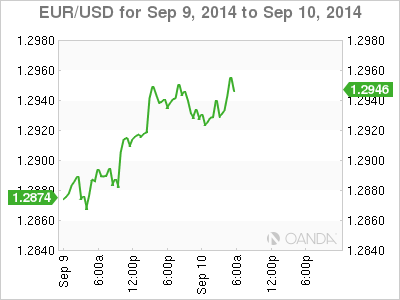

The euro continues to have a quiet week, in marked contrast to the sharp drops we saw last week. On Wednesday, EUR/USD is trading in the low-1.29 range. It could shape up to be an uneventful day for the pair, with no major releases out of the Eurozone or the US.

Will the real Germany please stand up? Recent German numbers have been mixed. GDP and Business Climate were weak, while recent manufacturing data has been sharp. This week started off on a high note, as the trade surplus climbed to EUR 22.2 billion, up from 16.2 billion a month earlier. This easily beat the estimate of 17.3 billion. The strong figure follows impressive German manufacturing data last week, led by Industrial Production, which gained 1.9% in August, its strongest showing in 2014. The euro is sensitive to German data, as Germany boasts the largest economy in the Eurozone.

US numbers continue to point to a deepening recovery, but the labor market is showing some troubling signs. JOLTS Job Openings was unchanged in August at 4.67 million, short of the estimate of 4.72 million. On Friday, the eagerly-anticipated Nonfarm Employment Change crashed to 142 thousand, its lowest gain since January. This surprised the markets, which had expected a gain of 226 thousand. The disappointing release follows a weak ADP Nonfarm Payrolls report as well as a rise in unemployment claims.

After months of fighting in eastern Ukraine between government forces and pro-Russian fighters, a ceasefire which began on Friday appears to be holding up, although some sporadic fighting has been reported. Russia has denied assisting the rebels, but both Ukraine and NATO have said that Russian forces are actively involved in the fighting. The crisis has severely strained relations between the West and Russia, and trade between Europe and Russia could be significantly affected. European countries have already implemented sanctions against Russia, and have threatened further sanctions if the ceasefire does not last.

EUR/USD 1.2951 H: 1.2952 L: 1.2923

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.