US data released last night all missed market expectations. The ISD February manufacturing PMI fell for the fourth consecutive month to 53, showing the US manufacturing expansion is slowing. Also, personal spending has contracted by 0.2% implying that US families are still careful on consumption even when job market has been improving and oil prices have fallen significantly. The January PCE price index remains lower than the Fed’s target rising by 1.3% YoY, pared to USD intraday gains and supported US stocks.

However, the major peers have yet to take opportunity to bounce against the Dollar. This is most probably due to China’s rate cut reminding the market of the monetary policy discrepancy between the US and other economies.

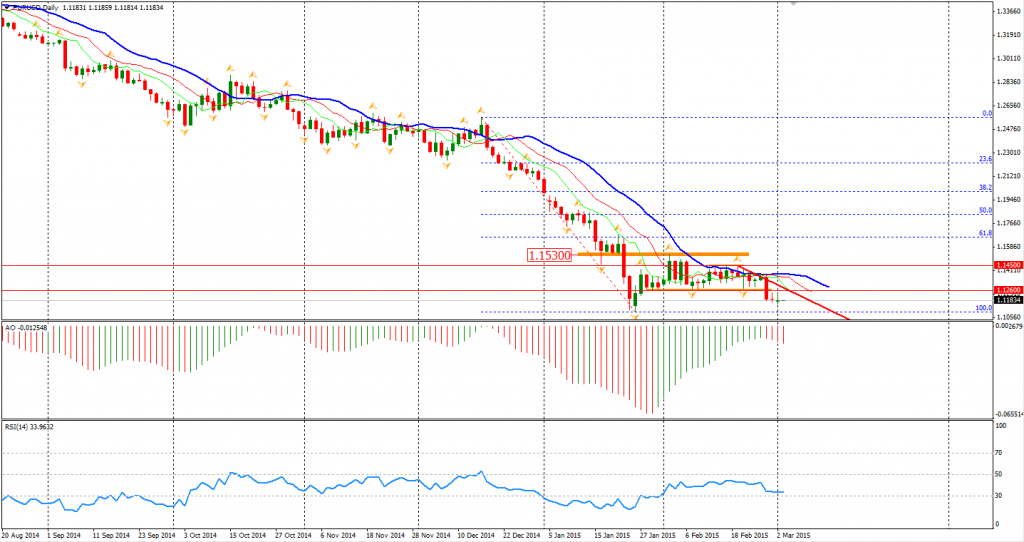

Looking across the seas, the Euro Dollar fluctuated around the 1.12 level yesterday on improving Euro-area data. Unemployment rate fell to 11.2% and deflation slowed to 0.3%. However, if 1.1260 cannot be retaken within the next trading days, the Euro will probably hit a new low in the short term.

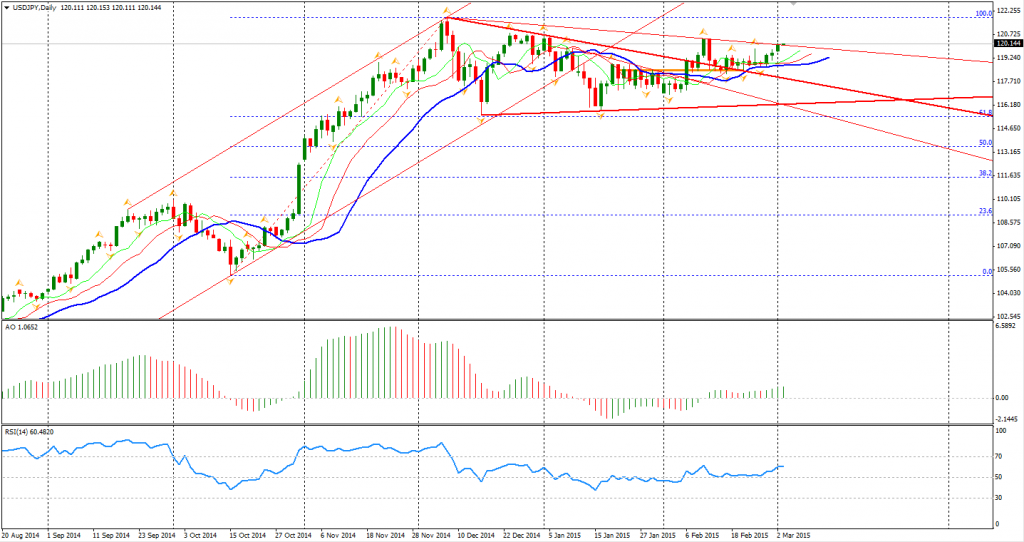

The Dollar Yen rose above the 120 mark as participants again increased their speculations on further easing coming from the Bank of Japan. Japanese economist Yuji Shimanaka, who successfully predicted BOJ’s easing in last October, warned that BOJ may surprise the market again in April as inflation level falls to zero. A confirmed breakout of the 3-month consolidation wedge will imply a significant rise of USDJPY. Former highs of 120.50 will be watched.

As to the stock markets, Shanghai Composite rose by 0.78% on rate cut. The Nikkei Stock Average gained 0.15%. Australian ASX 200 rebounded by 0.51% to 5959. In European markets, the UK FTSE was down 0.1%, the German DAX climbed 0.1% and the French CAC Index lost 0.69%. The US stock indices gained as inflation level was lower than expected with Nasdaq hitting 5000 for the first time since March 2000. The S&P 500 closed 0.6% higher at 2117. The Dow rose by 0.86% to 18289, and the Nasdaq Composite Index climbed 0.9% to 5008.

On the data front, Australia Building Approvals and Current Account will be released at 11:30 AEDST. The most focused event during the Asian session will be the RBA rate decision at 14:30 AEDST – the market has priced it for another rate cut. Canada GDP will be out at 0:30 AEDST after midnight.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Ethereum may sustain trading inside key range, ETH ETFs to be delayed until 2025

Ethereum is beginning to show signs of recovery on Thursday despite a second consecutive day of poor performance in Hong Kong's spot Ethereum ETFs. Bloomberg analyst James Seyffart has also shared that a spot Ethereum ETF may not happen in the US in 2024.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.