EURUSD

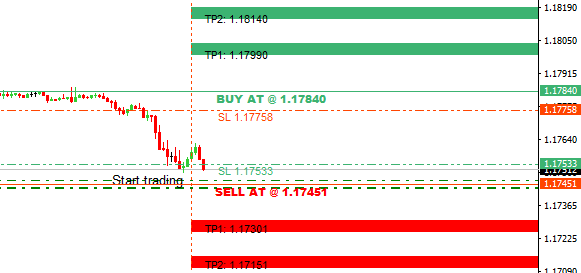

PENDING ORDER BUY EUR/USD @ 1. 1784 SL: 1. 1753 TP1: 1.1799 TP2: 1.1814

PENDING ORDER SELL EUR/USD @ 1.1745 SL: 1.1775 TP1: 1.1730 TP2: 1.1715

The price reached a level of 1. 1745

We expect a further fall in prices to the level of 1.1715

Our advice is to take the profit on the price of 1.1730

SL. setup on the price of 1.1775

Otherwise, if you have the EURUSD trend for BUY, PENDING ORDER set the price of 1. 1784 with SL. 1. 1753 and first TP with price 1.1799

EURUSD Current Trading Positions

Our company Global Investments Capital LTD, our website www.TheBestForexSignal.com our employees, our associates are not responsible for any financial or other loss that you have if you use our services. By using the information and services of www.TheBestForexSignal.com and Global Investments Capital LTD, you assume full responsibility for any and all gains and losses, financial, emotional or otherwise, experienced, suffered or incurred by you. www.TheBestForexSignal.com and Global Investments Capital LTD does not guarantee the accuracy, completeness or timeliness of, or otherwise endorse in any way, the views, opinions or recommendations expressed in the information, does not give investment advice, and does not advocate the purchase or sale of any security or investment by you or any other individual. You expressly understand and agree that www.TheBestForexSignal.com and GLOBAL INVESTMENTS CAPITAL LTD our employees, our associates shall not be liable for any direct, indirect, incidental, special, or consequential damages, including but not limited to, damages for loss or profits, goodwill, use, data or other intangible losses. By using www.TheBestForexSignal.com and Global Investments Capital LTD. including any services, products, software and content contained therein, you agree that use of the Service is entirely at your own risk. You understand and acknowledge that there is a very high degree of risk involved in trading on the markets. Past results of any individual trader published on this Website are not indicative of future returns by that trader, and are not indicative of future returns which be realized by you. We assume no responsibility or liability for your trading and investment results. The signals, strategies, learning, articles and all other features of www.TheBestForexSignal.com and Global Investments Capital LTD are provided for informational and educational purposes only and should not be construed as investment advice.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Pepe price forecast: Eyes for 30% rally

Pepe’s price broke and closed above the descending trendline on Thursday, eyeing for a rally. On-chain data hints at a bullish move as PEPE’s dormant wallets are active, and the long-to-short ratio is above one.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.