EUR/USD Weekly Forecast: US Dollar comeback has already begun

- Geopolitical tensions taking their toll on financial markets.

- Hawkish central banks backed by persistent inflation and slower growth.

- EUR/USD selling spiral accelerated ahead of the close and will likely extend next week.

The US Dollar resumed its advance this week, rallying vs all of its major rivals and pushing EUR/USD down to fresh February lows. The USD benefited throughout the first half of the week from a risk-averse environment amid geopolitical tensions between Russia and Western nations. Additionally, hawkish United States Federal Reserve (Fed) messages fueled demand for the Greenback, whilst European Central Bank (ECB) officials were also out with combative words.

Global tensions undermine the mood

A year after Moscow launched its invasion of Ukraine, the world continues to suffer from the side effects of the war. US President Joe Biden unexpectedly visited Kyiv and pledged to support the country. It did not take long for Russian President Vladimir Putin to respond, as he announced the suspension of the nuclear arms treaty with America.

Furthermore, the usually sensitive US-China relationship came under scrutiny after the US shot down what Beijing claimed were weather balloons overflying US space. Tensions arose after Deputy Secretary Antony Blinken called China “irresponsible,” while his Chinese counterpart called the American reaction “hysterical.” Tensions escalated as China’s top diplomat, Wang Yi, visited Moscow to reaffirm the bilateral relationship with Putin.

Beyond the diplomatic conflict, the war has led to massive increases in energy prices, which ended up affecting mostly the Eurozone (EU), as the region depends on Russian oil and gas. Europe has so far bared up quite well with a mild winter, but as the war extends in time, the potential of a steeper economic setback in the EU increases.

US Federal Reserve´s and European Central Bank's hawkish stances

The Federal Open Market Committee (FOMC) released the Minutes of the latest meeting on Wednesday, definitely skewing the scale to the US Dollar side. The document showed that “a few” voting members favored a 50 basis points (bps) rate hike in early February, although they finally delivered a 25 bps one.

The document was read as more hawkish than anticipated, as the meeting took place before the release of the higher-than-expected Consumer Price Index (CPI) data. Policymakers expressed their concerns about upside risks for inflation while adding a tight job market contributes to upward pressures. Additionally, some participants saw an elevated prospect of a recession in 2023. Finally, they believe that it would take some time for inflation to fall to target and that a restrictive monetary policy would be needed until they are confident it will be at 2%. It is worth adding policymakers are optimistic about easing price pressures.

Opposing the US Federal Reserve, the European Central Bank (ECB) President Christine Lagarde commented this week that underlying price pressures remained “alive and kicking,” reaffirming the central bank’s decision to hike rates by 50 bps in March. However, market players are still discounting a possible pause afterwards, as Lagarde & co clarified upcoming decisions will be data-dependant.

Bundesbank President Joachim Nagel repeated Lagarde’s hawkish remarks on Friday, saying he expects a robust rate hike in March while adding that the ECB may still need to proceed with significant rate hikes afterwards.

Worrisome inflation and growth figures

Macroeconomic data took its toll on the Euro while fueling the risk-averse mood. S&P Global unveiled the preliminary estimates of the February PMIs. European manufacturing indexes missed expectations, although services output improved by more than anticipated. In the US, the outcome of both indexes was above the market’s forecast, although manufacturing activity held within contraction territory.

Germany downwardly revised its Q4 Gross Domestic Product (GDP) with the annual pace of growth at 0.9% down from 1.1% previously estimated. Inflation in the country was confirmed at 9.2% YoY in January according to the Harmonized Index of Consumer Prices (HICP). Eurozone HICP, on the other hand, was confirmed at 8.6% YoY, although the core reading was upwardly revised to 5.3%.

US data was quite shocking. On the one hand, the second estimate of the Q4 GDP showed that the annual pace of growth was downwardly revised from 2.9% to 2.7%. More relevantly and in the same quarter, Personal Consumption Expenditures Prices were up by 3.9%, higher than the 3.5% previously estimated.

The United States released the January Personal Consumption Expenditures (PCE) Price Index on Friday, which rose 5.4% YoY and 0.6% MoM, surpassing expectations. The US Federal Reserve’s favorite inflation gauge, the core PCE Price Index, rose 4.7% YoY. The report came in line with the Fed’s hawkish view of inflation still needing time and efforts to fall back to 2%. As a result, high-yielding assets plummeted and the US Dollar made another leg higher ahead of the weekly close.

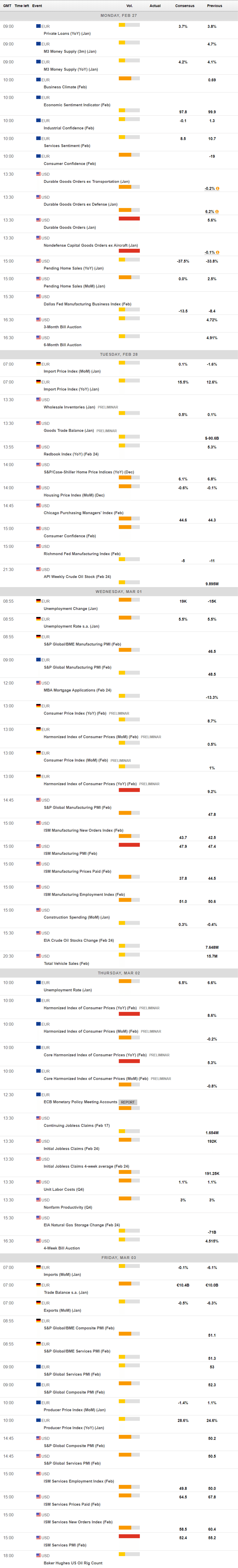

The upcoming week will bring January US Durable Goods Orders, and the final estimates of S&P Global PMIs for all major economies. Meanwhile, Germany and the EU will publish the preliminary estimates of their February HICP. In between, the US will release the February ISM Manufacturing PMI on Wednesday, and the Services PMI on Thursday.

EUR/USD technical outlook

The EUR/USD pair trades in the 1.0530 area head of the close, and has room to extend its slump. The weekly chart shows that the pair is quickly approaching the 50% Fibonacci retracement of its 2022 yearly decline at 1.0515, a static support level. Repeated daily failure to overcome the 61.8% retracement at 1.0745 over the last few weeks discouraged bulls.

In the aforementioned time frame, a bullish 20 Simple Moving Average (SMA) nears the static support level, reinforcing its relevance and making a break below it a stronger signal for a bearish mid-term run. Technical indicators, in the meantime, have extended their vertical slopes within positive levels and are getting closer to their midlines, reflecting increased selling interest.

Technical readings in the daily chart support a downward extension, particularly if 1.0515 gives up. A bearish 20 SMA has accelerated south well above the current level and is currently piercing the immediate Fibonacci resistance. The Momentum indicator hovers directionless within negative levels, but the RSI indicator heads firmly lower at around 33, anticipating further slides.

Once below 1.0515, a bullish 100 DMA provides dynamic support at around 1.0440. The next relevant level to watch is the 38.2% retracement of the 2022 decline at 1.0280. The first line of sellers is at 1.0620, with a non-too relevant resistance at 1.0680. Above the latter, 1.0745 is the next level to watch.

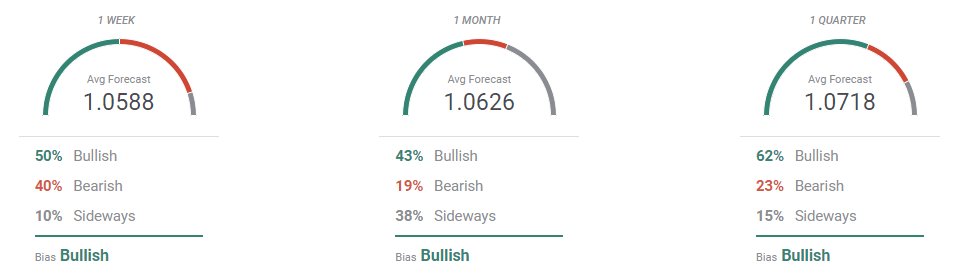

EUR/USD sentiment poll

The FXStreet Forecast Poll shows that market players weren’t expecting such US Dollar strength, as most remain bullish in EUR/USD. The average target for the next week is at 1.0588, although as time goes by the average increase. Bulls are the shyest in a one-month perspective, as they account for 43% of the polled experts. In the same time frame, however, bears stand at 19%.

The Overview chart shows that the near-term moving average remains directionless, as the spread of potential targets is quite even. The monthly MA turned south, although there is no clear accumulation but around the current level. Finally, the quarterly perspective shows that bulls are still betting for a retest of the 1.1000 price zone and even higher levels are on the table.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.