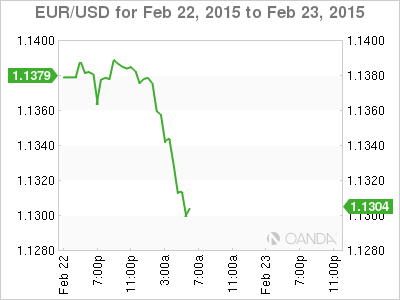

EUR/USD has started the new trading week with losses, as the pair trades just above the 1.13 line in Monday’s European session. It’s a quiet day on the release front, with only two events on the calendar. German Ifo Business Climate was almost unchanged at 106.7 points, but this was below the estimate of 107.4 points. In the US, today’s sole event is Existing Home Sales, with an estimate of 5.03 million.

Eurozone manufacturing numbers were a disappointment on Friday, as French and German manufacturing PMIs fell short of their estimates. French Flash Manufacturing PMI slipped to 47.7 points, short of the forecast of 49.7 points. The index has been below the 50-point level since April, pointing to ongoing contraction. The German PMI was almost unchanged at 50.0 points, but this was shy of the estimate of 51.8 points.

The Greek saga continues, as Greece and its creditors try to find some common ground on a bailout extension. Greece was granted a four-month extension on Friday, provided that the country could provide a list of “reform commitments” showing that Greece would continue to reform its economy. Greece’s creditors will review the proposals on Tuesday before giving their approval to the extension. Even if this occurs, the extension is a stop-gap measure and the bailout crisis is far from over.

Last week, the ECB took a major step aimed at improving transparency, as the central bank published a summary of its January policy meeting, the first time the Bank has done so. At the January meeting, the ECB decided that it would implement a massive QE program in March, with purchases of EUR 60 billion each month. The summary did not contain any surprises, but did note that ECB policymakers had discussed a EUR 50 billion QE scheme before deciding to set the amount at EUR 60 billion each month. The summary release puts the ECB more in line with major central banks such as the Federal Reserve and BOJ, which publish minutes of each policy meeting.

EUR/USD 1.1310 H: 1.1394 L: 1.1296

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Ethereum may sustain trading inside key range, ETH ETFs to be delayed until 2025

Ethereum is beginning to show signs of recovery on Thursday despite a second consecutive day of poor performance in Hong Kong's spot Ethereum ETFs. Bloomberg analyst James Seyffart has also shared that a spot Ethereum ETF may not happen in the US in 2024.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.