The USD rose against most majors as the IMF once again downgraded global growth prospects for 2015 and 2016. The US is the only major economy being upgraded, while the expected growth rate of China, Japan, Eurozone and Russia were cut. The economic activities of major oil producing countries will fall on lower oil prices.

The IMF forecasts China will only expand by 6.8% in 2015, after the second biggest economy itself had just released its 2014 growth rate as 7.4%. Although 7.4% is the slowest GDP growth in 24 years, it is mostly in line with the government target and slightly better than expected. The pressure on Beijing is to maintain the high-speed expansion, so moderate easing is expected.

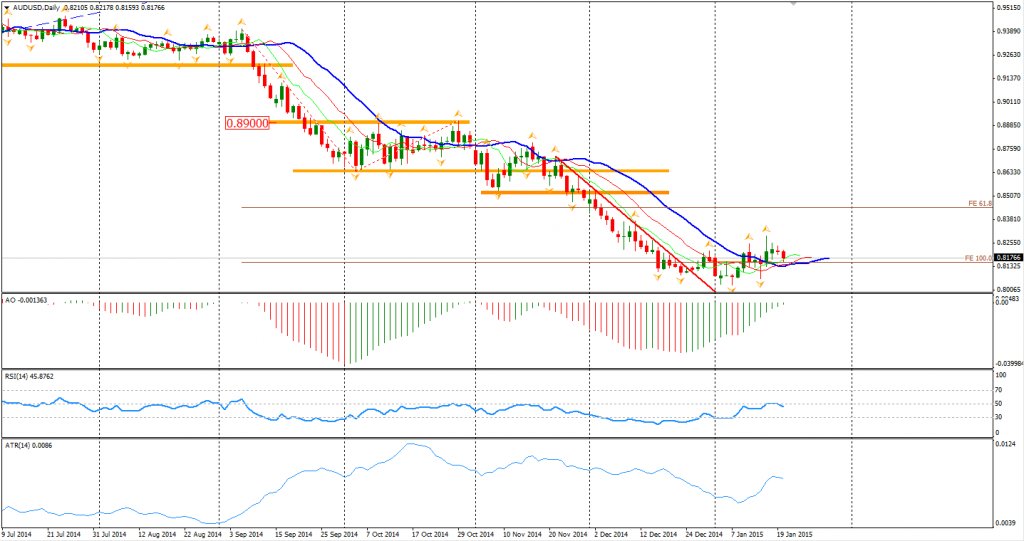

The Aussie Dollar fluctuated between 0.8150 and 0.8220 after the GDP release. However, the outlook of this pair is still bearish. The acceptable GDP growth means that large scale investments from Chinese authority may not happen in the short run. Hence, the needs of iron ore and other materials will remain weak. I suppose, shortly the AUDUSD will break the 0.8150 support and test the 0.8030 bottom again.

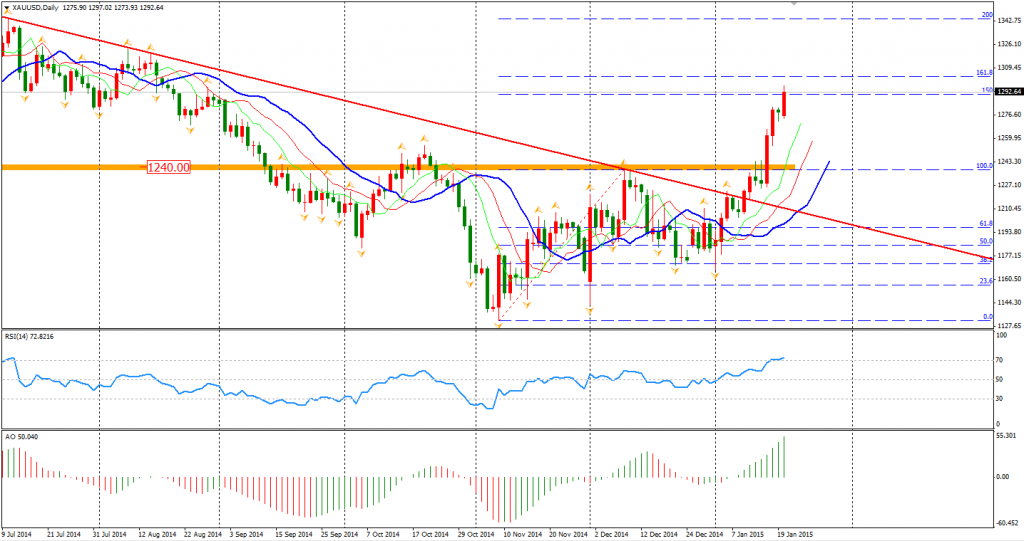

The cut of global outlook surged the safe-haven demands. Gold prices rocketed to $1292 per ounce and touched $1297 during the US session, highest since August 2014. The RSI reached 72, showing gold is overbuying in the short term, especially confronting the $1300 integer level.

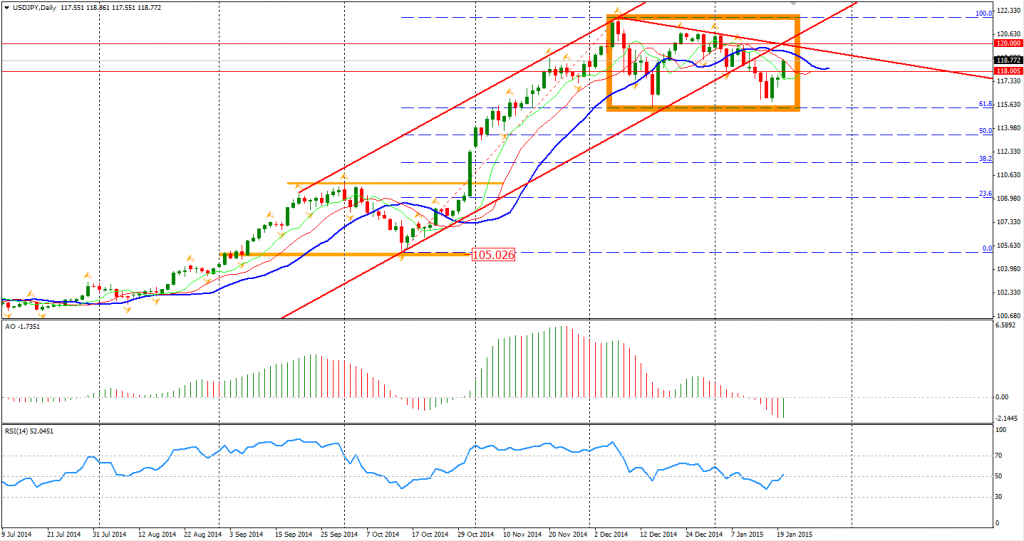

The Dollar Yen kept rising after I mentioned the bullish reversal sign on the daily chart. The consolidation will continue and the 120 level will be the next target.

Back to stock markets – the Shanghai Composite rebounded 1.82% to 3173. ASX 200 fell 0.1% to 5307. The Nikkei Stock Average gained 2.07%. In European markets, the UK FTSE was up 0.52%, the German DAX gained 0.14% and the French CAC Index rose 1.16%. The US market closed rose slightly after the holiday. The S&P 500 closed 0.15% higher to 2023. The Dow gained closed flat at 17515, and the Nasdaq Composite Index rose 0.44% to 4655.

On the data front, Australia Westpac Consumer Sentiment will be released at 10:30 AEDST. BOJ press conference will be today in the afternoon. UK jobs report and BOE rate decision will be out at 20:30 AEDST.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold price pullback on Fed hawkish tilt amidst lower US yields, weaker US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.