EUR/USD Weekly Forecast: Bullish correction or trend change?

- High-yielding assets came back as the US Federal Reserve stands pat.

- Signs of slowing economic growth and lingering inflation were temporarily ignored.

- EUR/USD comeback falling short of confirming a mid-term bullish continuation.

The EUR/USD pair advanced for a second consecutive week after bottoming at a multi-year low of 1.0348 in mid-May to close above 1.0700. The broad dollar’s weakness was behind the advance, with the latter pressured despite lingering risk aversion.

Investors were cautious, as macroeconomic data pointed to slowing economic growth and persistent inflationary pressures, while recession fears added to the global picture. However, Wall Street was able to recover, with major indexes posting substantial weekly gains after a six-week losing streak.

Fed fails to surprise, ECB singing the same song

Tepid US data and a less-aggressive-than-anticipated US Federal Reserve were responsible for the dollar’s decline and stocks’ advance. The Fed published the Minutes of the May meeting, and the document showed that policymakers are prepared to continue hiking the official rate by 50 bps each time while opening the door to move past a neutral stance and into restrictive rates. However, they also expressed their concerns that a tighter monetary policy could lead to instability in financial markets.

At some point, officials noted that the Fed would be “well-positioned later this year” to reevaluate the effect of the current policy on inflation. Following such an announcement, market participants rushed to price in a pause in hikes in September, something that Atlanta’s Fed Raphael Bostic suggested ahead of the release. Bostic is usually labeled as hawkish, probably the main reason why his words had such an impact on markets. Stocks rallied on relief as investors cheered a not-that-aggressive Fed while demand for safe-haven assets decreased.

The European Central bank, on the other hand, keeps paving the way for a rate hike at the beginning of Q3, shortly after ending the ongoing Asset Purchase Programme. President Christine Lagarde anticipated they would likely be in a position to exit negative interest rates by the end of the third quarter. That means at least two 25 bps hikes between July and September.

What fundamentals say

From a macroeconomic perspective, there are no reasons to support a continued rally in high-yielding assets, neither equities nor the shared currency. By the time the European Central Bank moves out of negative rates, the US will have a rate of roughly 2% if everything goes as planned. Furthermore, the ongoing war in Ukraine will only exacerbate economic turmoil, although that will take its toll on both the EU and the US. The shortage of oil and other commodities is putting additional pressure on prices, and there are no signs the situation will change in the foreseeable future.

There is a trick to the dollar’s potential recovery. The market has long ago priced in a super tight monetary policy arc from the Fed. Anything that falls short of more hawkish will be seen as dovish. The ECB, on the other hand, has multiple options to be more aggressive, although chances of that happening are a few at the time being. In this scenario, macroeconomic data may become more relevant.

During the upcoming week, the focus will be on inflation. Germany and the EU will release the preliminary estimates of their May Consumer Price Index, both seen accelerating on an annual basis. Germany and the EU will also publish April Retail Sales, while the EU will unveil the April Producer Price Index. The US will publish the official May ISM PMIs and the May Nonfarm Payrolls report.

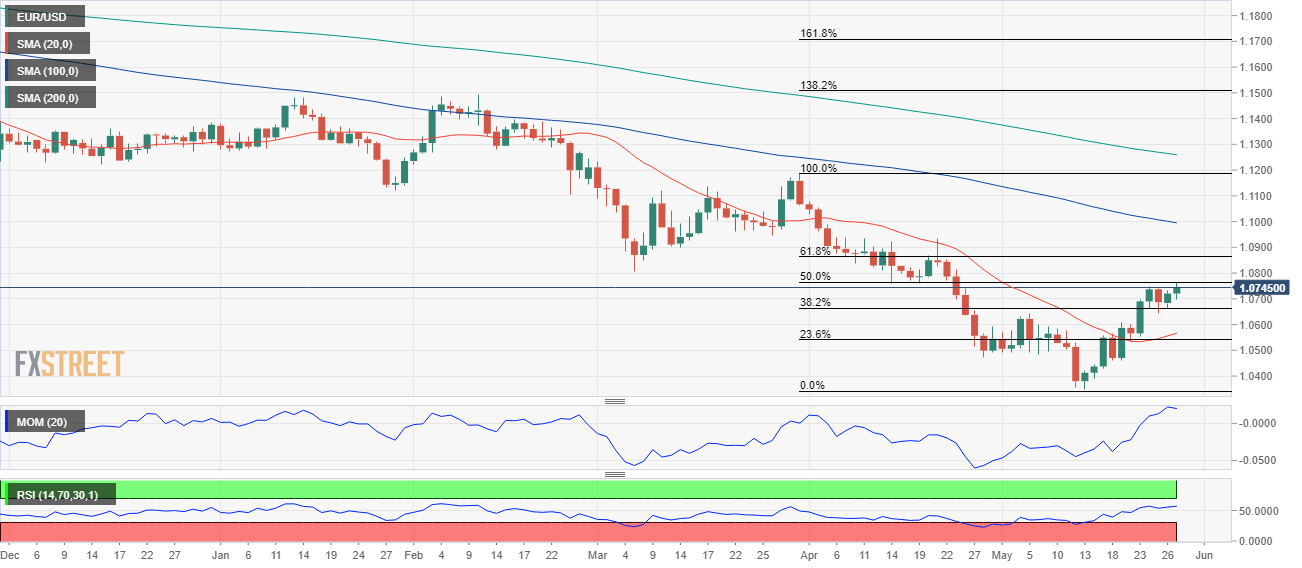

EUR/USD technical outlook

So far, the dollar’s decline seems corrective, at least from a technical perspective, as the currency reached overbought conditions after rallying since the beginning of the year. However, it is not far from confirming a potential bottom.

The EUR/USD pair traded as high as 1.0764, retreating from the 50% retracement of the 1.1184/1.0348 at around the mentioned level ahead of the weekly close. According to the weekly chart, the advance is still seen as corrective. Technical indicators advance within negative levels, recovering from extreme oversold readings but still far below their midlines. At the same time, the pair develops below all of its moving averages, with the 20 SMA heading firmly south at around 1.0960.

The bullish rally has lost steam, according to the daily chart. The Momentum indicator retreats after nearing overbought readings, while the RSI indicator is flat at around 55. The 20 SMA aims modestly higher below the current level, but the longer moving averages maintain their bearish slopes far above the current level.

Buyers have been defending the downside around the 38.2% retracement of the aforementioned slide at 1.0670. The pair briefly pierced the level before bouncing back. Another attempt below the level will likely spook bulls and expose the next Fibonacci support at 1.0545.

On the other hand, if the pair manages to extend gains beyond 1.0770, chances of a bullish continuation towards 1.0860 should increase. An extension beyond the latter will open the door for a test of the 1.0940/60 price zone.

EUR/USD sentiment poll

According to the FXStreet Forecast Poll, the EUR/USD pair may extend its gains in the near term, but will then resume its decline. Bulls represent 50% of the polled experts in the shorter perspective, with an average target of 1.0744. However, those betting for a continued advance decrease to 24% and 30% in the monthly and quarterly views. In both cases, bears are above 50%, although the pair is seen averaging 1.0610/40.

The Overview chart shows that the bearish case is losing adepts. The weekly moving average is bullish, while the longer ones have turned flat. In the monthly perspective, however, more targets accumulate around or below the current target, while the favored range in the wider view is 1.0400/1.0800. Chances of a recovery beyond the 1.1000 level remain out of sight as only a few polled analysts anticipate such a recovery.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.