EUR/USD Forecast: Unable to leave the 1.1800 area

EUR/USD Current Price: 1.1835

- German data resulted better than anticipated lending temporal support to the EUR.

- US Consumer Confidence plunged to a new pandemic low of 84.8 in August, according to CB.

- EUR/USD is technically neutral, but the risk skews to the downside.

The EUR/USD pair is ending yet another day around the 1.1800 level, as FX traders seem to lack motivation. Major pairs remained within familiar levels, despite some wild swings elsewhere. Markets were in a risk-on mood throughout the first half of the day, amid China and the US announcing good talks related to their trade deal. EUR/USD hit an intraday high of 1.1843, further supported by encouraging German data, as Q2 GDP was revised to -9.7% from a previous estimate of -10.1%. The IFO Business Climate improved to 92.6 in August from 90.4 in July. The assessment of the current situation and expectations also improved when compared to the previous month.

The greenback recovered some ground during US trading hours as the market sentiment deteriorated following the release of the US CB Consumer Confidence, which fell in August to a new pandemic low of 84.8, well below the previous 91.7. Wall Street took a turn to the worse, trimming most of its previous weekly gains. Other data coming from the US, however, were positive, as the Housing Price Index increased to 0.9% in June, while New Home Sales was up by 13.9% in July. This Wednesday, the US will publish July Durable Goods Orders, seen up 4.3%.

EUR/USD short-term technical outlook

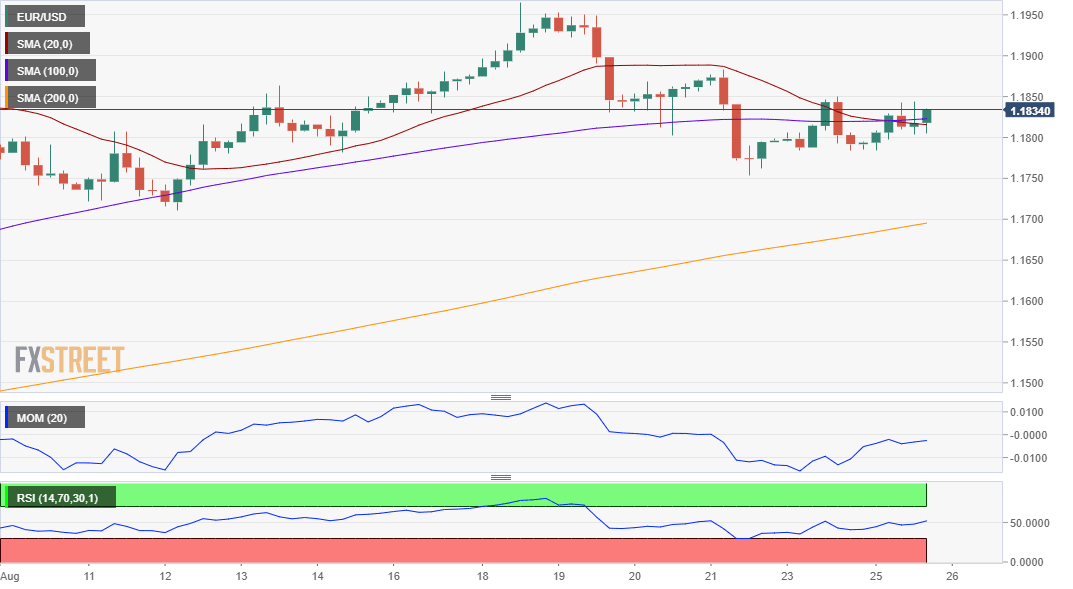

The EUR/USD pair is trading in the 1.1830 price zone by the end of the American session, with a neutral technical stance. In the 4-hour chart, the price has spent the day hovering around converging 20 and 100 SMA. The Momentum indicator advances above its midline, while the RSI heads nowhere around 50. Overall, the risk is skewed to the downside, with a bearish extension clearer on a break below 1.1790, while a bullish extension would have more chances if the pair breaks above 1.1885, quite unlikely in the current scenario.

Support levels: 1.1790 1.1750 1.1710

Resistance levels: 1.1840 1.1885 1.1920

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.