Risk aversion lead the way during Asian trading hours, on mounting concerns over China's economic health and a pullback in oil, with most commodities generally lower. European indexes opened lower, tracking losses of the previous session, but are currently trading around their daily openings, weighing on the common currency.

The macroeconomic calendar will remain light in Europe and the US, with the most relevant readings being probably US crude stockpiles, later on the day, which means the pair will continue responding to market's sentiment, although in cautious mode, ahead of the ECB decision this Thursday.

Market players have been largely speculating that the European Central Bank will offer some form of extension in its ongoing stimulus plan, contemplating the possibility of an additional 10-15bp rate cut in the deposit rate. However, and given that inflation has fell into negative territory last month, some speculators are expecting an extension of QE or another measure to complement the deposit rate cut. Mario Draghi always has something up his sleeve, and the market is being extremely cautious forthcoming.

View the Live chart of the EUR/USD

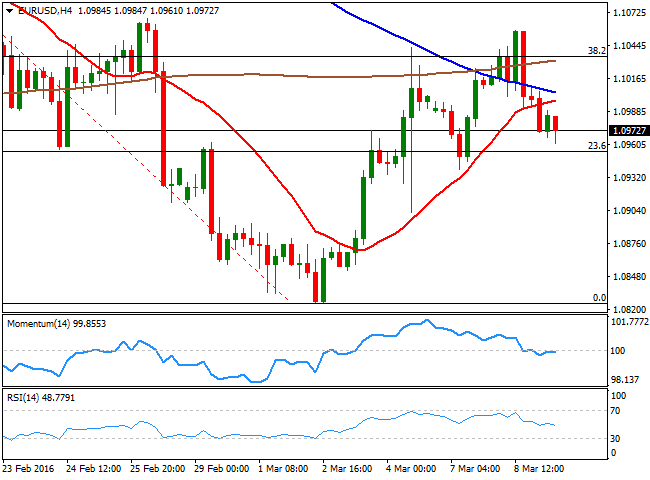

Technically, the pair is now 100 pips below the high post in the previous American afternoon at 1.1056, having failed to sustain gains beyond the 38.2% retracement of the latest daily slump, around 1.1040. In the 4 hours chart, the price has broken below its moving averages, while the technical indicators are heading slightly lower below their mid-lines, increasing the risk of additional declines towards the 1.0940 level, this week low.

Further declines are not expected ahead of the mentioned risk event, yet if somehow the EUR enters sell-off mode, the pair can test the 1.0890 region. A recovery above 1.1000 on dollar's weakness can send the pair towards the 1.1040 region, but seems unlikely investors will force the pair into new highs today.

Latest updates on the EUR/USD Forecast

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 as focus shifts to Fed policy decisions

EUR/USD stays in its daily range below 1.0700 following the mixed macroeconomic data releases from the US. Private sector rose more than expected in April, while the ISM Manufacturing PMI fell below 50. Fed will announce monetary policy decisions next.

GBP/USD holds steady below 1.2500 ahead of Fed

GBP/USD is off the lows but stays flatlined below 1.2500 on Wednesday. The US Dollar stays resilient against its rivals despite mixed data releases and doesn't allow the pair to stage a rebound ahead of the Fed's policy decisions.

Gold rebounds above $2,300 after US data, eyes on Fed policy decision

Gold gained traction and recovered above $2,300 in the American session on Wednesday. The benchmark 10-year US Treasury bond yield turned negative on the day after US data, helping XAU/USD push higher ahead of Fed policy announcements.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.

US Federal Reserve Decision Preview: Markets look for clues about interest rate cut timing

The Federal Reserve is widely anticipated to keep interest rates unchanged. Fed Chairman Powell’s remarks could provide important clues about the timing of the policy pivot.