EUR/USD traders are bracing for one of the busiest trading days of the year. Calendar dynamics have conspired to put together a week with a monster jam of economic events, with Wednesday bringing the heaviest ones.

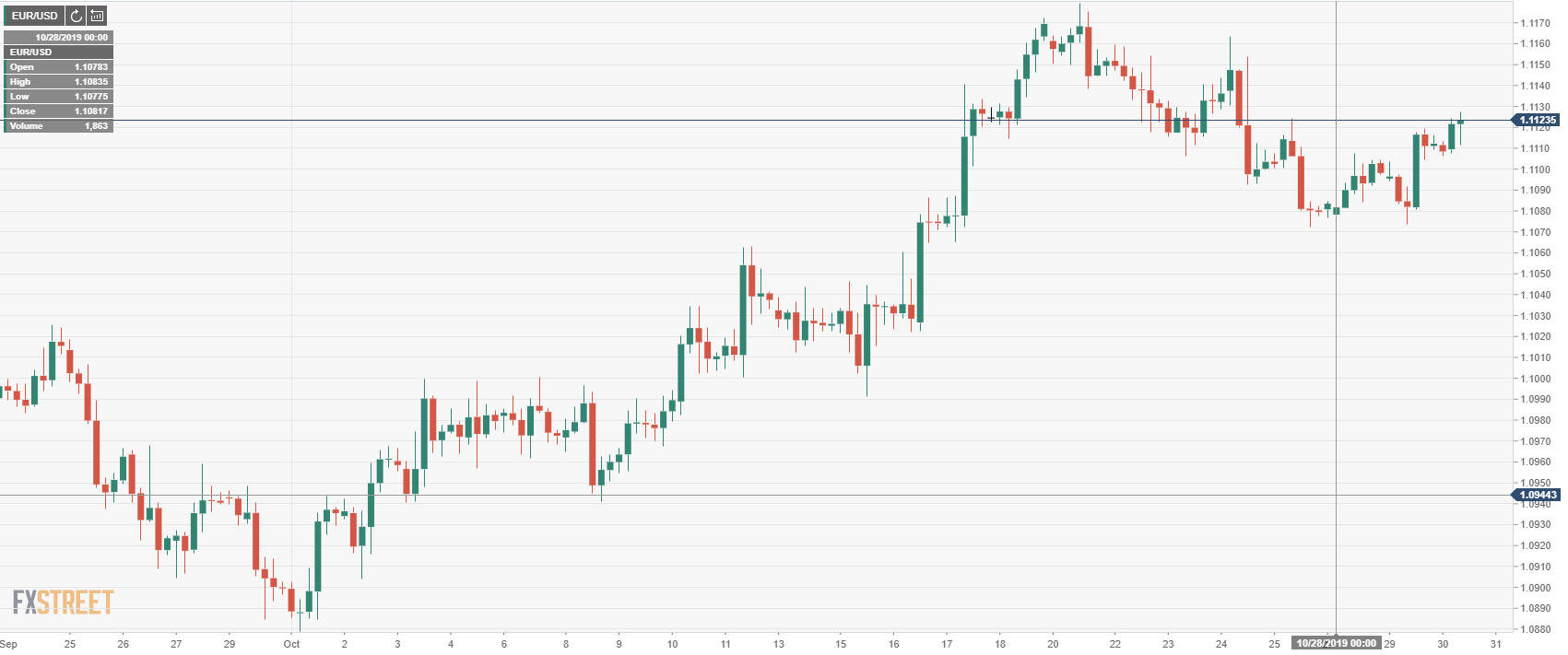

EUR/USD bulls have led for most of the week, leading the pair to rise from the 1.1078 opening level to the current levels above 1.11. Rising hopes about the Brexit extension to Jan 31st being the last one – after UK political picture gets sorted out on upcoming Dec 12th Parliamentary Election – supported the euro, while a mediocre US Consumer Confidence survey contributed to some US dollar sell-off. Reports that a US-China trade deal is nearing also supported the EUR/USD pair.

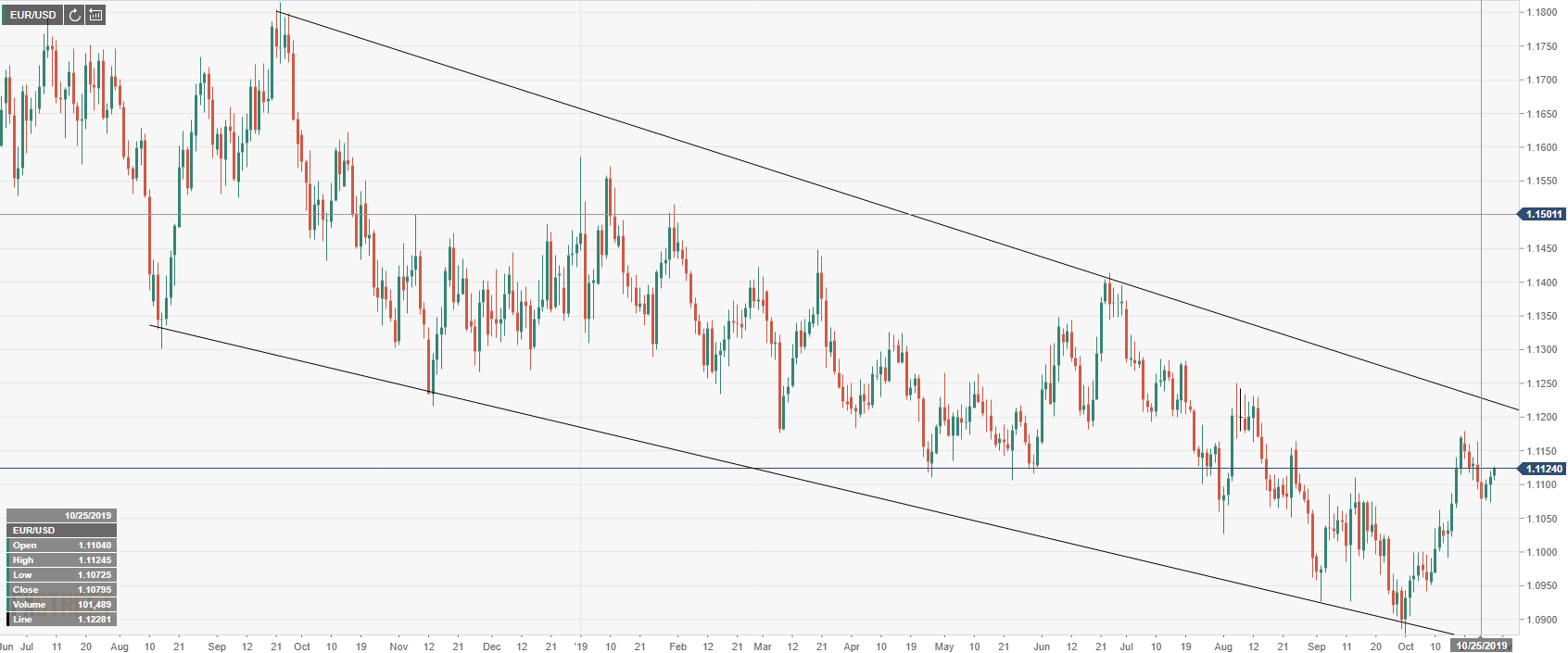

Short-term charts show a bullish EUR/USD outlook, as the pair has gained over 250 pips in October, having set a high at 1.1177 last Oct 21st. Taking a look at longer-framed charts paints a different picture, though. Daily and weekly Fiber charts show a relentless bearish trend still in place. Bulls will need to break above the previously mentioned high to have a chance to break that trend.

It is at these crossroads between short-term bullish momentum meeting long-term bearish forces where today’s Super Wednesday might help clear the picture and tell us where the Euro/Dollar pair will be heading in the coming weeks. Let’s take a look at the key events.

Modest expectations on the US ADP Employment report

The most important Non-Farm Payrolls leading indicator is being released today at 12.15 GMT. Having carried for months a bearish trend, expectations for the ADP private employment report are modest, with a forecast of 120k jobs added in October. If that number is the one released, that would be the sixth consecutive month with a job gain below the 160k mark. That would only add pessimism to the already red-looking NFP leading indicator table.

ADP Employment Report has failed to rock the EUR/USD market on its last releases and this could be the case again, as it is being released only 15 minutes ahead of the more important US GDP Q3 first release. That said, a dismal reading could add bearish pressure to the US dollar as the Fed could start worrying about a slowdown in the labor market.

US GDP growth is slowing down, but how much?

US Gross Domestic Product third-quarter first estimate is set to be released at 12.30 GMT. This is a key release, particularly being so close (the same day!) to the Fed interest rate decision, as there will not be much time for the market and Fed officials to digest the latest update about the US economy performance.

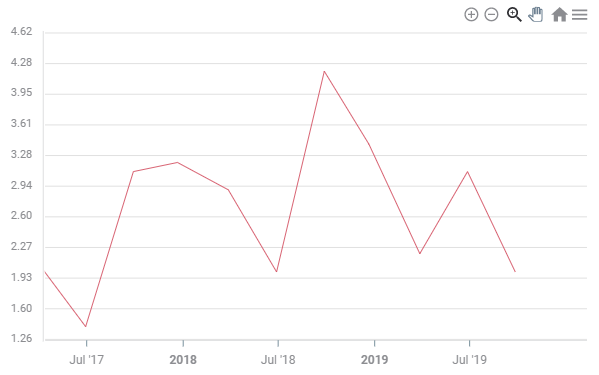

It is well-known that United States economic growth is slowing down, as three of the last four quarters have shown decreasing rises in the GDP, but a confirmation of the below 2% pace – expectations are at 1.7% – would likely support more Fed rate cuts after the already priced-in one expected later on the day. That would likely trigger a US dollar sell-off.

US Gross Domestic Product growth chart

On the other hand, if the US GDP release beats the predicted figure, EUR/USD bears could be back on track to ride the bearish trend some more. That was the case on the Q1 first release back in Apr 26th, when the 3.1% release beat estimations and produced a notable EUR/USD sell-off.

German inflation to keep dragging the EUR down?

On the euro side, Germany is set to release its October preliminary inflation figures at 13 GMT. This has been one of the most-bearish macroeconomic developments for the euro in the last year, as harmonized inflation has fallen from a 2.4% YoY last October to the current 0.9% number. Prices are stagnating in Europe’s leading economy and that has led the European Central Bank to trigger more and new accommodative policies that have weakened the common currency.

This time, the year-over-year Harmonized Consumer Price Index is expected to drop another tick to 0.8%, so it’s difficult to see any euro-bullish arguments there. If any, another disappointment would help another round of EUR/USD sell-off.

Federal Reserve Meeting holds the key to EUR/USD rest-of-the-year picture

Having little time to digest all these macroeconomic releases, Jerome Powell and the Federal Reserve’s Open Market Committee will take the main stage at 18 GMT. Unanimously expected to cut interest rates from 2% to 1.75%, this will be the third consecutive rate cut for the Fed. The EUR/USD traders’ interest will be on whether the FOMC hints at more interest rate reductions or if, as the market currently expects, it is three and done.

By keeping the optimistic overview of the US economy, Powell and the Fed would erase the chance of another rate cut before the end of the year and support the US dollar. But a change in the statement wording would do the opposite effect and trigger a bullish EUR/USD run. This is the most important event of the day – and the week, the month and probably the remainder of the year – and has the largest chance to trigger a big EUR/USD swing.

GBPUSD Forecast

The cable has also been gaining some ground in the last weeks, benefitting from the Brexit extension and some optimism that the December 12th recently announced Parliamentary Election will help to finally unlock the Brexit conundrum with an agreed exit between the United Kingdom and the European Union.

GBP/USD is facing heavy resistance, though, and will need meaningful disappointments in the US data or a change of script from the Fed to keep rising. If not, the downside is also limited as political developments in the UK are supporting the pound for now.

About the EUR/USD market

Euro US dollar pair is part of the ‘majors’ assets. This group also includes GBP/USD, USD/JPY, AUD/USD, USD/CHF, NZD/USD and USD/CAD. Fiber could be affected by news or decisions taken by two main central banks: the European Central Bank (ECB) that governs the monetary policy for the countries of the European Union and the Federal Reserve Bank (Fed) that does the same for the United States. The websites of these two institutions and the speeches or statements from the most responsible of these institutions Mario Draghi – from the next meeting on, Christine Lagarde – and Jerome Powell could have a great impact on the current and future price of this asset. You can access information about Draghi and Powell by visiting their official profiles (Draghi’s profile, Powell's profile) and by looking for information on our editorial page about the Euro/Dollar outlook.

Recommended content about EUR/USD Prediction:

EUR/USD: Are early rises justified on Super Wednesday? Four events to fear

EUR/USD could still visit the 1.1180 region – UOB

EUR/USD Bullish Reversal Keeps Uptrend Hopes Alive

Related Links:

ECB monetary policy

FED monetary policy

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.

-637080318528071734.png)