This must have been one of the most boring weeks in the history of the EUR/USD pair that lacked direction and volume, ever since the US published an impressive employment report last Friday. The lackluster prevailed, despite central bankers' jawboning both shores of the Atlantic, and plenty of macroeconomic data releases.

In regards of the economic policies' future, nor Draghi, neither Yellen and their courts, offered something new. The ECB is in its way to extend its QE next December, and there was even some talking about the Central Bank front-loading assets purchases before December. FED's officers on the other hand, has been discussing the pace of the upcoming rate hikes, rather than if a rate hike is coming, for the most, giving it for granted.

View the Live chart of the EUR/USD

The week ends with soft data in both economies this Friday, but worse-than-expected US Retail Sales and PPI data for October, was not enough to push the dollar lower, as the currency remains near its weekly opening against its European counterpart.

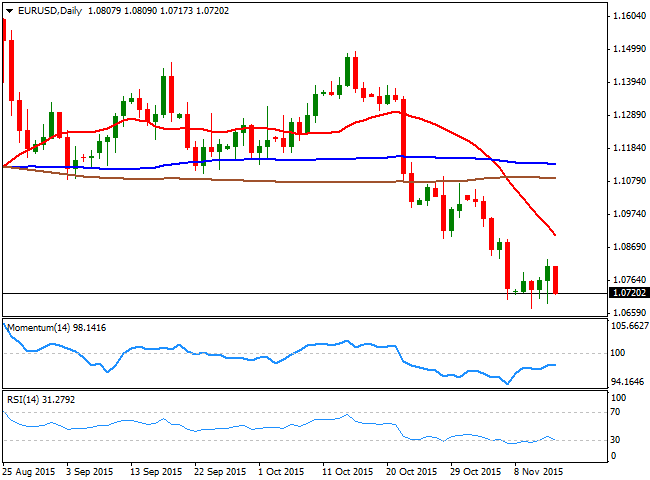

Technically, the daily chart shows that these days have helped technical readings to correct the extreme oversold readings reached last week, but that they remain well below their mid-lines, and the RSI indicator is even turning lower around 32, in line with further declines. In the same chart, the 20 SMA has accelerated further lower above the current level, and stands now around 1.0920. In the weekly chart, the technical indicators have lost their downward strength below their mid-lines, but the price remains below its 20 SMA, in line with the ongoing bearish momentum.

The weekly low was set at 1.0673, which means that an extension below it should signal further declines this week, with a first bearish target at 1.0520, April this year low. If the level is taken, the year low of 1.0460 is next. So far, advances towards the 1.0800 level have attracted selling interest, but a strong resistance comes at 1.0840, the former base of the monthly range. Above it, the pair can rally another 100 pips, up to the 1.0940 price zone, before resuming its decline, as it will take a weekly close above 1.1000 to start talking about a reversal, something quite unlikely at this point.

Latest updates on the EUR/USD Forecast

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0750 following Monday's indecisive action

EUR/USD continues to fluctuate in a tight channel at around 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

GBP/USD retreats below 1.2550 as USD recovers

GBP/USD stays under modest bearish pressure and trades below 1.2550 in the European session on Tuesday. The cautious market stance helps the USD hold its ground and doesn't allow the pair to regain its traction. The Bank of England will announce policy decisions on Thursday.

Gold price turns red below $2,320 amid renewed US dollar demand

Gold trades in negative territory below $2,320 as the souring mood allows the USD to find demand on Tuesday. Nevertheless, the benchmark 10-year US Treasury bond yield stays below 4.5% and helps XAU/USD limit its losses.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.