The decline in the world stock indices was restored on Thursday. The major Portuguese bank Banco Espirito Santo delayed the payments on its securities due to financial problems. Its shares have fallen by 19%. Investors are afraid of a new banking crisis.

Yesterday's intraday drop of the S&P 500 by 1% was the highest during the last three months. However, the trading session results showed it declined less significantly – by 0.41%. Still, European problems do not really bother the U.S. stock market participants. In addition, support was provided by positive data on the labor market of the United States this week. The number of new unemployed people fell to 304 thousand. Trading volume on the U.S. exchanges was only 1% higher than the monthly average. Today we will not see any major macroeconomic data, but the major U.S. bank Wells Fargo will report for the second quarter before the trading session begins. This can significantly affect the sentiment of market participants on the background of problems with the banking sector in Europe. It is expected that Wells Fargo will be all right - U.S. futures and European stocks are now being traded positively.

The heads of Banco Espirito Santo and Espirito Santo Financial Group made a number of positive statements and partly reassured investors. This morning neutral inflation data in Germany were released and there will not be any macroeconomic information in the EU today.

Japanese Nikkei keeps moving within a narrow neutral range. On Monday morning, at 4-30 CET, the data on industrial production for May will be released during the second reading. No changes, compared to the first reading, are expected.

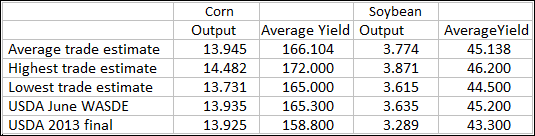

The U.S. Department of Agriculture (USDA) will publish its report at 18-00 CET, which will contain the forecast for reserves and production of the following products: wheat, corn, soybeans, cotton, beef and pork. The table shows the current forecasts of market participants, the June forecast from USDA (WASDE) and the harvest of the last year for corn and soybeans. Production is expressed in billions of bushels, yield - in bushels per acre.

As it can be seen from the table, market participants expect further rise in crop forecasts for the current year from the USDA. Accordingly, despite the increase in the intra-day chart due to the bad weather in Europe, the majority of grain futures closed with the decrease yesterday. An additional negative factor was the latest auction in China on selling government’s reserves of corn in the domestic market. On Wednesday and Thursday, 2.2 million tons out of the proposed 4.5 million tons was sold. Elimination of state reserves is accompanied by a reduction in Chinese imports of grain, which leads to their surplus in the world market.

The Natgas prices rose slightly. The Societe Generale bank has published a review where it is stated that for the export of liquefied natural gas from the U.S. to Europe, the domestic Gas price should not fall below $4-4.5 per million British thermal units (mmBtu) in America in 2014-2016. In Europe the Gas price should not be below $9/mmBtu, whereas now it is only $6.25/mmBtu.

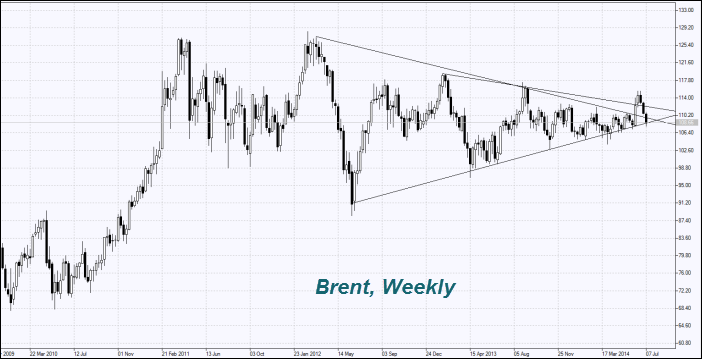

The Oil is corrected upwards after a significant fall. The International Energy Agency predicts an increase in its global demand by 1.4 million barrels per day (bpd) for the next year. In 2014 the demand growth reached 1.2 million bpd, compared with 2013 year. At the same time the OPEC production can be reduced by 100 thousand bpd to 29.8 million bpd next year. Note that according to the head of the Total, Christophe de Margerie, the preservation of the world's oil production requires around $ 1 trillion exploration costs by 2017. In our opinion, it can support the price of "black gold". Every year the world consumes about 33 billion barrels of oil, and new oil fields are being opened for only 10-20 billion barrels.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Ethereum may sustain trading inside key range, ETH ETFs to be delayed until 2025

Ethereum is beginning to show signs of recovery on Thursday despite a second consecutive day of poor performance in Hong Kong's spot Ethereum ETFs. Bloomberg analyst James Seyffart has also shared that a spot Ethereum ETF may not happen in the US in 2024.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.