EUR/USD Price Forecast: Next on the downside comes 1.1000

- EUR/USD gave away further ground and dropped to three-week lows.

- The US Dollar kept its bullish stance unchanged following geopolitics.

- The US ADP report surprised to the upside in September.

EUR/USD extended its weekly leg lower on Wednesday, slipping to three-week lows near 1.1030 due to a persistent risk-off mood and a robust recovery in the US Dollar (USD).

That said, the Greenback gained further momentum as market participants remained prudent following Tuesday’s geopolitical developments in the Middle East and the lingering probability that Israel might retaliate any time soon.

In the meantime, the persistent risk aversion mood seems to have clouded the recent optimism after China announced a new set of stimulus aimed at kickstarting its economy in the post-pandemic era.

Back to monetary policy, markets anticipate further rate cuts in the Federal Reserve’s (Fed) November and December meetings. On this, it is worth recalling that Chair Jerome Powell favoured a 25 basis point rate cut at those meetings, contrasting with market expectations of around 75 basis points of easing from the central bank for the remainder of the year.

Still around the Fed, Atlanta Federal Reserve President Raphael Bostic was once again on the wires, suggesting that he is open to a half-percentage-point rate cut at the November meeting if data show a faster-than-expected slowdown in job growth. However, his decision will hinge on how inflation progresses and the results of upcoming job reports, starting with the September employment report due on Friday.

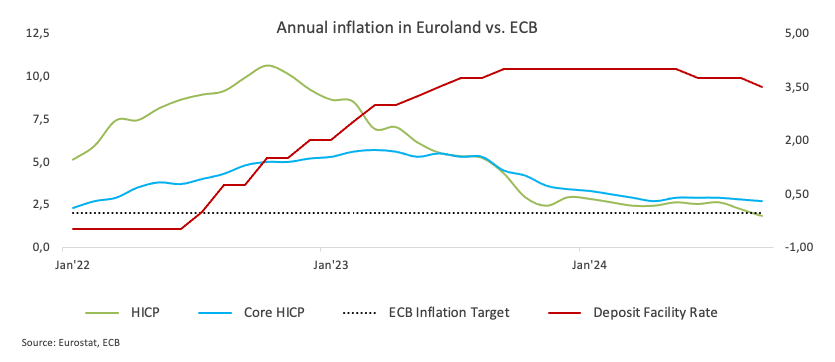

On the European side, the ECB adopted a moredovish stance during its September meeting due to inflationary and economic pressures. ECB President Christine Lagarde remarked that while domestic inflation remains high, restrictive policies are easing, which could support the European economy. The ECB expects inflation to return to its 2% target by 2025.

Meanwhile, on Wednesday, ECB Vice President Luis de Guindos indicated that Eurozone growth could be weaker in the near term than the bank had anticipated, but he expressed optimism that the recovery would pick up later. He noted that the recovery should gain strength over time, driven by rising real incomes and the lessening impact of restrictive monetary policies, which would likely boost consumption and investment.

On the same day, ECB board member Frank Elderson argued that inflation in the Eurozone is expected to reach the ECB’s 2% target next year but warned against complacency, citing the significant structural changes facing the currency bloc.

Finally, ECB board member Isabel Schnabel remarked that Eurozone inflation is becoming more likely to permanently ease back to the bank’s 2% target. Her comments are expected to strengthen expectations for future interest rate cuts.

Let’s recall that preliminary inflation data in the eurozone showed the headline HICP rising by 1.8% YoY in September, while the Core HICP rose 2.7% over the same period. In addition, the Unemployment Rate in the region held steady at 6.4% in August.

Looking ahead, further Fed rate cuts could reduce the policy divergence between the Fed and ECB, which may support EUR/USD. Markets currently anticipate two more rate cuts from the ECB and around 100 to 125 basis points of easing from the Fed over the next 12 months. However, the US economy’s expected outperformance relative to Europe’s may prevent substantial dollar weakness.

In terms of speculative positioning, non-commercial net long positions in the Euro hit a two-week high, while commercial players’ net short positions remained mostly unchanged, with a slight rise in open interest. Despite ongoing volatility, EUR/USD maintained a modest upward trend, trading near the upper 1.1100 range during this period.

EUR/USD daily chart

EUR/USD short-term technical outlook

Further EUR/USD advances are expected to encounter initial resistance at the 2024 high of 1.1214 (September 25), followed by the 2023 high of 1.1275 (July 18).

The pair's next downward target is the provisional 55-day SMA at 1.1024, which comes before the September low of 1.1001 (September 11) and the weekly low of 1.0881 (August 8).

Meanwhile, the pair's upward trend is projected to continue as long as it remains above the crucial 200-day SMA at 1.0874.

The four-hour chart shows a strengthening of the negative trend. The initial resistance level is still at 1.1214, followed by 1.1275. On the other side, the initial level of conflict is 1.1032, seconded by 1.1001. The relative strength index (RSI) decreased to about 34.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.