Pharma stocks roar back following Trump’s 90-day tariff pause

- Donald Trump pauses his "reciprocal" tariffs for 90 days.

- Dow Jones pharma stocks reverse higher on tariff pause.

- Trump raises his tariffs on Chinese goods to 125%.

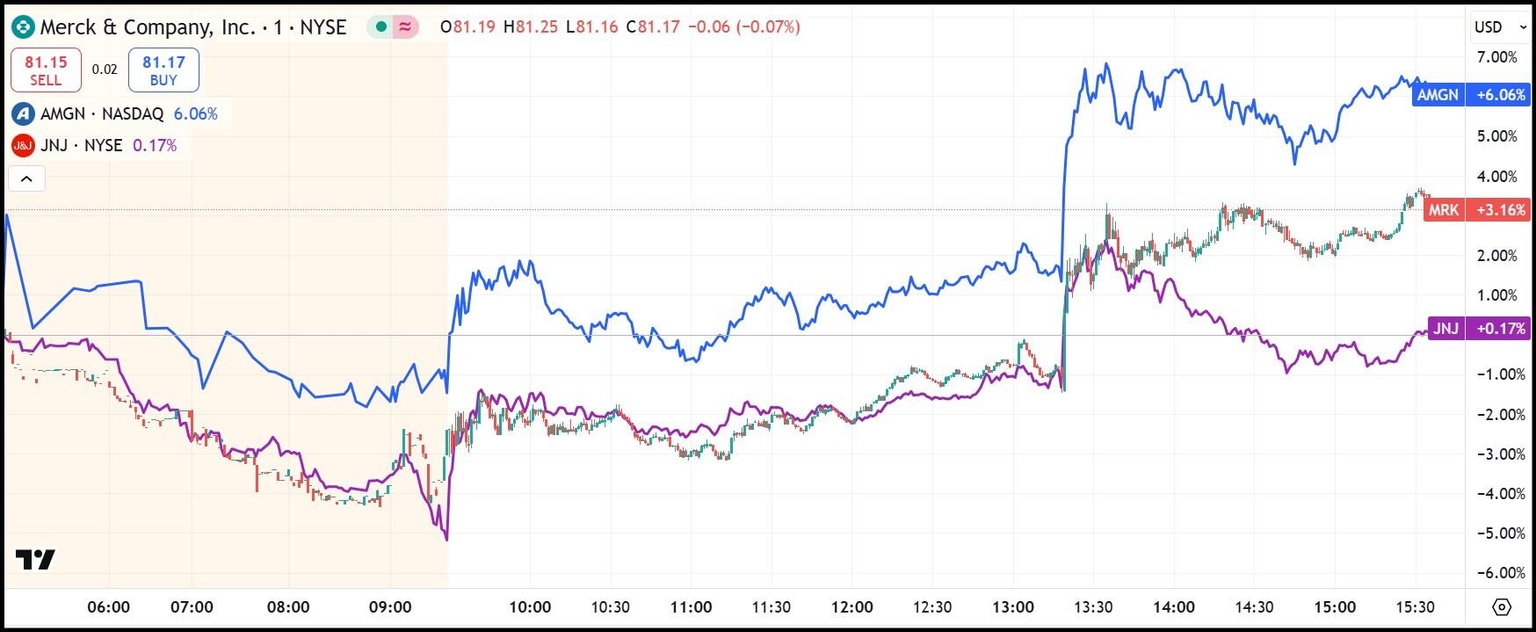

- MRK, AMGN and JNJ all recover from intraday lows.

US President Donald Trump’s sudden, shocking 90-day pause on his so-called “reciprocal” tariffs (they were not reciprocal) has helped pharmaceutical stocks recover on Wednesday.

After trading significantly lower Wednesday morning on expectations that Trump would ditch the pharma exemption for tariffs, pharma stocks exploded higher as the exemption is no longer necessary now that the higher bilateral tariffs have been delayed.

Trump instead has signaled that he will stick with the across-the-board 10% base tariff for the time being. This sent the NASDAQ Composite skyrocketing 10% and the Dow Jones Industrial Average (DJIA) up 7%.

Pharma stocks recover: Amgen, Johnson & Johnson, Merck

US President Donald Trump told a private gathering of Republican House members late Tuesday evening that he was considering removing the tariff exemption for the pharmaceutical industry. According to The Wall Street Journal, Trump said, “We’re going to tariff our pharmaceuticals, and once we do that they’re going to come rushing back into our country because we’re the big market.”

This reporting abruptly hurt pharma stocks at first, including Dow Jones Industrial Average (DJIA) components Johnson & Johnson (JNJ), Merck (MRK) and Amgen (AMGN).

However, Trump’s post on his Truth Social platform on Wednesday afternoon changed all that. Suddenly, investors have 90 days to plan around the future tariffs and some might expect that the much higher tariffs never see the light of day.

After trading down 2% to 3% early Wednesday, all three reversed course following the tariff delay. Only JNJ stock is still trading in the red at the time of writing, albeit well off the session lows. JNJ traded down to $141.50 earlier before reversing to above $148.00.

When Trump announced 25% tariffs on South Korea, 24% tariffs on Japan, 17% tariffs on Israel, 20% tariffs on the European Union, and 26% tariffs on India last week, pharma stocks breathed a sigh of relief that they were exempt alongside semiconductors and a few other industries. But Trump’s interest in removing their exemption might mean that when the 90-day pause is up in July, the companies will be hit with tariffs when trying to bring their foreign-produced products into the US market.

Trump also raised his tariffs from 104% on Chinese goods to 125%, effective immediately, in response to China's raising its own tariffs on US goods to 84%.

Trump would prefer if the pharmaceutical industry reshored production. However, many US pharma companies house their production units in low-tax nations like Switzerland and Ireland so that they can report their US sales in the foreign locales and skirt US corporate taxes. Reshoring production due to tariffs would then be less attractive since they would have to pay these US tax rates on their US profits.

Bernstein analyst Courtney Breen estimates that Trump’s paused tariff rates would add about $46 billion in import costs alone for the industry.

MRK (candlesticks), AMGN (blue), JNJ (purple) stock performance for April 9, 2025 (1-minute candles)

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Clay Webster

FXStreet

Clay Webster grew up in the US outside Buffalo, New York and Lancaster, Pennsylvania. He began investing after college following the 2008 financial crisis.