The US Dollar surged against major peers yesterday and the USD Index reached the February high of 95.20. Not much material news happened during the session. Europe is in focus as their leaders are trying to solve both the Greek and Ukrainian crisis at the same time, while US President Obama has claimed to hit IS troops.

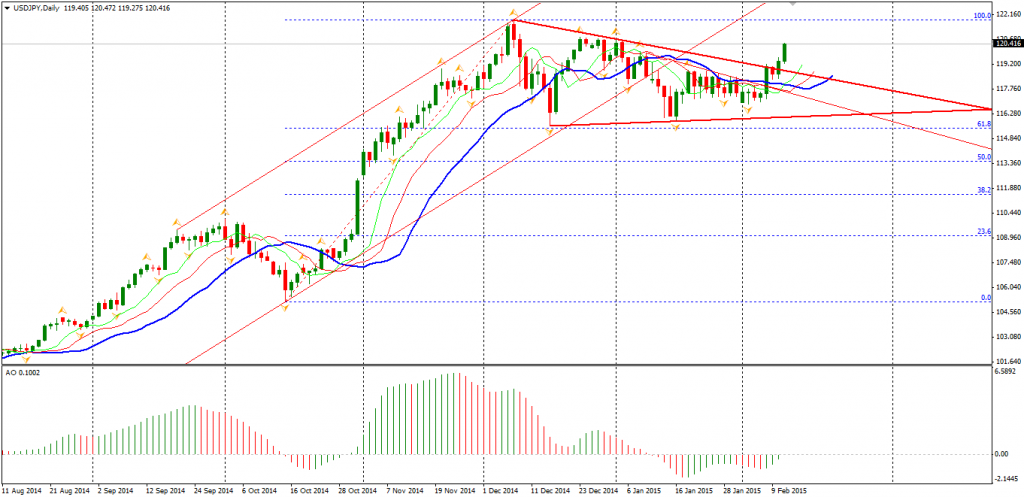

USDJPY kept its rally by 0.7% to 120.28 along with the gain of US treasury yields. As the breakout has been confirmed, market participants may now turn their former sideways view into a bearish one on JPY. The former highs 120.80 and 121.80 are the next two targets. However, the currency pair may not stop by there but challenge the high set before the global financial crisis at 124.10.

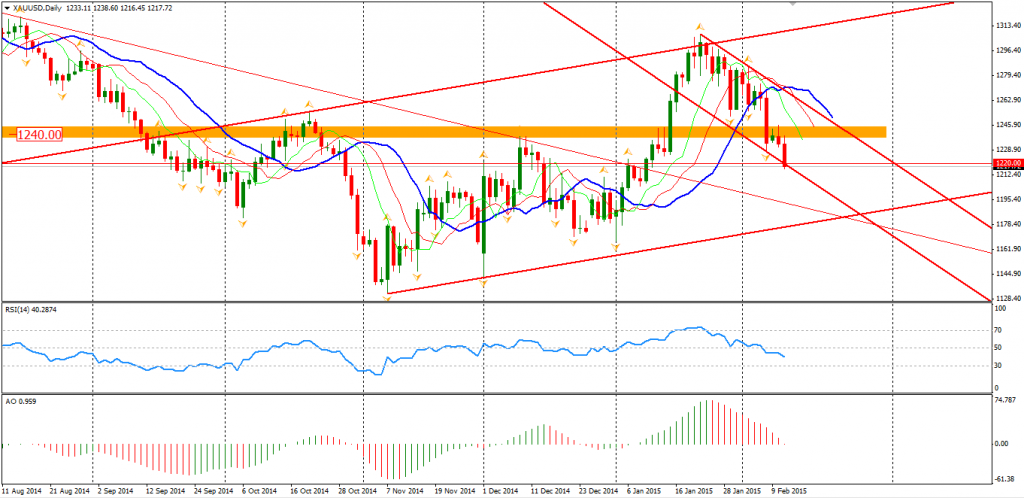

While investors are still waiting for the confirmed results from Europe, Gold fell 1% and hit the resistance of $1220 per ounce, probably due to the strong Dollar largely reducing the attraction of yellow metal. RSI has fallen below 50, showing this round of fall possibly continuing. Gold prices may reach the lower boundary of the recent slow upward channel area near $1190-1200.

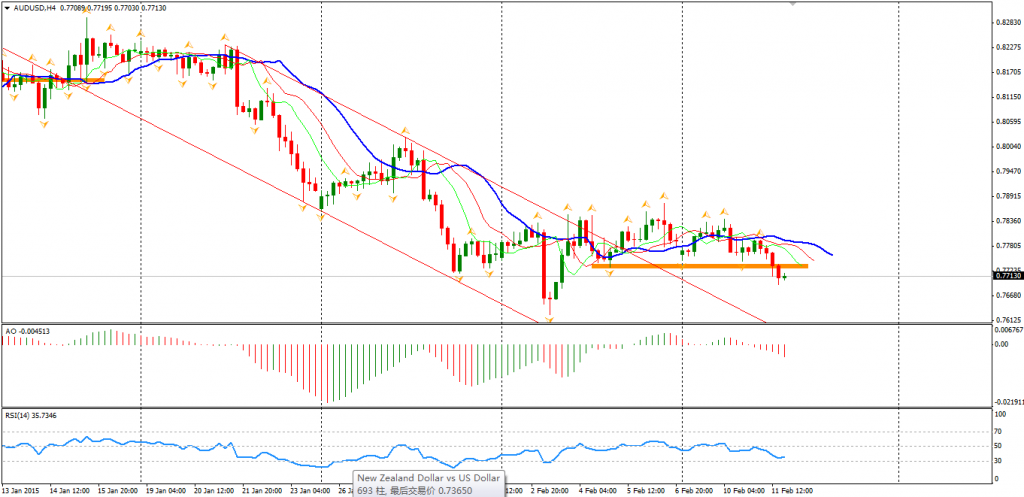

The Aussie Dollar finally broke the bottom of a one-week sideway at 0.7730 and fell to the 0.77 mark. A new round of falling has started and former low 0.7626 may not hold the bears’ attack for long. As the China’s import remains weak and investors lose interest in carry trades, AUDUSD will find it impossible to defy gravity. The 0.75 level may be the target after 0.7626 breached.

Back to stock markets, the Shanghai Composite rebounded 0.5% to 3157. The Nikkei Stock Average slid 0.33%. Australian ASX 200 lost 0.54% to 5769. In European markets, the UK FTSE was down 0.16%, the German DAX closed as unchanged and the French CAC Index fell 0.36%. US stocks closed as mixed. The S&P 500 closed at 2069. The Dow fell 0.1% to 17862, and the Nasdaq Composite Index rose 0.28% to 4800.

On the data front, Australian job market data will be out at 11:30 AEDST. BOE Inflation Report will be released 21:00 AEDST. US retail sales and weekly unemployment claims will be at 0:30 AEDST after midnight.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.