EUR/USD Forecast: Pressured around 1.0800

EUR/USD Current Price: 1.0808

- The US private sector lost 20.23 million jobs in April, according to the ADP survey.

- The market’s sentiment fluctuates between reopening’s hopes and US-China tensions.

- EUR/USD bearish, battling with the 1.0800 price zone.

The EUR/USD pair fell to 1.0781 early London, as the shared currency received another hit from data. German’s Factory Orders plunged 15.6% monthly basis in March and fell by 16% when compared to a year earlier, worse than anticipated. The final versions of the Markit Services PMI were upwardly revised in Germany and the Union, although in Spain and France were worse than previously estimated. EU Retail Sales were better than expected in March, down anyway 9.2% in the month.

Meanwhile, the US released the ADP survey on private jobs’ creation. The report showed that during April, 20.23 million jobs were lost, although the market barely reacted to the news, already waiting for such a dismal number. The macroeconomic calendar has nothing else to offer during the American session.

Ahead of the opening, Wall Street is in retreat mode, lead by falling oil prices and European indexes trimming daily gains. The sentiment is mixed, pivoting between hopes of economic reopenings and tensions between the US and China.

EUR/USD short-term technical outlook

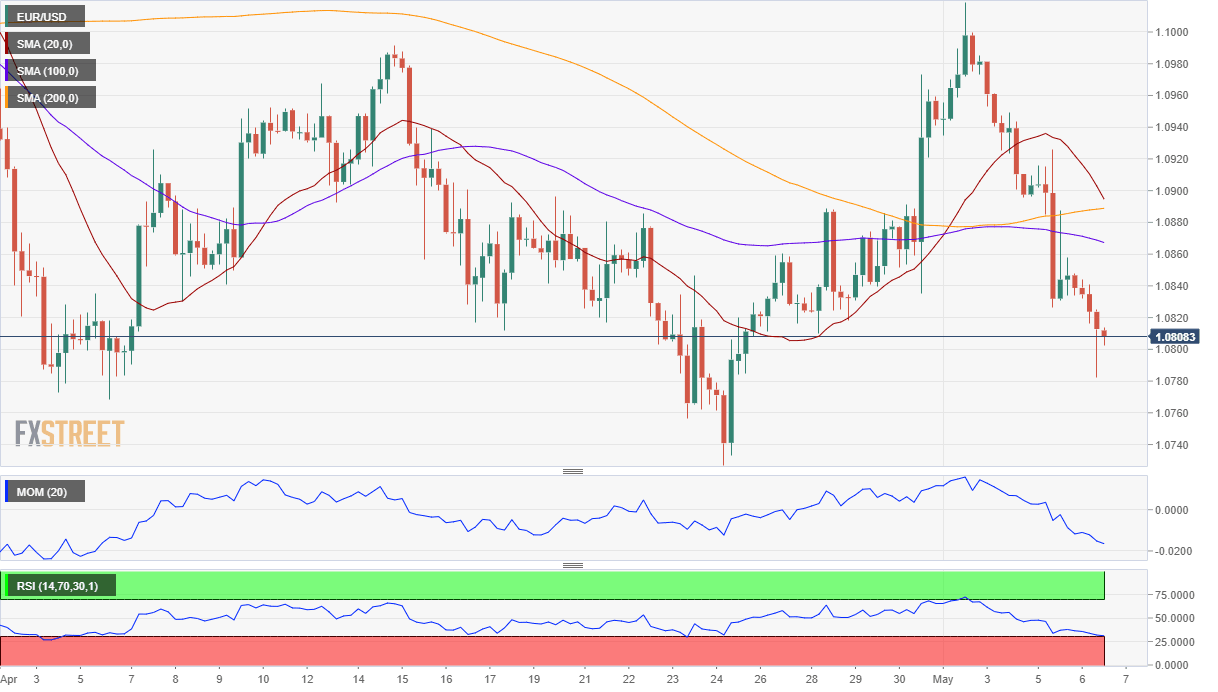

The EUR/USD pair is trading around 1.0800 and at risk of falling further. In the 4-hour chart, it is now well below all of its moving averages, with the 20 SMA gaining bearish strength, although still above the larger ones. Technical indicators have pared their declines near oversold levels, holding on to daily lows. Overall, the risk remains skewed to the downside, with scope to test the 1.0700 price zone.

Support levels: 1.0790 1.0755 1.0710

Resistance levels: 1.0830 1.0865 1.0900

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.