All eyes are on the European Central Bank on Thursday as it prepares to announce its latest policy response to the ongoing depressed levels of inflation that have left the central bank well below its target of below but close to 2%.

It’s quite rare that the market is so united in its belief that a major central bank will announce further monetary easing but ECB President Mario Draghi has made it perfectly clear that further stimulus measures are being drawn up in preparation for this meeting. The result is that the question today is not whether the ECB will ease, but how far it will go.

The problem the ECB may now face is that the need for stimulus has been so talked up that only something extremely bold will meet market expectations. Fortunately, under Draghi, the ECB does have history of exceeding market expectations when it comes to monetary stimulus and I expect the same to happen again today.

A combination of a cut to the deposit rate and an expansion of the central banks quantitative easing program may be necessary to meet market expectations today and in reality, this would be the sensible option. Especially if the market is correct in assuming that the range of assets available to the ECB for purchases is shrinking. A cut to the deposit rate could open up the number of available assets that would otherwise not be eligible because rates are currently below the deposit rate.

With that in mind, I think we could see the ECB reduce the deposit rate by 15-20 basis points and increase its asset purchases by €15-20 billion. That would more than satisfy the markets and could drive the euro and yields on eurozone debt even lower, despite both already trading at very low levels in anticipation of more easing.

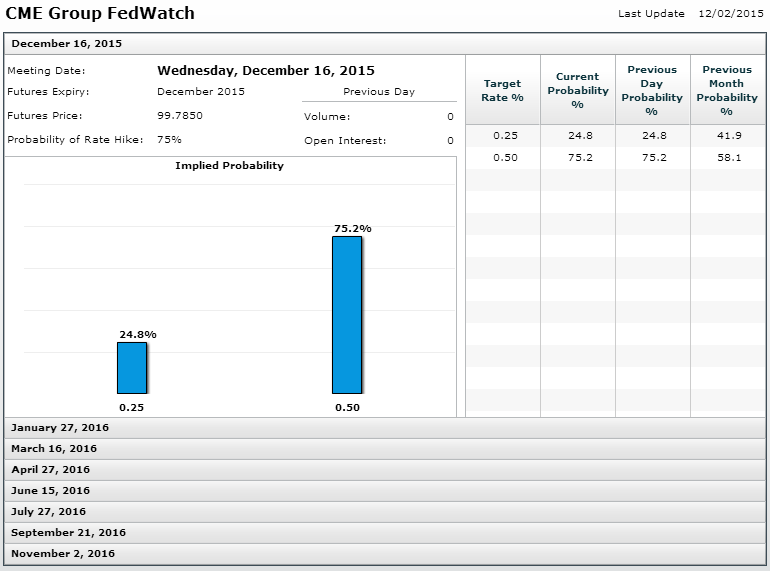

To add to what is already likely to be very volatile markets, we’ll also hear from Federal Reserve Chair Janet Yellen today as she testifies on monetary policy before the Joint Economic Committee. As the ECB prepares to announce more stimulus, the Federal Reserve is planning to begin its first tightening cycle in almost a decade, with markets now pricing in a 75% chance of a hike in a couple of weeks.

It will be interesting to see just how hawkish Yellen is today and whether she drops any significant hints that a hike is highly probable. Yellen set quite a hawkish tone on Wednesday claiming the economy has recovered substantially with current growth sufficient to achieve full employment and 2% inflation. Yellen was very bullish on the economy and claimed she is looking forward to raising rates. More of this talk today would surely be a direct intentional signal to the markets that rates are rising in two weeks.

The S&P is expected to open 17 points higher, the Dow 153 points higher and the Nasdaq 44 points higher.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.