Analysis for December 15th, 2014

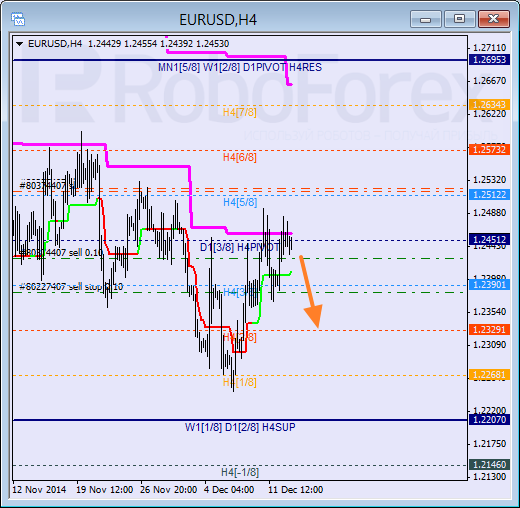

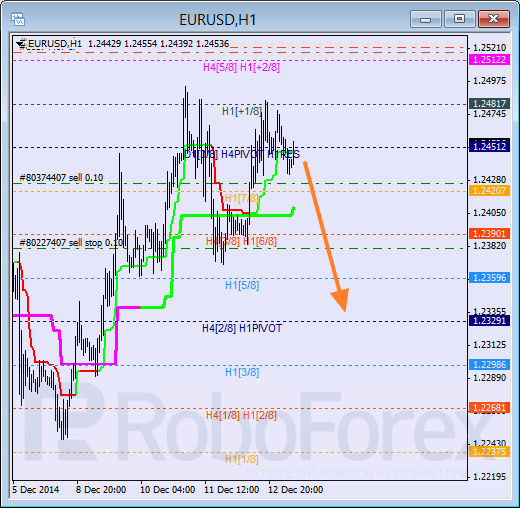

EUR USD, “Euro vs US Dollar”

Eurodollar is testing the daily Super Trend and the 4/8 level one more time. If the price rebounds from them again, the market may resume moving downwards. The local target is at the 2/8 level.

The market is moving at the top of the H1 chart and trying to rebound from the 8/8 level. If the pair is able to stay below Super Trends and they form “bearish cross”, sellers will return to the market.

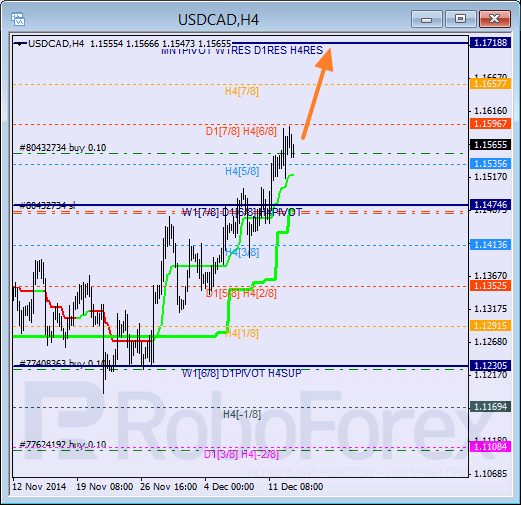

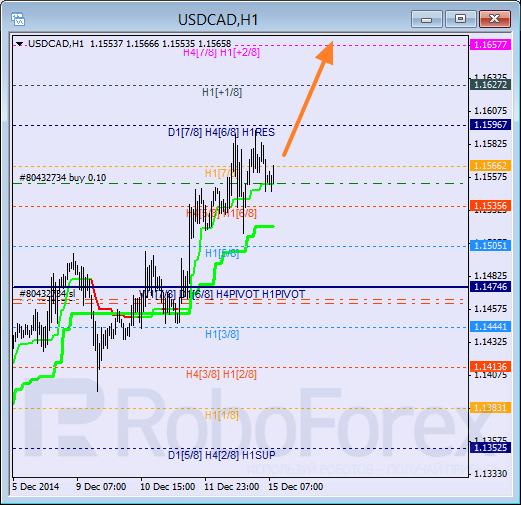

USDCAD, “US Dollar vs Canadian Dollar”

Last week, Canadian Dollar successfully managed to stay above the 5/8 level. The price is supported by Super Trends, which earlier formed “bullish cross”. The main target is at the 8/8 level, however, if the pair rebounds from the 7/8 level fast, the market may start a new correction earlier.

The pair is consolidating at the top of the H1 chart. Considering that bulls were supported by the 6/8 level, the price is expected to resume the uptrend and break the 8/8 one. If the pair is able to stay above the latter level, the price may continue growing towards the +2/8 one.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Ethereum may sustain trading inside key range, ETH ETFs to be delayed until 2025

Ethereum is beginning to show signs of recovery on Thursday despite a second consecutive day of poor performance in Hong Kong's spot Ethereum ETFs. Bloomberg analyst James Seyffart has also shared that a spot Ethereum ETF may not happen in the US in 2024.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.