The EUR/USD pair has shown little signs of life so far this Friday, extending its range-bound trading around the 1.1200 figure. With negotiations between Greece and its creditors delayed into the weekend, investors are leaving aside the common currency ahead of some definitions regarding the future of the Euro Union. There's little relevant data ahead, with only the US Michigan confidence index, being able to imprint some life to the market.

View live chart of the EUR/USD

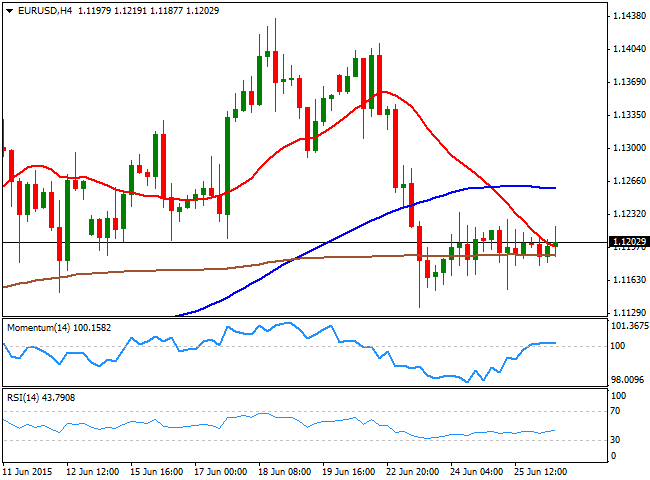

In the meantime, the technical picture remains neutral as the 4 hours chart shows that the price hovers around its 20 SMA, whilst the Momentum indicator lies flat around the 100 level. In the same chart, the RSI indicator aims slightly higher in negative territory, lacking enough directional strength.

The 1.1160/80 price zone has attracted buying interest for most of this week, which means only a clear break below it could see the pair extending its decline down to 1.1120, a strong static support level. To the upside, 1.1245 is the resistance to watch, as it will take a recovery above it to see an upward extension towards the 1.1300 region.

Latest updates on the EUR/USD Forecast

Recommended Content

Editors’ Picks

Fed statement language and QT strategy could drive USD action – LIVE

The US Federal Reserve is set to leave the policy rate unchanged after April 30 - May 1 policy meeting. Possible changes to the statement language and quantitative tightening strategy could impact the USD's valuation.

EUR/USD stays below 1.0700 as focus shifts to Fed policy decisions

EUR/USD stays in its daily range below 1.0700 following the mixed macroeconomic data releases from the US. Private sector rose more than expected in April, while the ISM Manufacturing PMI fell below 50. Fed will announce monetary policy decisions next.

GBP/USD holds steady below 1.2500 ahead of Fed

GBP/USD is off the lows but stays flatlined below 1.2500 on Wednesday. The US Dollar stays resilient against its rivals despite mixed data releases and doesn't allow the pair to stage a rebound ahead of the Fed's policy decisions.

Gold rebounds above $2,300 after US data, eyes on Fed policy decision

Gold gained traction and recovered above $2,300 in the American session on Wednesday. The benchmark 10-year US Treasury bond yield turned negative on the day after US data, helping XAU/USD push higher ahead of Fed policy announcements.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.