- Pessimism about US-Sino trade talks is beneficial for the safe-haven dollar.

- The greenback is getting a boost from the Fed's minutes.

- The ECB's minutes may reveal openness to more stimulus, weighing on the euro.

- Thursday's technical chart remains mixed amid tight range trading.

Are we witnessing the calm before the storm? EUR/USD has been trading within a narrow range of around 40 pips this week – but such low-volatility periods are not here to stay.

To which direction will euro/dollar break? Three recent developments are pointing to the downside.

1) Trade troubles

China's Vice-Premier Liu He has reportedly expressed cautious optimism about trade talks – but that is the only piece of hope in a sea of pessimism.

Washington and Beijing have been unable to agree on the removal of tariffs. Reports coming out of the negotiations between the world's largest economies suggest that the issue of duties – that is part of the first phase of the deal and that markets care about most – is yet to be agreed.

The safe-haven US dollar tends to be bid when markets fear about the fate of talks.

The row over Hong Kong remains prominent. Beijing was angered by the Senate's unanimous approval of a bill supporting protesters in the city-state. The House of Representatives advanced the legislation and it is now awaiting for President Donald Trump's signature. He may turn it into law as soon as today.

Moreover, the president seemed reluctant to move ahead with a deal, saying that China wants it but that it depends on him. Perhaps his hawkish advisers have convinced him that the new levies planned for December 15 – directly affecting consumers –will be shrugged off by shoppers and the broader economy.

Trump is also pressured by the impeachment inquiry. Gordon Sondland, US ambassador to the EU, spilled the beans by telling a Congressional committee that there was a quid-pro-quo with Ukraine and that all top officials were in the loop.

2) Federal Reserve firmly on hold

The meeting minutes from the Federal Open Markets Committee (FOMC) have confirmed that the world's most powerful central bank plans to leave interest rates unchanged. Only "a couple" of members wanted to cut rates further, while "several" rejected cutting rates in the October meeting.

Earlier, Lael Brainard, Governor at the Fed, said that trade uncertainty is weighing on investment, but supported the Fed's wait-and-see approach.

Overall, only a "material reassessment" would push the bank to reduce rates – and that is dollar-positive. See FOMC minutes dash hope for future rate cuts, trade deal worries send equities plunging

Cleveland Fed President Laureta Mester, a hawk, will deliver a speech later today. She is highly unlikely to veer from the message.

The Fed's approach is dollar-positive. Several second-tier US figures are due out later on Thursday, with housing figures standing out. See Existing-Home Sales Preview: Sales follow mortgage rates

3) ECB minutes may weigh on the euro

Looking forward, the European Central Bank's Monetary Policy Meeting Accounts may show that the doves are fighting back and may push for more stimulus. Several ECB members have said that monetary policy has yet to reach its limits, and this message –that the Frankfurt-based institution may print more money – may be repeated, sending the euro down.

Germany escaped a recession, but that may be detrimental for the euro, as the largest economy may refrain from spending and stimulating the economy. And that may push the ECB to add more stimulus, weighing on the common currency.

Christine Lagarde, the new President of the ECB, will speak on Friday, at the same time as Markit publishes fresh Purchasing Managers' Indexes.

See Euro-zone PMIs preview: Modest expectations may be too high, three EUR/USD scenarios

Overall, the main factors favor the dollar over the euro.

EUR/USD Technical Analysis

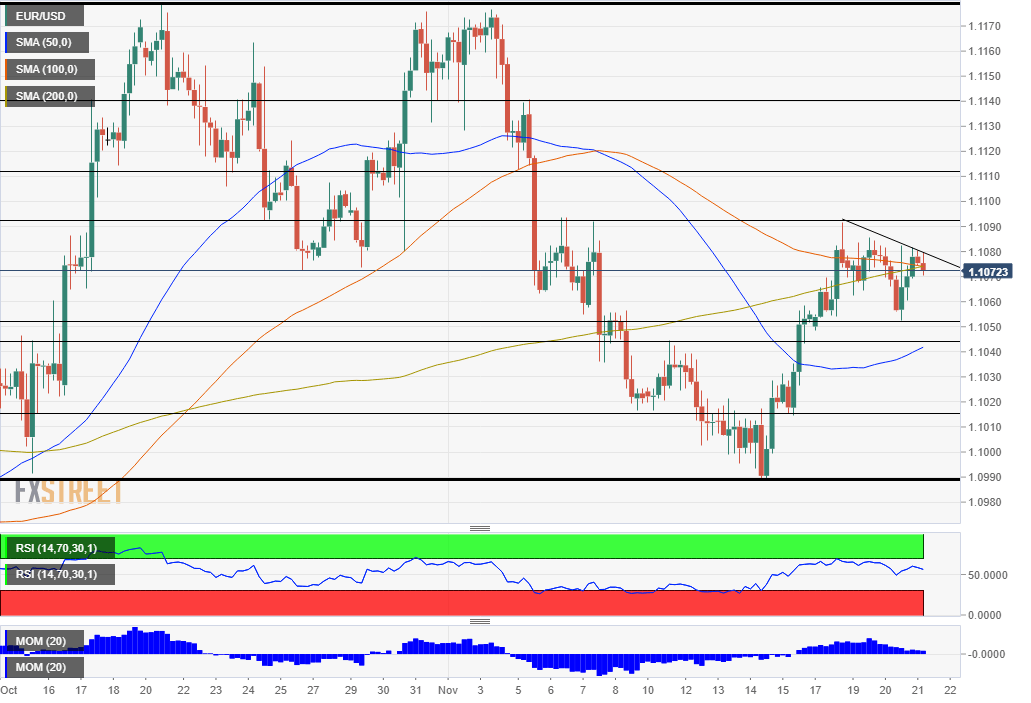

Several days of virtual standstill have weighed on momentum, which is almost non-existent. The 100 and 200 Simple Moving Averages have converged close to the current price, while euro/dollar holds above the 50 SMA. EUR/USD is capped by a minor downtrend resistance line.

All in all, the picture is mixed.

Support awaits at 1.1050, the weekly low, and it is closely followed by 1.1045, which held it down earlier in November. Next,1.1015 provided support last week, and it is followed by 1.0990, November's low point.

Resistance awaits at 1.1090, the weekly high. Next, we find 1.1110, which provided support in early November, followed by 1.1140, a swing high around that time. The double-top of 1.1180 is next.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD keeps the bullish outlook above 0.6600

A negative session in the Greenback allowed AUD/USD to leave behind two consecutive sessions of losses and reclaim the area beyond the key barrier at 0.6600 the figure on Thursday.

EUR/USD: Next target emerges at 1.0800

In line with the broad improvement in the risk appetite, EUR/USD reversed part of the recent weakness and advanced to the vicinity of the 1.0800 region in response to the renewed selling pressure hurting the Dollar.

Gold poised to resume its advance

XAU/USD now gathers fresh steam and advances to the highest level in many sessions north of the $2,330 mark per troy ounce on the back of further selling pressure hurting the Greenback as well as mixed US yields.

Bitcoin price is down over 20% from its peak, but BTC macro uptrend remains very much intact

Bitcoin (BTC) price peaked at $73,777 in March, marking a new all-time high recorded over a month before the fourth halving. The bold move north has however been followed by a cascade of load-shedding exercises, though not enough to invalidate the big-picture bullish outlook for BTC.

Bank of England update: A mixed bag

As widely expected, the Bank of England (BoE) held the Bank Rate on hold at 5.25% for a sixth consecutive meeting, its highest level since 2008. However, what was key today was the central bank signalled it could be getting closer to easing policy in the summer, possibly as early as June’s meeting or in August, which is fully priced in at the moment.