The EUR/USD pair is about to end the week with minor gains, boosted by a decline of the US dollar in the market. Greenback was among the worst performers in the currency market during the last five days as the expected date of the Federal Reserve liftoff continues to move away; US inflation data on Thursday limited the decline. The euro was not particularly strong as data continued to show some slowdown.

Next week will be of particular importance for the euro. The main event will be the European Central Bank (ECB) meeting on Thursday. No change in monetary policy is expected neither an extraordinary announcement. But with inflation trending lower, talks about the ECB doing more has increased lately. The Governing Council member, Ewald Nowotny spoke on Thursday about the central bank missing its inflation target and about the use of additional structural instruments to bright growth back. The other key report will be the preliminary Manufacturing PMI reading of the euro area that will show how the sector did during October.

If the ECB remains in its status quo (keeping the purchase program unchanged) and the PMIs do not disappoint, the euro could receive some impulse. One of the main risks is Mario Draghi, who could talk down the euro during the press conference.

No relevant economic reports will come from the US and attention will remain on Fed’s officials speeches and interviews as investors look for clues about when the central bank will raise rates. The next meeting will be October 27/28, no change is expected. Some officials continue to mention that they would like a rate hike during 2015 but economic data continues to reduce the odds of a December liftoff.

View the Live chart of the EUR/USD

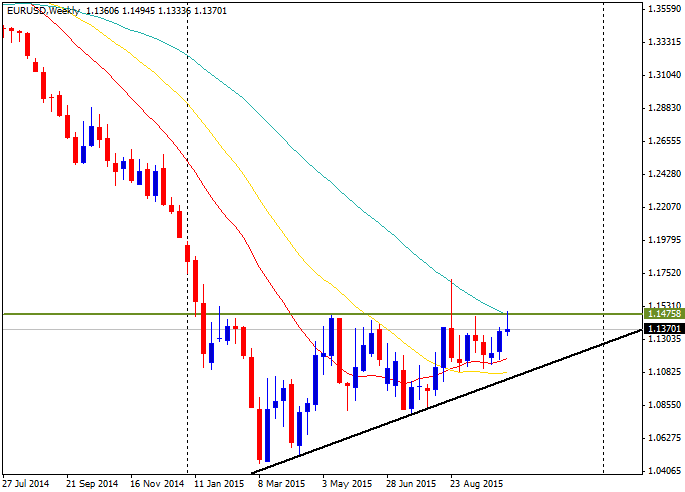

The weekly chart shows EUR/USD standing above an uptrend line and also the 20 and 55 weekly moving averages that offer support at 1.1160 and 1.1050 respectively. In the short term it continues to move sideways, between 1.1100 and 1.1400. During the week it approached 1.1500 but it was rejected from those levels opening the doors for a corrective move.

The area around 1.1500 continues to be the key resistance. A consolidation on top would clear the way for more gains in the medium term with a short term target at 1.1700. But as long as it remains below the risk to the downside is big. The current decline could extend toward the 1.1115 without creating any major threat. But below, attention would turn to the 55 week MA and to the uptrend line that currently stands around 1.1020/30: if it is broken, then 1.0800 would be an easy target.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.