- EUR/USD has been edging higher after President Trump talked up the chances for a fiscal stimulus deal.

- Adverse headlines from Washington and concerns about Europe's coronavirus may push the pair down.

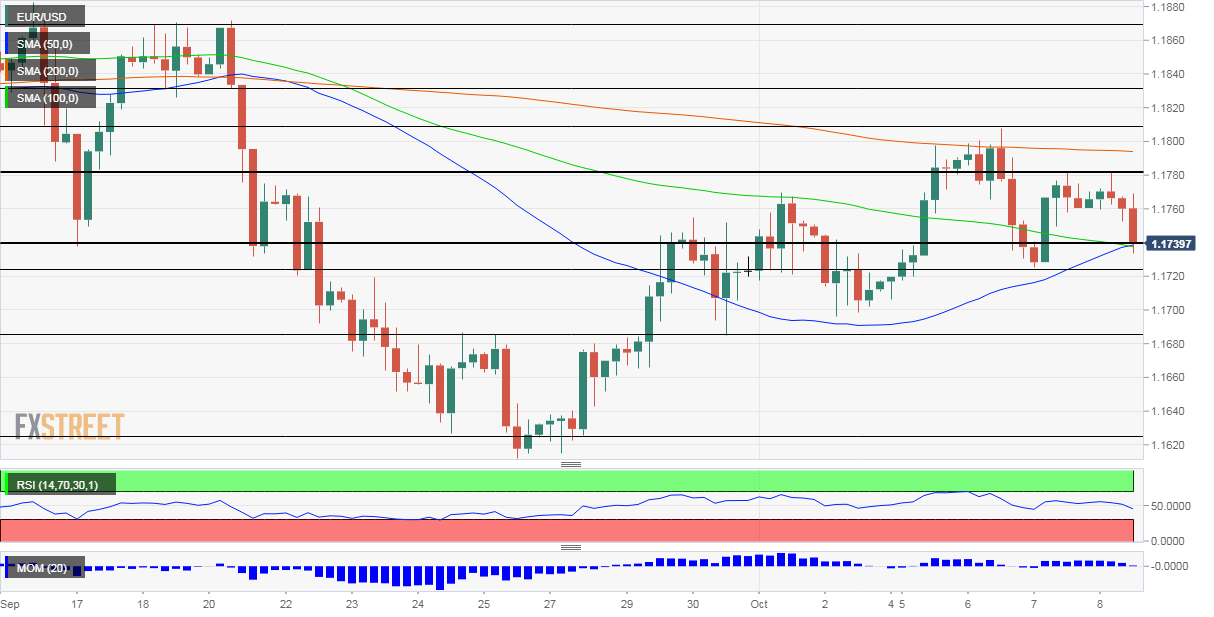

- Thursday's four-hour chart is showing that critical support awaits at 1.1750.

No to a virtual debate – that is the headline that has come out of President Donald Trump's first live interview since he contracted coronavirus. Yet markets are less interest in next week's potential political clash, but rather the fate of more federal funds to revive the economy – and here, Trump's message was more upbeat, lifting the euro.

The Commander-In-Chief said that House Speaker Nancy Pelosi wants a deal. The man behind "The Art of the Deal" used the same phrases when negotiating the trade accord with China before going for the Phase One agreement. Is Pelosi genuinely willing to compromise or is Trump revealing his own urge to cut a deal? For markets, the answer does not seem to matter.

The safe-haven dollar is under pressure and EUR/USD escaped critical support at 1.1740, but it can break resistance at 1.1780? Pelosi will be speaking with US Treasury Secretary Steven Mnuchin for the umpteenth time later in the day, and there are reasons to doubt a deal is reached.

First, Democrats want a generous $2.2 trillion deal and Republicans aim for a mini-accord focusing on airlines and checks to all Americans – with Trump's signature on them. The gap may be too big – at least today – and markets may be disappointed.

Secondly, Senate Republicans may have reached the conclusion that Trump is about to lose the vote, and may move to stick to their long-forgotten principle of keeping the deficit low and focusing on what matters more – the Supreme Court nomination.

Third, Dems have no reason to give ground after Trump's own goal on Tuesday, when he cut off talks with the opposition. They may let him continue struggling.

Elsewhere, US jobless claims marginally estimate with 840,000 applications, while continuing claims beat estimates by dipping below 11 million. The European Central Bank's meeting minutes seemed to consist of more attention to the exchange rate than usual – but repeated known stances. The ECB does not target the value of the euro but watches it carefully.

Overall, the fate of US fiscal stimulus is left, right, and center, and after the recent rise, it may turn down.

More Who will be the next president? Markets seem to care more about Congress' actions (for now)

EUR/USD Technical Analysis

The 59 and 100 Simple Moving Averages converge at 1.1740, making it a critical support line. The currency pair dipped below that level but has not lost it. Nevertheless, upside momentum, has waned and EUR/USD trades below the 200 SMA.

Further support awaits at 1.1725, 1.1685, and 1.1625.

Strong resistance is at 1.1780, which held euro/dollar twice in the past few sessions. It is followed by 1.1810 and 1.830.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.