EUR/USD has posted modest gains on Tuesday, as the pair trades just shy of the 1.38 line in the European session. In economic news, Federal Reserve chair Janet Yellen surprised the markets when she said that the US economy would require monetary stimulus for some time. It's a busy day in the Eurozone. PMI releases met expectations, while German Unemployment Claims beat the estimate for a fourth straight time. There was more good news, as the Eurozone Unemployment Rate dropped below the 12.0% rate for the first time since February 2013. Today's highlight in the US is ISM Manufacturing PMI.

On Monday, Fed chair Janet Yellen said that "considerable slack" remained in the US economy and this would require further stimulus measures. Currently, the Fed is purchasing $55 billion in assets under its QE scheme. There have been three tapers to QE so far, and Yellen plans to wind up the program in the fall, provided that the US economy does not run into any serious turbulence. At the same time, the Federal Reserve has stated that its has no plans to raise interest rates until sometime in 2015.

German data continues to look solid. February's German Unemployment Change continues to show improvement, as the indicator dropped to -12 thousand, down from -14 thousand a month earlier. German Consumer Climate and Business Climate also looked sharp in February, pointing to stronger confidence in the German economy, the largest in the Eurozone.

With the Eurozone struggling with weak inflation and the euro continuing to trade at high levels, the ECB is openly considering QE and negative rates. Last week, German Bundesbank head Jens Weidmann gave support to a negative deposit rate in order to respond to the strong euro. He also raised the possibility of a QE scheme for the ECB, whereby the central bank would purchase loans or other assets in order to fight deflation, which remains a serious concern. Mario Draghi also spoke on the issue, saying that the ECB is ready to act if inflation slips further.

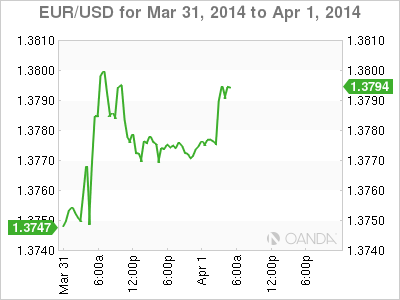

EUR/USD 1.3795 H: 1.3802 L: 1.3669

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Ethereum may sustain trading inside key range, ETH ETFs to be delayed until 2025

Ethereum is beginning to show signs of recovery on Thursday despite a second consecutive day of poor performance in Hong Kong's spot Ethereum ETFs. Bloomberg analyst James Seyffart has also shared that a spot Ethereum ETF may not happen in the US in 2024.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.