British stocks fall together with commodities

British FTSE 100 is pushed lower by falling commodities and energy prices. Oil and gas sector accounts for 22% of the index while commodities account for 13%. Will FTSE 100 continue falling?

Falling stocks of UK companies which have much of their business located in developing countries are additional negative for British indices. Majority of stock indices in developing countries fell as investors expect the new US president Donald Trump to bring in new protectionist measures to support US industry and transfer production back to US. British commodity and defense stocks slumped on Monday. As a rule, they make steady dividend payments and are viewed by investors as alternative to bonds. At present, markets are concerned with rising inflation in UK in the aftermath of Brexit. 10-year treasuries are traded lower which pushed up their yields to record high in recent 6 months. British trade balance is constantly negative of about -12bn pounds per month. Quarterly current account balance is negative of almost -30bn pounds a quarter. This may be negative for countries economy. On Tuesday at 10-30 СЕТ the negative consumer price index for October 2016 came out in UK.

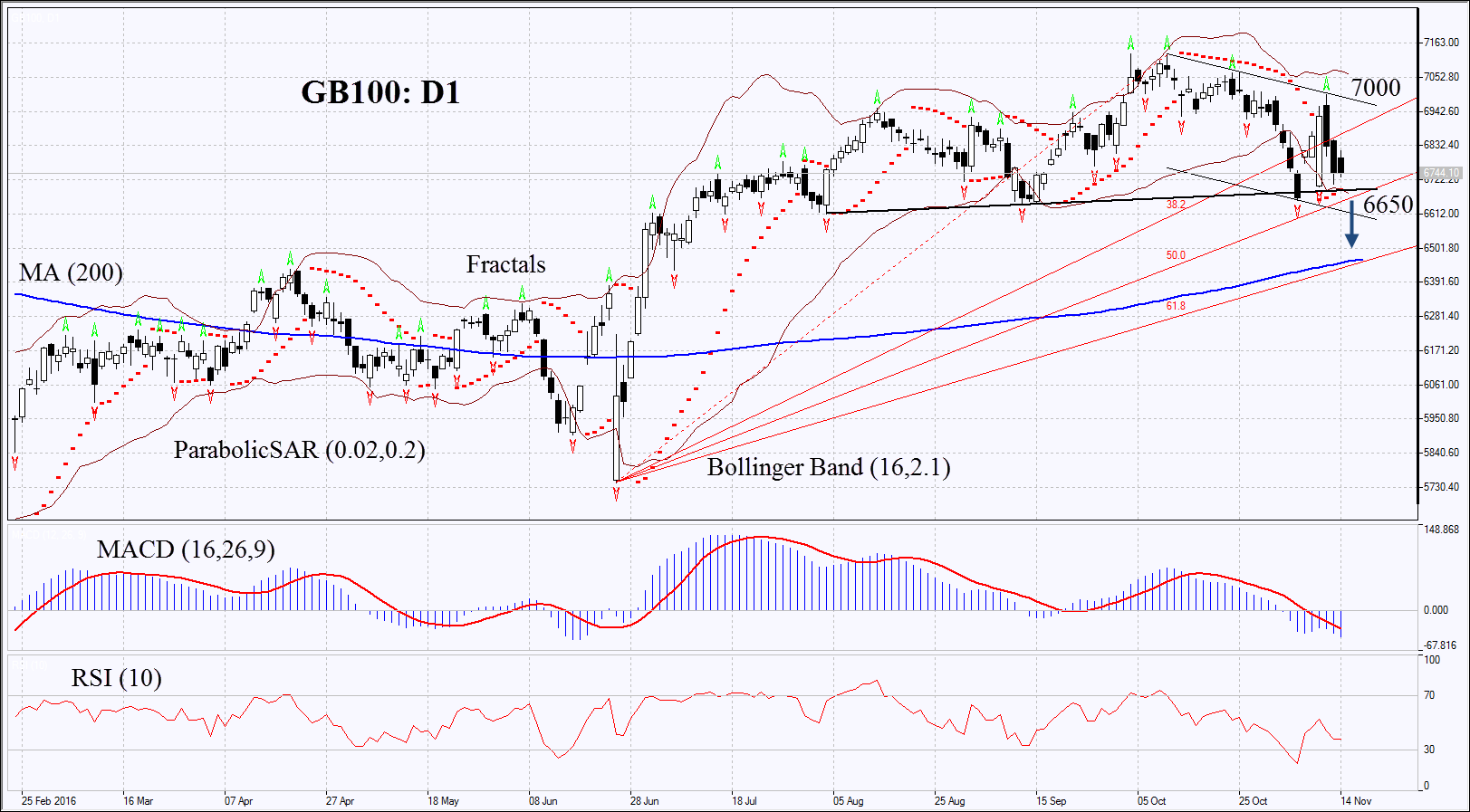

On the daily chart GB100: D1 is correcting down within the descending channel. Further decline is possible in case of weak economic indicators in UK and lower global commodity prices.

-

Parabolic gives bullish signals. It may serve as additional support which is to be broken down.

-

Bollinger bands have widened which means higher volatility. They are tilted downward.

-

RSI is below 50 but is far from the oversold zone, no divergence.

-

MACD gives bearish signals.

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.