Because the BoE is independent nobody expects it to cut rates now

Outlook

Yesterday, dove-turned-hawk Minneapolis Fed Kashkari said "If we need to hold rates where they are for an extended period of time to tap the brakes on the economy, or if we even needed to raise, we would do what we needed to do to get inflation back down.” Kashkari is not a voting member these days but that’s not why the market brushed off his hawkish remarks—the market is back in “Fed will cut” mode and not willing to listen to “endless hold” or even a hike.

Now that Sweden has cut rates, off we go to the races. Several ECB members have been out for some time now delivering the message that it wants to cut on June 6, assuming inflation keeps sliding downwards. The FT remarks that the Swedish economy is more like EU countries’ than Switzerland, which actually came first.

“But there are worries that if rates in Europe fall faster than in the US, it would cause European currencies to depreciate against the dollar, raising import prices and fuelling higher inflation. Riksbank governor Erik Thedéen recently acknowledged that the krona could be affected if the Fed sustains higher rates.”

There is no unwritten rule that central banks can or should synchronize monetary policy but long-time observers believe they inform one another of their attitudes and intentions. Mr. Powell (and/or TreasSec Yellen) probably knew about the Riksbank decision before the public.

So, Swiss National Bank in March, Riksbank in May and ECB in June--the Fed sometime after that, maybe September but perhaps July. This gives the dollar a tailwind unless other factors interfere, like peace in the Middle East or super-lousy CPI next week.

After the Riksbank news, today is the last fairly tame day before a flood of potentially market-moving new data on Thursday and Friday. (And by Friday we will be looking forward to US CPI the next week).

First is household spending in Japan, plus the balance of payments. Japan’s image as export-oriented is out of date and domestic spending is becoming a more important factor for growth and inflation.

Then there’s the BoE policy meeting, along with Q1 GDP. A lot of attention has gone to last week’s elections in which the Tories had the worst outcome in 40 years, losing 397 council seats and control of 10 councils. Labour got 8 of them with the Lib Dems getting two. PM Sunak bravely said the outcome doesn’t necessarily mean a general election, contrary to popular belief it has to come this year.

Because the BoE is independent (as of 1998), nobody expects it to cut rates now in order to favor Mr. Sunak, and in fact, expectations of a cut are seen as early as June, or maybe August. Others say not until year-end. In April Morgan Stanley had tomorrow as the first cut but that seems to have been squashed. The best we can hope for tomorrow is the MPC vote to get more pro-cut voters. Analysts watch the vote counts like hawks.

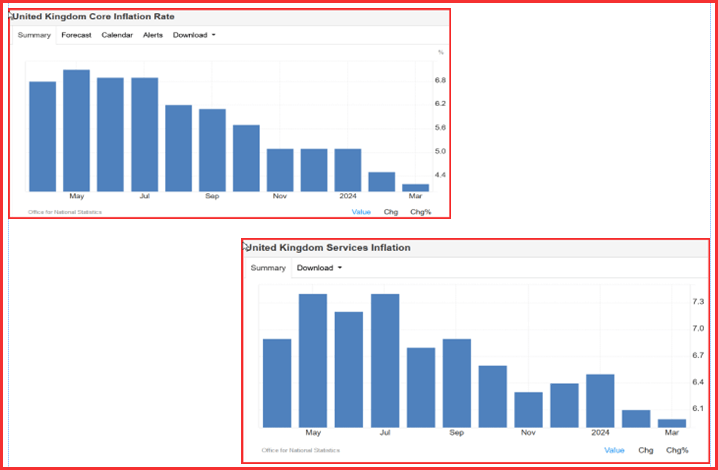

It’s important to get a grip on UK inflation, and they don’t make it easy, with multiple variations (as in the US) and one-time special factors, like housing prices having stopped rising. The last data we have is March, when core inflation slowed to 4.2%, the lowest since Dec 2021, from 4.5% the month before but higher than the forecast of 4.1%. The chart looks pretty good (from Trading Economics) but we don’t get an update until May 22. Note that overall headline inflation is 3.2% y/y from 3.4% but also higher than the forecast of 3.1%.

Frankly, this looks a lot like the US, although a bit better because services inflation is falling. The point remains the same, though—not yet for a cut. But June is possible, and that would put it in line with the ECB—maybe. ING had a forecast of June to August with a bias toward August, but that was in April.

This is named “leapfrogging” the Fed, now seen as doing the deed in Sept at the earliest. We still like July, but never mind. What we have is divergence, and maybe it’s justifiable on the grounds that the US economy is vastly different from the UK and Europe, especially in the dominance of the consumer and his spending, plus overall robustness and resilience. The US recovered from the Covid pandemic in months while across the pond it took years.

This implies that the US economy will be far more responsive to a rate cut than elsewhere and that in the long run, the BoE and the ECB will have to cut more to the terminal rate than the US.

Then the question becomes whither the dollar when it has higher growth and higher rates? The easy answer is the dollar resumes its upswing, but realistically and historically, that doesn’t happen. Before the current backslide, the financial press was full of stories about how the dollar is too strong and damaging everybody else’s economy, especially emerging markets with dollar-denominated debt. This reflects all kinds of resentment against the US for all kinds of reasons, not just the economic ones, but it’s a strong sentiment.

Besides, the Big Traders have limits on how concentrated and sizeable their positions can be in a single currency.

Then there are the dollar negatives. Two spring instantly to mind, the first being over-indebtedness and the second being Donald Trump and the havoc he would wreak upon the world.

Forecast: The Tuesday pullback is now visible on the chart and has spread pretty much everywhere, with the AUD and NZD resisting the most but seeming to give in overnight. The max move in the euro would be to about 1.0672, hand-drawn support and close to the parabolic. The move should last another few days, barring a Surprise.

Intervention Saga:

BoJ Gov Ueda met with PM Kishida yesterday and today we have a flood of jawboning comments. Ueda said not only that currency volatility is bad for business, but the BoJ may consider a rate hike to halt the yen decline.

Reuters reports “Ueda also said the BOJ could raise interest rates sooner than expected if inflation overshoots its forecasts, or risks to the price outlook increases.” FinMin Suzuki voiced "strong concern" on Wednesday over the negative impact of a weak yen, such as boosting import costs, and repeated Tokyo's readiness to intervene in the market to prop up the sagging currency.

This time Ueda said "Exchange-rate moves could have a big impact on the economy and prices, so there's a chance we may need to respond with monetary policy." It was only April 26 when Ueda had said the yen has no immediate effect on inflation.

Bloomberg has essentially the same story but not on the front page—you have to search for it. The FT is worse—search for “Bank of Japan” and the most recent story is from March. What would be a better search term? “Intervention” delivers the May 1 story. The same search at the WSJ delivers zip.

This lack of regard for official statements by top Japanese officials will not go unnoticed in Tokyo. It’s practically insulting. See the chart. As the dollar/yen reaches the top of the channel or beyond, it seems clear that some action will take place, if only to wake up the financial press reporters.

Or perhaps the MoF/BoJ can see that the rising dollar has nothing much to do with the yen and is a dollar-event, and will be patient, something at which they excel.

Reasons for the Fed to cut rates

Avoid embarrassment from getting inflation wrong twice.

Normalize the yield curve.

Head off any recessionary tendencies.

Help housing via mortgage rates.

Help banks rollover commercial property loans.

Help the stock market.

Synchronize with the ECB (and Riksbank and SNB).

(Help the current White House).

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat