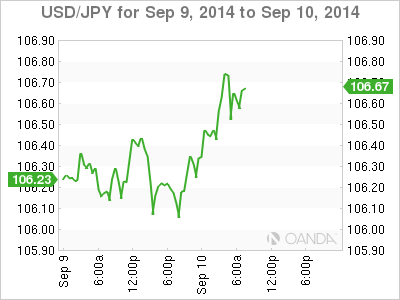

The Japanese yen can't buy a break this week, as USD/JPY continues to climb. On Wednesday, the pair is trading in the mid-106 range. The yen has shed over 150 points this week, as it wallows at six-year lows against the dollar, which has enjoyed broad gains. On the release front, Japanese Core Machinery Orders softened last month to 3.5%, short of expectations. The BSI Manufacturing Index will be released later in the day, and the markets are bracing for a weak reading.

The Japanese manufacturing sector continues to struggle. Core Machinery Orders came in at 3.5%, sharply down from 8.8% in the previous release. This followed a weak reading from Tertiary Industry Activity, which posted a flat reading of 0.0%. Earlier in the week, Japanese GDP posting a decline of 1.8%, matching the forecast. This marked the first quarter that the economy has contracted since Q3 of 2012. The sales tax hike in April, which has taken a bite out of economic growth, continued to take its toll in the second quarter as retail sales and household spending has softened. The government signaled last week that it is prepared to increase stimulus to help the economy absorb another sales tax hike in October. Further stimulus could send the sagging yen to even lower levels.

The BoJ minutes did not contain any surprises, coming on the heels of a policy meeting in which the BoJ unanimously decided to maintain its current monetary policy. Policy makers stated that inflation levels should be carefully assessed as to whether inflation will reach the 2% target in 2015. On an optimistic note, the minutes stated that economic growth and inflation were in line with forecasts.

US numbers continue to point to a deepening recovery, and the Federal Reserve is expected to trim QE next week and wind up the scheme in October. The markets are expecting an interest rate hike by mid-2015, and will be looking for hints from Fed policymakers as to the timing of a rate hike. At the same time, the US labor market is showing some troubling signs. JOLTS Job Openings was unchanged in August at 4.67 million, short of the estimate of 4.72 million. On Friday, the eagerly-anticipated Nonfarm Employment Change crashed to 142 thousand, its lowest gain since January. This surprised the markets, which had expected a gain of 226 thousand. The disappointing release follows a weak ADP Nonfarm Payrolls report as well as a rise in unemployment claims.

USD/JPY 106.66 H: 106.79 L: 106.04

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750, eyes on Fedspeak

EUR/USD stays under modest bearish pressure and trades slightly near 1.0750 on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD struggles to hold above 1.2500 ahead of Thursday's BoE event

GBP/USD stays on the back foot and trades in negative territory below 1.2500 after losing nearly 0.5% on Tuesday. The renewed US Dollar strength on hawkish Fed comments weighs on the pair as market focus shifts to the BoE's policy announcements on Thursday.

Gold fluctuates in narrow range below $2,320

After retreating to the $2,310 area early Wednesday, Gold regained its traction and rose toward $2,320. Hawkish tone of Fed policymakers help the US Treasury bond yields edge higher and make it difficult for XAU/USD to gather bullish momentum.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.