EUR/USD Weekly Forecast: Unimpressive Powell hits the greenback

- FOMC Minutes showed that policymakers remain optimistic but cautious.

- Activity in the services sector improved by more than anticipated in the US and the EU.

- EUR/USD recovered, but it is far from shrugging off its intrinsic weakness.

The EUR/USD pair edged higher this week, reaching a high of 1.1927 and settling a few pips below the 1.1900 figure. The upbeat US employment report released last Friday was the main catalyst for the broad dollar weakness. Wall Street rallied to unexplored territory, while government bond yields remained subdued throughout the week, with the yield on the 10-year Treasury note losing the 1.70% level. Such a level has become an indicator of the dollar potential strength/weakness against its major rivals.

Central banks paths separating?

The market had not much more to pay attention to these days. The most relevant event was the release of the US Federal Reserve Meeting Minutes on Wednesday. Policymakers said nothing new to what the market already knows, reiterating their optimistic stance about economic progress but reaffirming their current compromise to an ultra-loose monetary policy until “substantial further progress” toward the Fed’s goals on inflation and employment is achieved. Tapering is out of the picture for now, as uncertainty surrounding real GDP growth and the employment outlooks are still elevated.

Meanwhile, the shared currency found support from comments from Robert Holzmann, Austria central bank Governor, as he said that the European Central Bank might be able to start reducing its bond purchases during the summer. The notion of the ECB moving ahead of the Fed has not yet reached trading desks, but it is something that may shortly take its toll on EUR/USD.

Covid is still a theme

News related to the coronavirus pandemic has had a limited impact on prices, although they are still relevant in terms of economic progress. Concerns related to the AstraZeneca vaccine and the “rare link” with the blood clots it may cause have hurt GBP, but are a major concern for Europe, where the application of the vaccine is widely spread. EU countries have been struggling to get enough shots and kick-started the immunization process with such a jab, which has been cancelled in several countries, in some just for people under 60 years old.

The US run toward herd immunity is doing better than the European one, as 33.7% of the population has received at least one dose of a coronavirus vaccine.

Positive data failed to impress

There were some positive surprises on the data front. The official US ISM Services PMI jumped to 63.7 in March, showing a 10th straight month of growth for the services sector, which has expanded for all but two of the last 134 months. Markit upwardly revised the March Services PMIs for the Union, with that for the EU confirmed at 49.6.

The US macroeconomic calendar included some not-so-encouraging surprises, as the February Goods Trade Balance posted a deficit of $ 71.1billion, while weekly unemployment claims unexpectedly surged to 744K in the week ended April 2.

Investors will be busier next week, with more macro data to follow. The EU will publish February Retail Sales on Monday, while Germany will release the April ZEW Survey on Tuesday when the US unveils March inflation data.

Later in the week, the EU will publish February Industrial Production, while Germany is set to release March inflation figures. The US is scheduled to release March Retail Sales next Thursday and the preliminary estimate of the April Michigan Consumer Sentiment Index on Friday.

EUR/USD technical outlook

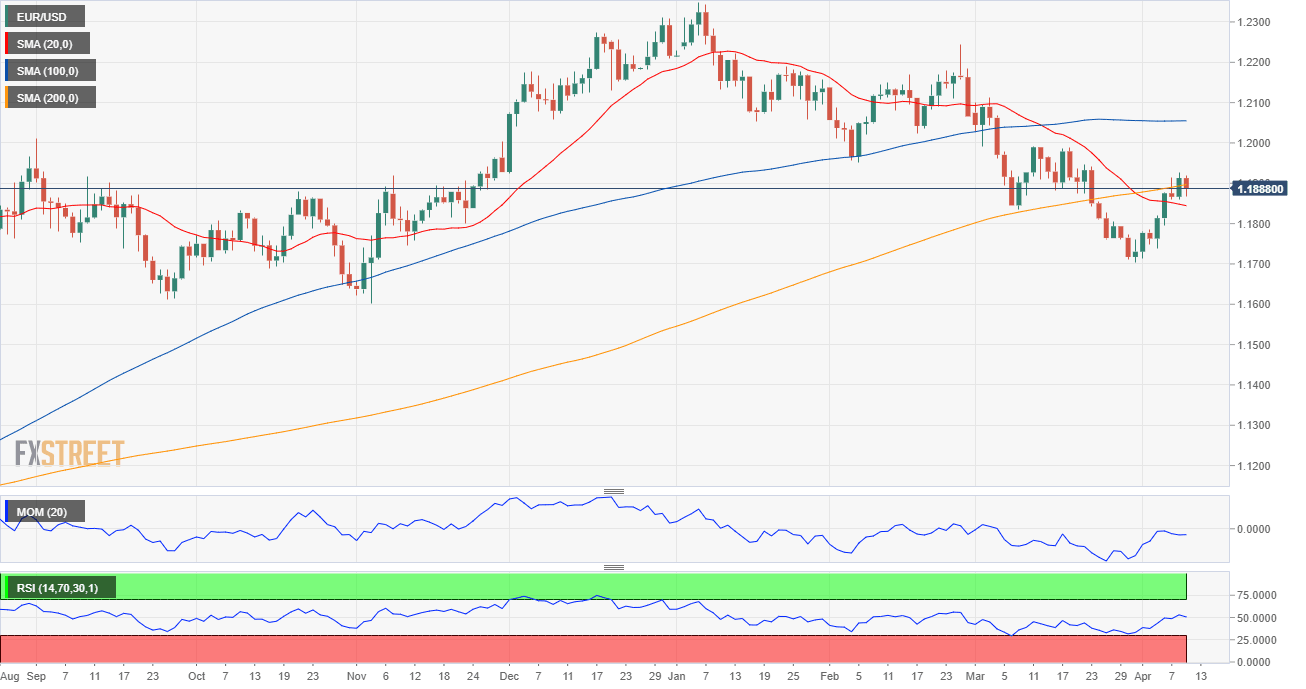

The EUR/USD pair is far from changing the long-term bearish bias. The weekly chart shows that technical indicators have bounced just modestly from multi-month lows, but that they lack bullish strength well below their midlines. In the mentioned time-frame, the pair develops below a directionless 20 SMA, currently around 1.2040. The longer moving averages remain well below the current level, also lacking directional clues.

In the daily chart, the pair seesaws around a mildly bullish 200 SMA, holding above a bearish 20 SMA. Technical indicators are retreating from their midlines after failing to extend their positive impulse into positive territory, maintaining the risk skewed to the downside.

The immediate support level is the 1.1810/20 price zone. It will take a break below the 1.1700 level to see the pair extending its slump to 1.1602, the November 2020 monthly low. A weekly close below this last level opens the door for a test of the 1.1470 region, a long-term static support level. The pair topped this week at 1.1927, with gains beyond it exposing the 1.2000 mark.

EUR/USD sentiment poll

The FXStreet Forecast Poll shows that the pair is generally expected to retain the 1.1800 level, as on average, is seen holding above it in the three time-frame under study. Bulls dominate the near term, although the weekly target is located at 1.1831. Bears are a majority in the monthly view, but the pair is seen closer to 1.1900. Bulls dominate the quarterly perspective with the pair expected to trade between 1.1900 and 1.2000.

The Overview chart shows that the near-term moving average picked up, heading north for the first time this year. The longer-term moving averages maintain their bearish slopes, despite in the monthly view, most targets accumulate around the 1.1800 figure.

Related Forecasts:

USD/JPY Weekly Forecast: Fed fails to dim dollar prospects

GBP/USD Weekly Forecast: Is the correction over? US consumer, vaccines hold keys

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.