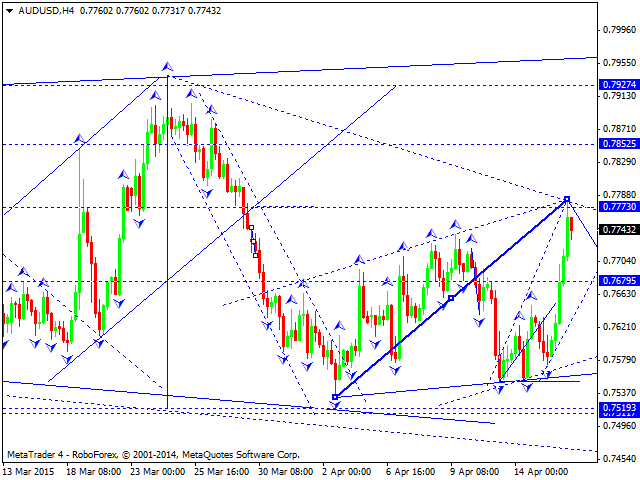

AUDUSD, “Australian Dollar vs US Dollar”

Although Australian Dollar extended its ascending structure, it formed this structure inside the correction. We think, today the price may form another descending structure with the target at level of 0.7510.

USDRUB, “US Dollar vs Russian Ruble”

Ruble is still moving downwards with the target at level of 48.50. We think, today the price may reach it and then start a correction towards level of 54.00. After that, the market may resume falling to reach the target at level of 44.00. An alternative scenario implies that the pair may continue forming this descending wave without any corrections.

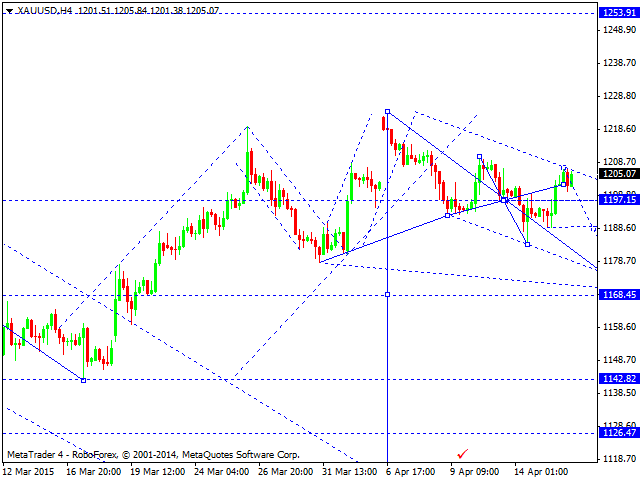

XAUUSD, “Gold vs US Dollar”

Gold is still forming a consolidation channel and may break it downwards by the first descending impulse. The target of this structure is at level of 1168. Later, in our opinion, the market may consolidate again and form a downside continuation pattern. The main target is at level of 1113.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold price pullback on Fed hawkish tilt amidst lower US yields, weaker US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Ethereum may sustain trading inside key range, ETH ETFs to be delayed until 2025

Ethereum is beginning to show signs of recovery on Thursday despite a second consecutive day of poor performance in Hong Kong's spot Ethereum ETFs. Bloomberg analyst James Seyffart has also shared that a spot Ethereum ETF may not happen in the US in 2024.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.