EUR/USD Forecast: Eurozone reopening, potential US cooldown, bullish charts all point higher

- EUR/USD has been edging higher amid an upbeat market mood.

- Germany and Italy's reopening are supportive of the euro ahead of data.

- The US ISM Manufacturing PMI could show cooling inflation.

- Tuesday's four-hour chart is pointing to further gains.

New month, time for new gains? EUR/USD has ended May with substantial gains and after a minor correction, there is room for rises. Several factors make the bullish case for the world's most popular currency pair.

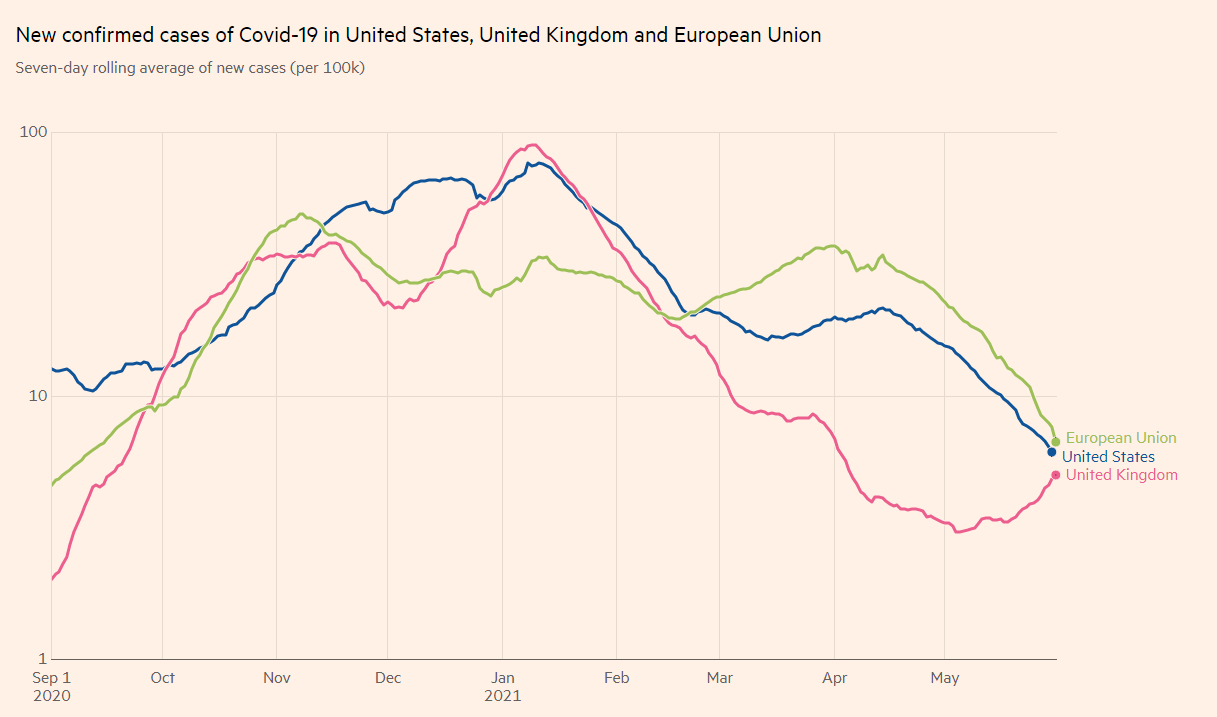

As June begins, Italy is taking another step in its reopening. The eurozone's third-largest economy was one of the hardest hit in the first wave of the virus. Germany's the continent's locomotive, is also mulling the removal of a controversial lockdown law, allowing more freedom as coronavirus cases drop sharply.

Roughly 40% of the old continent's population received one vaccine jab. The campaign is bearing fruit, as the chart below shows – Europe's trends are in the right direction.

Source: FT

The euro also received a boost from encouraging eurozone economic figures. Markit's Manufacturing Purchasing Managers' Indexes hovered around 60 points in May, reflecting strong growth. Preliminary inflation data for May is up next.

On the other side of the pond, the US dollar is letting go of some of its latest gains, The greenback benefited from end-of-month flows on Friday – ahead of a long weekend in the US – and a reversal of that move is one explanation for the retreat of the greenback.

Another reason is data. The dollar received a boost from stronger-than-expected Core Personal Consumption Expenditure (Core PCE), the Federal Reserve's preferred gauge of inflation. The leap to 3.1% in April may push the Fed to taper down its $120 billion/month bond-buying scheme sooner than later. Fewer printed dollars mean a stronger greenback.

However, statistics for May could show some signs of a cooldown in price pressures – at least a retreat from the highs. The ISM Manufacturing PMI for May is forecast to include an elevated Prices Paid component. After this inflation gauge hit the highest on record in April, there is room to fall.

Investors will also watch the headline Manufacturing PMI and the employment component, which is a leading indicator toward Friday's Nonfarm Payrolls.

ISM Manufacturing PMI Preview: NFP Hint? Inflation component to steal the show, rock the dollar

Federal Reserve Governors Lael Brainard and Randal Quarles are slated to speak later on, and if they reiterate the bank's dovish message, the dollar has room to fall.

All in all, the currency pair could move higher.

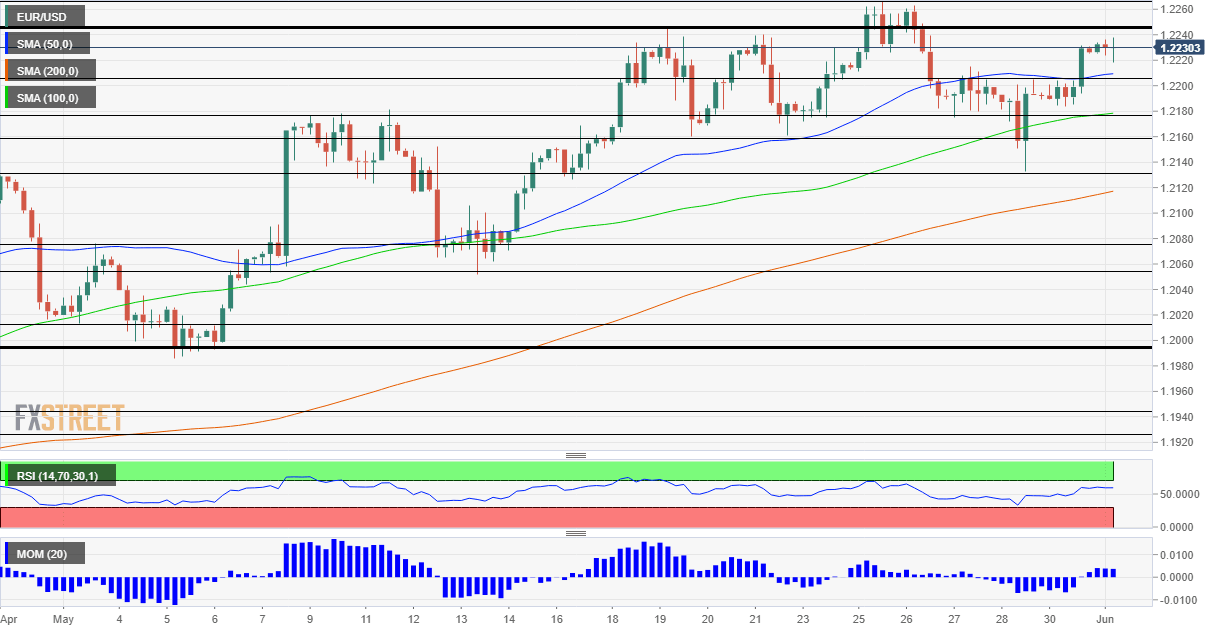

EUR/USD Technical Analysis

Euro/dollar has recaptured the 50 Simple Moving Average on the four-hour chart in its latest upswing, a bullish sign joining positive momentum.

Some resistance awaits at 1.2245, the former triple top that capped EUR/USD in May. It is followed by the peak of 1.2266, and then by 1.23.

The currency pair has some support at 1.22, which capped it late last week. Further down, 1.2180, 1.2160 and 1.2130 all played roles in recent weeks and serve as additional cushions.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.