EUR/USD Forecast: Picks up pace, eyes 2020 highs

- EUR/USD extends gains to fresh three-week highs amid dollar weakness.

- The pair looks poised to test the 1.1400 resistance area.

- Confirmation above trendline resistance could target 2020 highs.

The EUR/USD pair rose above 1.1300 on Wednesday and accelerated to the upside during the American session to hit its highest level in three weeks at 1.1351. The move was propelled by broad-based dollar weakness as, in the absence of first-tier economic data, investors took cues from equity markets, leaving aside concerns over the increase of COVID-19 cases in the United States to give way to moderate optimism.

During the European session, ECB’s Vicepresident Luis De Guindos expressed some optimism regarding the prospects for economic growth in the region on the back of the latest promising data releases. However, an agreement on the EU emergency fund remains elusive – with Austria, the Netherlands, Sweden and Denmark still opposing resistance – ahead of the leaders’ summit next week.

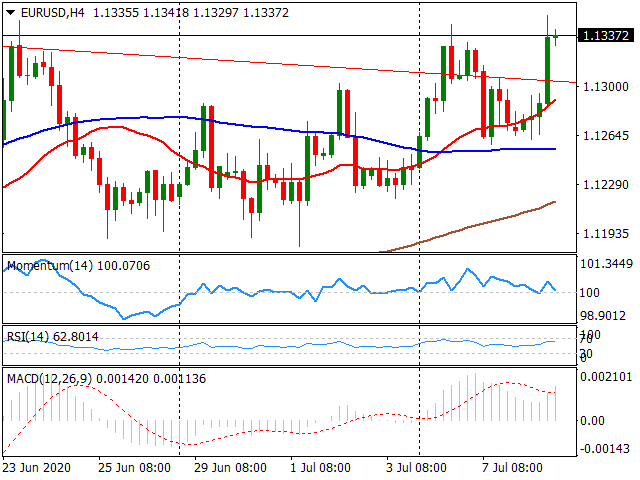

From a technical view, the EUR/USD pair has risen above a descending trendline coming from February 2018 high and looks set to extend gains toward the 1.1400-20 area, as indicators gain upward slope. June’s high at 1.1422 is the next hurdle to overcome en route to 2020 highs at 1.1497.

On the other hand, if the pair fails to hold above the mentioned trendline, it could lose upside potential and retreat to the 1.1255 area, where the 100-period SMA offers support. A break there could pave the way to the 200-period SMA at 1.1215.

Support levels: 1.1270 1.1255 1.1215

Resistance levels: 1.1350 1.1400 1.1422

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.