EUR/USD Weekly Forecast: The tide is about to turn for the dollar

- US inflation continues heating up, but the Fed will stay on hold.

- Economic progress at both shores of the Atlantic spurs optimism.

- EUR/USD is under strong selling pressure and poised to extend its slump.

The EUR/USD pair surged to 1.2266 this week, its highest since January, but trimmed gains ahead of the close, to end it in the red around 1.2180. A scarce macroeconomic calendar and the absence of explosive news maintained major pairs within limited ranges.

Financial markets rotated around US inflation expectations and their possible effects on the current monetary policy. However, Federal Reserve officials succeeded in cooling hopes for a soon-to-come tightening, leaving speculative interest without its main motto. On the other hand, the little American data published these days showed that the economic recovery is underway. Weekly unemployment claims fell to 406,000, its lowest reading since March 2020, while the Q1 Gross Domestic Product was confirmed at 6.4% QoQ. Even further, the Fed’s favourite inflation measure, the core PCE Price Index, soared to 3.6% from 2.4% in April.

Too early for central banks to take action

Economic growth translates into mounting inflationary pressures, which puts the central bank in a delicate position. Acting too early could be counterproductive, as raising rates could tempt banks to lend to the Fed rather than to private borrowers, slowing small businesses’ recoveries, hence weight on economic growth.

Meanwhile, US President Joe Biden is said to propose a $6 trillion budget, the largest spending program since WWII, to boost the economy. Among other things, he has called for a $2.3 trillion infrastructure proposal, although Senate Republicans are planning a counteroffer of $ 928 billion. President Biden has said that he would like to reach a consensus with the opposition.

Across the pond, the European Central Bank is on a different channel. Policymakers have repeated multiple times that the monetary policy will remain “very accommodative” amid persistent low inflation. ECB Governing Council member François Villeroy de Galhau said “Our monetary policy can be patient, as the euro area inflation is well below other jurisdictions.”

Focus shifts to US Nonfarm Payrolls

Data coming from the EU was generally encouraging but failed to impress. German Gross Domestic Product was downwardly revised to -1.8% QoQ in the first quarter of the year. Confidence-related measures were mixed, as the country’s GFK Consumer Confidence Survey printed at -7 for June, missing expectations, while the IFO Survey indicated that May’s Business Climate improved by more than expected, from 96.6 to 99.2. On Friday, the market knew that May Consumer Confidence in the EU improved as expected from -8.1 to -6.1, while the Economic Sentiment Indicator jumped to 114.5.

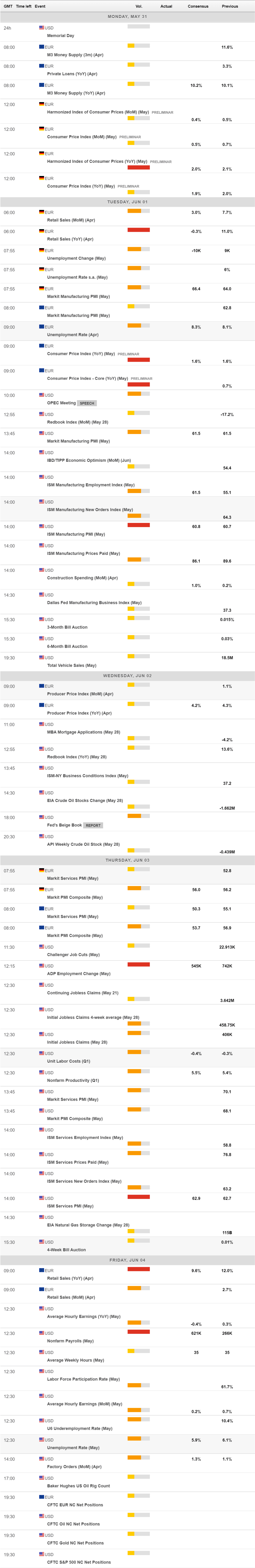

The first week of June will be much more entertaining on the data front. Germany will publish the preliminary estimate of May inflation figures and April Retail Sales. The EU will also unveil the preliminary estimate of its May Consumer Price Index, foreseen steady at 1.6% YoY, and April Retail Sales.

The US will offer the official ISM Manufacturing PMI, seen at 60.8 from 60.7 previously, and the Services PMI, expected to have improved from 62.7 to 62.9. At the end of the week, the country will publish the May Nonfarm Payroll Report. The country is expected to have added 621K new jobs in May, while the Unemployment Rate is foreseen contracting to 5.9% from 6.1% previously. Average Hourly Earnings are expected to have contracted by 0.4% YoY.

Markit will publish the final readings of its May PMIs for all major economies.

EUR/USD technical outlook

The EUR/USD pair is at the brink of a bearish breakout as demand for the greenback accelerated heading into the weekly close. The daily chart shows that the pair is resting on a bullish 20 SMA, which maintains its bullish slope above the longer ones. Technical indicators have retreated sharply from near overbought readings heading south just above their midlines and indicating increased selling pressure.

In the weekly chart, technical readings turned neutral, but given that the pair is near a multi-week high, the bearish potential is limited. Technical indicators lack directional strength, with the Momentum just above its midline and the RSI at around 57. The 20 SMA is flat, providing dynamic support at around 1.2030.

A relevant support level comes at 1.2125, where the pair bottomed last week. Once below it, the mentioned 1.2030 level is the next one to watch. A break below the 1.2000 figure could result in a bearish extension to 1.1860. Sellers are aligned around 1.2200, the level that needs to be beaten for another leg higher, with the next resistance levels at 1.2280 and 1.2349.

EUR/USD sentiment poll

The FXStreet Forecast Poll indicates that dollar bulls are ready to return. The pair is bearish in the three time-frame under study, although on average, it is seen holding above the 1.2000 threshold. Bears account for 70% of the polled experts in the monthly perspective, decreasing to 54% in the quarterly view.

The Overview chart shows that moving averages are mostly flat, with the shorter one slowly turning south. Nevertheless, the chart shows that most targets now accumulate below the current level in all the time frames under study, with some high bullish targets distorting the average. Still, the number of those seeing the pair above 1.2200 is quite limited.

Related Forecasts:

Bitcoin Weekly Forecast: BTC price hangs between whales accumulation and miners woes

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.